In 2025, speed and efficiency alone don’t make a blockchain competitive. Utility, composability, and real-world value now define which protocols lead and which get left behind.

Solayer enters the picture with a new take on restaking, one that uses hardware acceleration and advanced token design to offer more than just another staking app. It promises a path to scalable, permissionless finance on Solana.

But does it deliver? In this review, we examine Solayer’s design, features, and upcoming plans to determine whether it’s providing real progress or just another promise.

Key Takeaways

Solayer enables native restaking on Solana, allowing users to reuse staked SOL and liquid tokens for greater yield while continuing to secure the network.

InfiniSVM powers Solayer with hardware-accelerated performance, offering near-instant execution and speeds of up to one million transactions per second.

sSOL and sUSD tokens expand the utility of staking by bridging yield strategies with real-world spending and DeFi use cases.

The Emerald Card links staking rewards to everyday payments, making it easier to spend crypto directly from the wallet.

Solayer's 2025 roadmap includes the Solayer Chain launch and a complete suite of DeFi and payment tools focused on usability and adoption.

What is Solayer?

Solayer is a protocol that unlocks more from staking on Solana. It allows users to restake their already staked assets, such as SOL or liquid staking tokens, and utilize them to help secure other applications and blockchains. This approach opens up new rewards without compromising security.

It’s built for both large-scale institutions and individual DeFi users. While Ethereum has EigenLayer, Solayer gives Solana a purpose-built restaking system designed to match its speed, flexibility, and rich developer environment. Rather than adapting something borrowed, Solayer builds from within the ecosystem.

Over 40,000 users joined launch events and card sales. More than 295,000 unique wallets have deposited, with total value locked exceeding $500 million.

All contracts are open-source. Audits are a routine here. Most notably, with Ottersec. And other key protocol actions rely on a decentralized multisig approval

Here’s how it all comes together behind the scenes.

