SharpLink Gaming (SBET) has quietly turned into a curious mix of sports betting affiliate marketing and Ethereum staking, and that blend is starting to matter more as investors reassess its recent share performance.

See our latest analysis for SharpLink Gaming.

At today’s $10.72 share price, SharpLink’s year to date share price return of 32.68% contrasts sharply with a 3 year total shareholder return of negative 75.19%. This hints that recent momentum may be more of a speculative reset than a durable rerating.

If SharpLink’s mix of sports betting and crypto aligned yield has your attention, it could be worth broadening your search and discovering fast growing stocks with high insider ownership.

With revenue nearly doubling yet profits still elusive and the share price far below analyst targets, has SharpLink quietly become a mispriced growth story, or is the recent rebound simply markets fairly valuing its future potential?

Price to Book of 0.7x: Is it justified?

On a price to book basis, SharpLink’s 0.7x multiple at a $10.72 share price screens as undervalued versus both its hospitality peers and our own fair value work.

The price to book ratio compares a company’s market value to the net assets on its balance sheet and is often used for asset light, service based or financially cyclical businesses. For SharpLink, trading below its book value suggests investors are placing a discount on its equity despite rapid top line growth and expectations for future profitability.

Compared with the wider US hospitality industry average of 2.6x and a peer group closer to 5.3x, SharpLink’s 0.7x price to book signals a steep valuation gap. If its execution in affiliate marketing and Ethereum staking even partially matches the forecast growth profile, there is room for the multiple to move meaningfully closer to sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 0.7x (UNDERVALUED)

However, lingering losses and heavy reliance on volatile Ethereum staking economics could quickly undermine today’s apparent discount if sentiment or regulation were to turn.

Find out about the key risks to this SharpLink Gaming narrative.

Another View: What Does Our DCF Say?

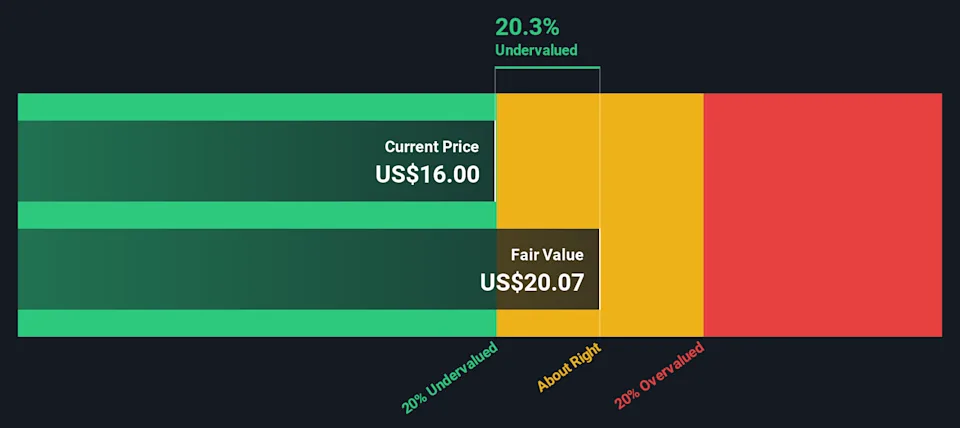

Our DCF model values SharpLink at $13.86 per share, around 22.7% above the current $10.72 price, which also points to undervaluation. However, DCFs depend heavily on long term growth and profitability assumptions. This raises the question: is the discount a genuine opportunity, or is it simply compensation for execution risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SharpLink Gaming for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SharpLink Gaming Narrative

If this perspective does not quite align with your own, or you would rather dig into the numbers yourself, you can build a personalised view in minutes, Do it your way.

A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Sharpen your edge by acting now. The next standout opportunity may be hiding in plain sight on a focused screener instead of your current watchlist.

Capture potential bargains early by scanning these 907 undervalued stocks based on cash flows that still trade at compelling discounts to their estimated cash flow potential.

Ride structural growth trends by targeting these 30 healthcare AI stocks using artificial intelligence to reshape diagnostics, treatment, and operational efficiency.

Tap into innovation at the frontier of finance by reviewing these 81 cryptocurrency and blockchain stocks positioned to benefit from blockchain adoption and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.