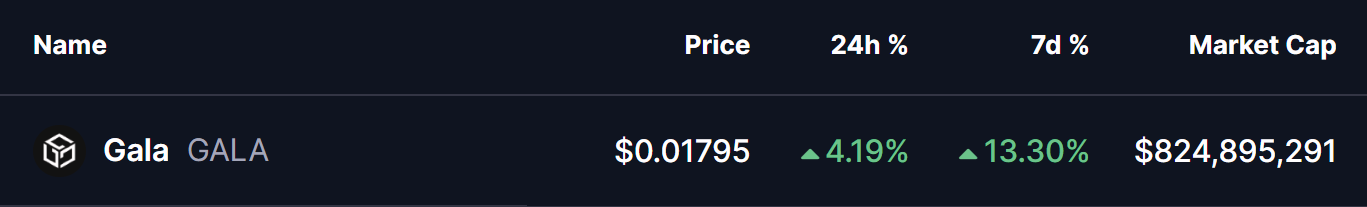

The cryptocurrency market is showing strength amid the anticipated potential US Federal Reserve rate cuts, with Ethereum (ETH) reclaiming the $4,550 mark today. Following this, several major altcoins are flashing bullish signals — including gaming token Gala (GALA).

GALA has turned green with an impressive 13% gain over the past week, and more importantly, its chart is now displaying a key pattern formation that hints at a potential breakout in the sessions ahead.

Source: Coinmarketcap

Symmetrical Triangle in Play?

On the daily chart, GALA is consolidating within a Symmetrical Triangle pattern, a setup that typically reflects a battle between buyers and sellers before a decisive move. While such structures can resolve in either direction, continuation to the upside is often favored when broader momentum is bullish.

Recently, GALA rebounded strongly from its support base around $0.01517, defended by buyers after a pullback. This move allowed the token to reclaim its 200-day moving average ($0.01672), with price now sitting near $0.01793, just below the triangle’s upper resistance trendline.

Gala (GALA) Daily Chart/Coinsprobe (Source: Tradingview)

This technical alignment suggests that a breakout attempt may be imminent.

What’s Next for GALA?

If bulls manage to secure a clean breakout above $0.01815, ideally supported by higher trading volume, it would confirm bullish momentum. Such a move could unlock a rally toward the measured move projection of $0.02913 — representing a potential upside of more than 60% from current levels.

On the downside, if GALA fails to push through resistance, the lower trendline of the triangle will act as the key support. Losing this level could temporarily delay the bullish breakout outlook.