How Solayer Works: Restaking, Rewards & Liquid Staking

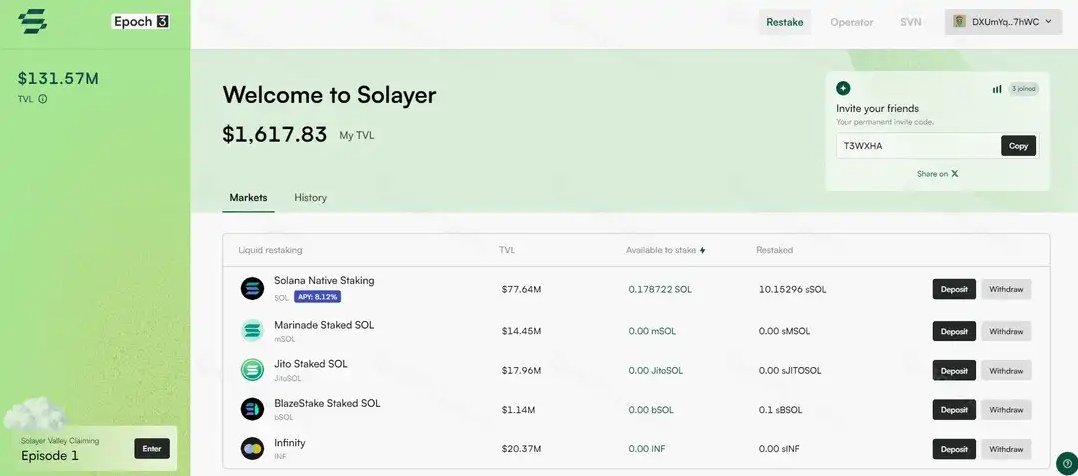

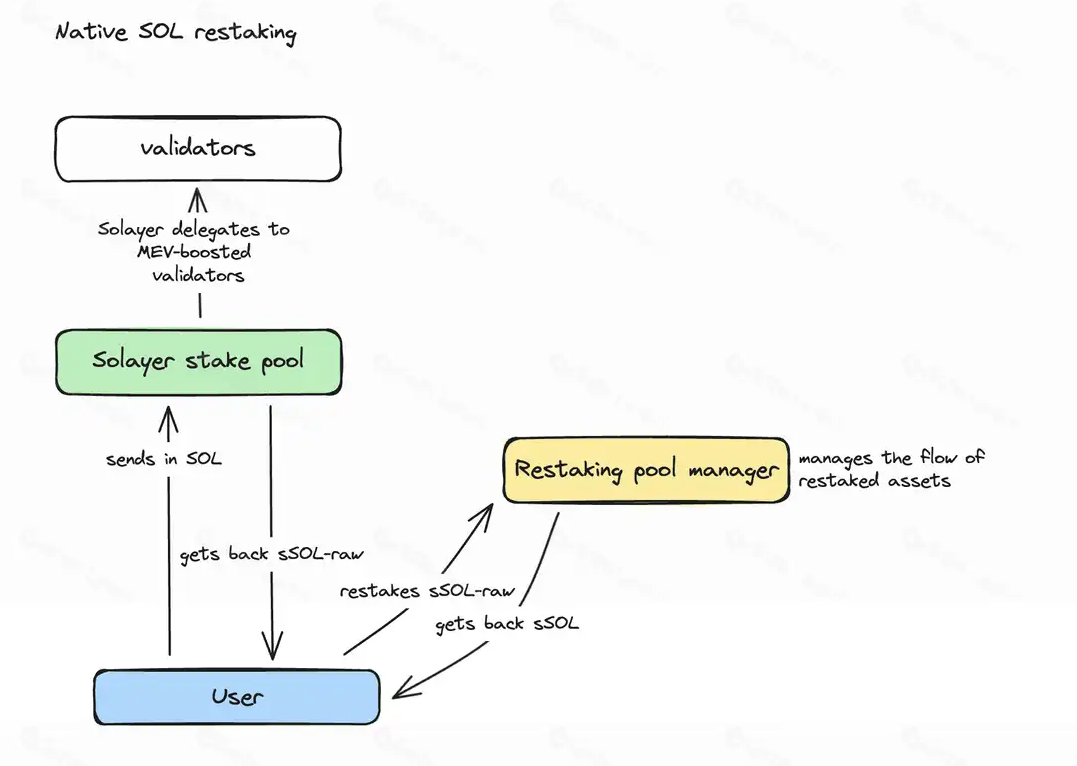

Solayer allows users to deposit either SOL or major liquid staking tokens from the Solana ecosystem, like mSOL, JitoSOL, bSOL, or INF, directly into its platform. Once deposited, these assets are restaked.

That means they continue to secure the Solana network while also helping support other protocols and application-level security layers. In exchange, users receive sSOL, a liquid restaking token that combines standard staking rewards with additional earnings from Solayer’s validator network and integrated DeFi opportunities.

Users can restake different assets and stay liquid at all times by holding sSOL. Rewards come from multiple sources, including Solana staking returns, Solayer-specific incentives, and MEV (maximal extractable value).

sSOL works across top DeFi platforms, with support for lending, farming, and crypto payments across different DApps.

What Sets Solayer Apart: InfiniSVM, sUSD, and sSOL

Solayer moves well beyond simple restaking. It introduces a suite of products designed to power a high-speed, yield-rich, and real-world-connected crypto experience.

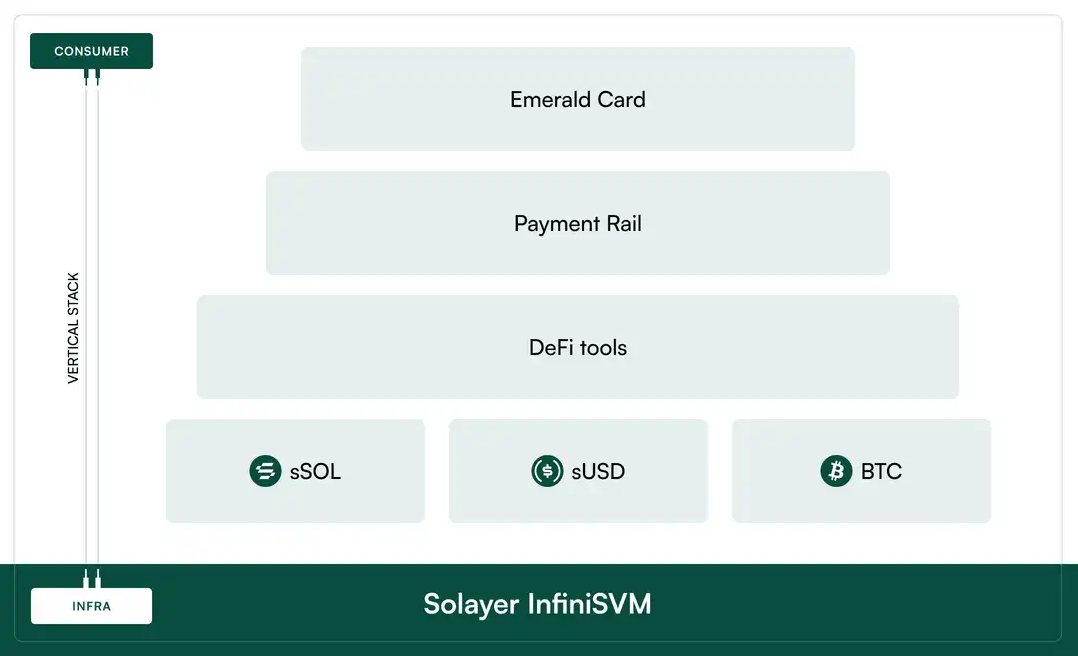

InfiniSVM

InfiniSVM is Solayer’s high-performance blockchain engine, built with hardware in mind. It taps into advanced networking tools like InfiniBand and RDMA, combines Proof-of-Authority with Proof-of-Stake, and runs on custom-built clusters to deliver:

Speed: Handles up to 1 million transactions per second with 100 Gbps of bandwidth

Fast finality: Confirms blocks in under a second with near-instant finality

Atomic sync: Keeps node data aligned and secure across the network

Built for builders: Supports high-frequency dApps like trading platforms, games, and payment apps

With this setup, Solayer Chain isn’t just for DeFi. It’s fast enough for real-time applications that rival the speed of traditional web platforms.

sSOL: Liquid Restaking Token

sSOL is Solayer’s restaking powerhouse. It represents staked SOL or supported liquid staking tokens and rewards holders with multiple income streams.

Stacked earnings: Earn Solana staking rewards, MEV capture, and protocol incentives at the same time.

DeFi-ready: Use sSOL in lending markets, liquidity pools, or as collateral without locking it up.

Delegation choice: Pick which DApps or validators your assets help secure, adjusting your strategy as needed.

sUSD: Interest-Bearing Stablecoin

sUSD is a dollar-pegged stablecoin backed by U.S. Treasury bills. It earns daily interest and flows easily across Solana’s DeFi ecosystem.

Auto-compounding: Generates ~4% yield through T-bill exposure and rebases in USDC

Fully liquid: Mint, redeem, or trade without restrictions

Payment-ready: Spend it anywhere using Solayer’s Emerald Card, no off-ramp needed

Take a look at our full list to know the best yield-bearing stablecoins

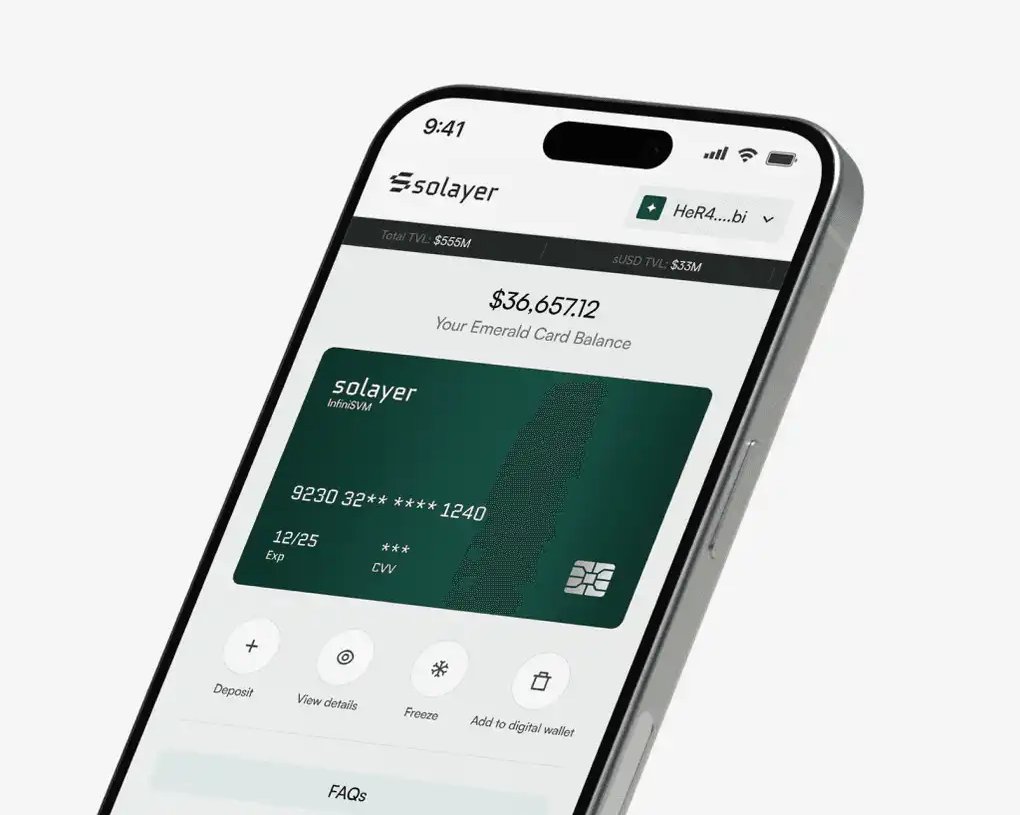

Emerald Card

And here’s where it all becomes real-world useful.

The Emerald Card brings your crypto into daily life. It connects Solayer’s app to global payment networks, turning yield into spendable cash.

Real-world access: Use sUSD, sSOL, and more at any store or ATM that accepts cards.

Cash withdrawals: Access local currency from your wallet, anytime.

Smart spending: Set budgets or automate purchases based on staking performance or rewards

User Interface & Experience

Solayer combines powerful DeFi tools with a clean, user-friendly interface, making advanced features like restaking and real-time crypto payments easy for both newcomers and seasoned users.

Solayer’s web dashboard and mobile view are built for clarity, speed, and full visibility into your assets and rewards:

Quick setup: Connecting a Solana wallet like Phantom, Backpack, or Ledger takes just a few clicks. Clear prompts guide users from the start.

All-in-one dashboard: Users can track their staked, restaked, and liquid assets, SOL, sSOL, sUSD, all in one place. They can also check the live rewards and historical yield data.

Simple restaking and delegation: Visual steps help users restake assets, pick AVS (Actively Validated Services), and move rewards between options. Helpful tooltips explain advanced settings as you go.

sUSD and Emerald Card tools: Users can mint or redeem sUSD with one-click swaps, check balances, set card limits, view spending history, and manage withdrawals directly in the dashboard.

Built-in safety checks: Real-time alerts warn users about risky actions. Governance moves or large transactions require multisig approval for extra protection.

Mobile-ready: The web app runs smoothly on mobile, with full access to staking, tracking, and the Emerald Card for on-the-go activity.

Support that works: A detailed help center, tooltips, and direct support links are built into the interface. Complex actions like emergency exits or advanced delegation come with step-by-step walkthroughs to prevent mistakes.

Tokenomics: LAYER Token Utility and Distribution

The LAYER token sits at the center of Solayer’s ecosystem, powering everything from security to rewards and decision-making.

Max supply: 1 billion

Network security: LAYER plays a role in staking and acts as collateral for key operations and protocol-level participation.

Rewards: Earned through restaking, protocol incentives, and airdrops for early users and validators.

Emissions and distribution: Released on a defined schedule, with clear breakdowns of total supply, validator shares, and reward flows made available to the public.

Governance: Token holders can vote on upgrades, parameter changes, and treasury strategy, helping shape the direction of the protocol.

Distribution-wise, this is what things look like:

Community & Ecosystem - 51.23%

34.23% is for the continued R&D, developer program, and ecosystem growth, and other user activities

14% is for community events/incentives [12% is reserved for Genesis Drop, which includes rewarding early adopters and other initial claim activities]

3% is distributed via the Emerald Card community sale

Core Contributors

17.11% for core contributors and advisors

Investors

16.66% has been sold to investors

Foundation

15% is allocated to the Solayer Foundation to support our vertical product expansion and network development

Get a better understanding of how the best governance is done in the DeFi ecosystem and what a DAO is here.

Solayer Ecosystem, Integrations & Partnerships

Solayer has woven itself into the fabric of the Solana ecosystem with strong integrations across wallets, DeFi apps, and validation networks.

Wallet integrations: Top Solana wallets like Phantom, Backpack, Bybit, Ledger, Nightly, OKX, Solflare, and SquadsX all support direct interaction with Solayer.

Partners: A mix of AVS providers, DeFi platforms, and institutional validators work alongside the protocol to grow its reach and utility.

DeFi use cases: sSOL and sUSD fuel lending, swapping, payments, and liquidity across Solana, giving users more ways to earn and move capital.

Solayer’s restaking marketplace gives decentralized apps a way to attract security from restakers. This model supports a large number of use cases from payments and trading to new Layer 1 chains and cross-chain experiments.

The 2025 Roadmap & Solayer Chain

So, what’s next for Solayer?

Solayer’s roadmap lays out a clear push to make Solana and its applications faster, more flexible, and easier to build on.

New features, product rollouts, and a custom high-speed chain are all on the horizon, each designed to unlock more for users, developers, and the broader ecosystem.

Q1–Q2 2025

Focus on growing the restaking market, adding new liquid staking assets (LSTs), expanding sUSD’s role in DeFi, and integrating more AVS providers.

Q3 2025

Launch of Solayer Chain, built on InfiniSVM. The chain is set to reach up to 1 million transactions per second, 100 Gbps bandwidth, and near-instant confirmation times. A full development environment will support everything from DeFi to high-frequency non-finance apps.

Q4 2025 and Beyond

Plans include cross-chain support for Solana, EVM chains, and more. Solayer also targets real-world asset integrations, scaling its validator network with advanced hardware, and attracting more institutional players.

The roadmap aims to turn Solayer into a bridge between decentralized tools and real-world finance. Thus, offering global payment rails, institutional-grade access, and fast, open infrastructure for anyone to build on.

Ongoing upgrades will focus on speed, security, and smoother governance.

Security, Transparency & Risks

Solayer places strong emphasis on safety and user control. All smart contracts go through independent audits, and any major updates or treasury actions require decentralized multisig approval. For stakers, built-in slashing protection and emergency exits add another layer of confidence.

That said, users should stay aware of the risks. Solayer introduces new technology, relies on Solana’s stability, and ties sUSD to Treasury yields, which can fluctuate. Regulations around the world are also being established, and like any DeFi platform, Solayer carries the usual trade-offs of innovation and execution.

Security protocols: Regular audits, multisig governance, slashing safeguards.

Risks to consider: Smart contract bugs, delays in product rollout, shifting regulations, and potential drops in DeFi yields over time.

Read our full guide on how you can protect your assets in the Web3 world.

Final Verdict

Solayer has vision, tech, traction, and timing. If it sticks the landing, it could become one of Solana’s most important protocols.

Solayer feels less like a typical DeFi product and more like infrastructure for what comes next. With its approach to restaking, on-chain utility, and hardware-based execution, it’s laying the groundwork for a new kind of financial system on Solana. If you’re looking to stake smarter or build the next dApp on Solana, Solayer might just be your next stop.