Bitcoin traders are preparing for a pivotal week, as four major US economic releases, including the Federal Reserve’s interest rate decision and essential labor market data, stand to influence market sentiment and determine the crypto’s next move.

This convergence of monetary policy updates and employment figures finds Bitcoin trading near technical levels that may result in notable volatility, upward or downward.

FOMC Interest Rate Decision

The FOMC (Federal Open Market Committee’s) interest rate decision, scheduled for Wednesday at 2:00 p.m. ET, is widely viewed as the most significant event for Bitcoin and risk assets this week.

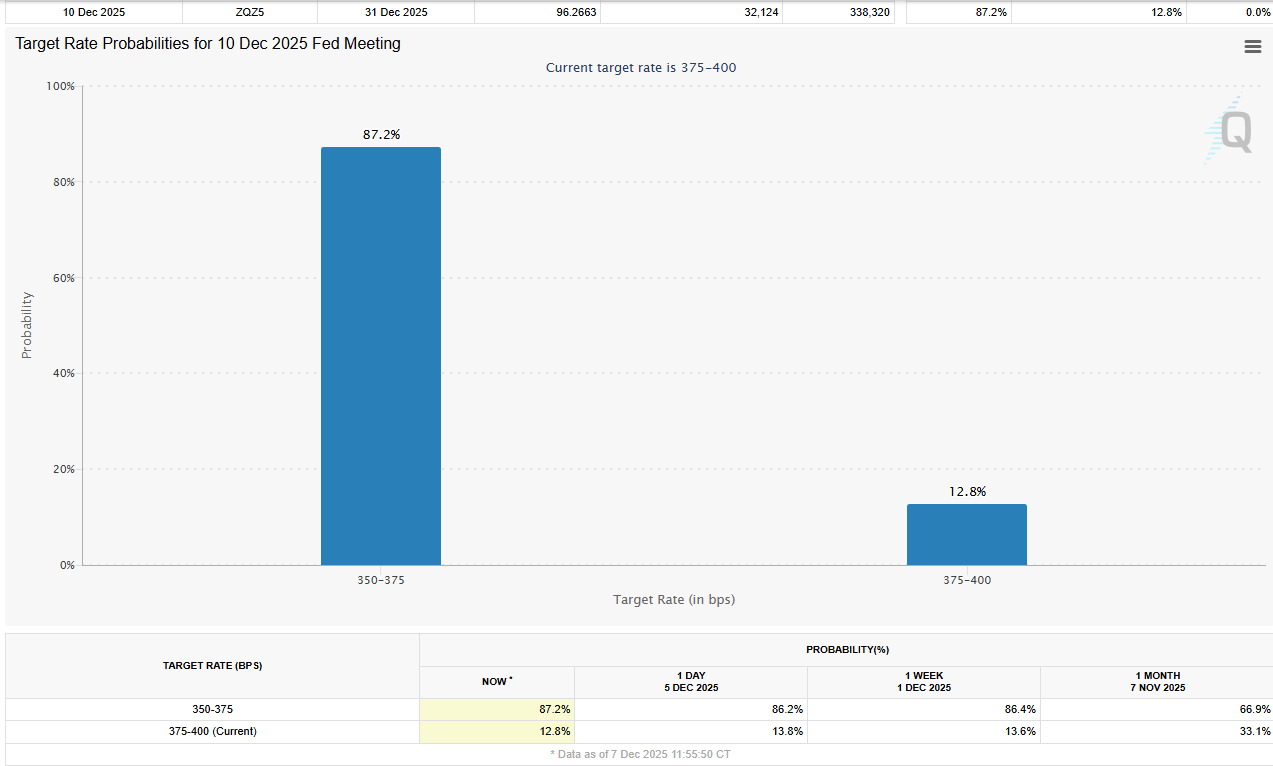

Market pricing implies an 87% probability of a rate cut, based on CME Group data, reflecting broad expectations for accommodative monetary policy that often benefits cryptocurrencies.

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Speculation is growing on social media about the scope of any rate change, with some saying that the market is already pricing a rate cut.

This assumption comes as the Bitcoin price is already showing strength, holding well above the $90,000 psychological level after the weekend’s whipsaw event.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

Beyond the interest rate decision, the actual impact on Bitcoin may depend less on the decision and more on the Fed’s guidance for future policy.

Fed Chair Powell Press Conference

After the announcement, Federal Reserve Chair Jerome Powell will hold a press conference at 2:30 p.m. ET. Powell’s commentary on future policy, inflation, and the economy is likely to provide important cues for crypto investors.

Historically, his statements have shaped positioning across markets, with Bitcoin being especially sensitive to changes in monetary policy direction.

Market analysts caution that unexpected hawkish comments could put pressure on Bitcoin, even if the rate decision itself appears positive for crypto.

Job Openings (JOLTS) and Initial Jobless Claims

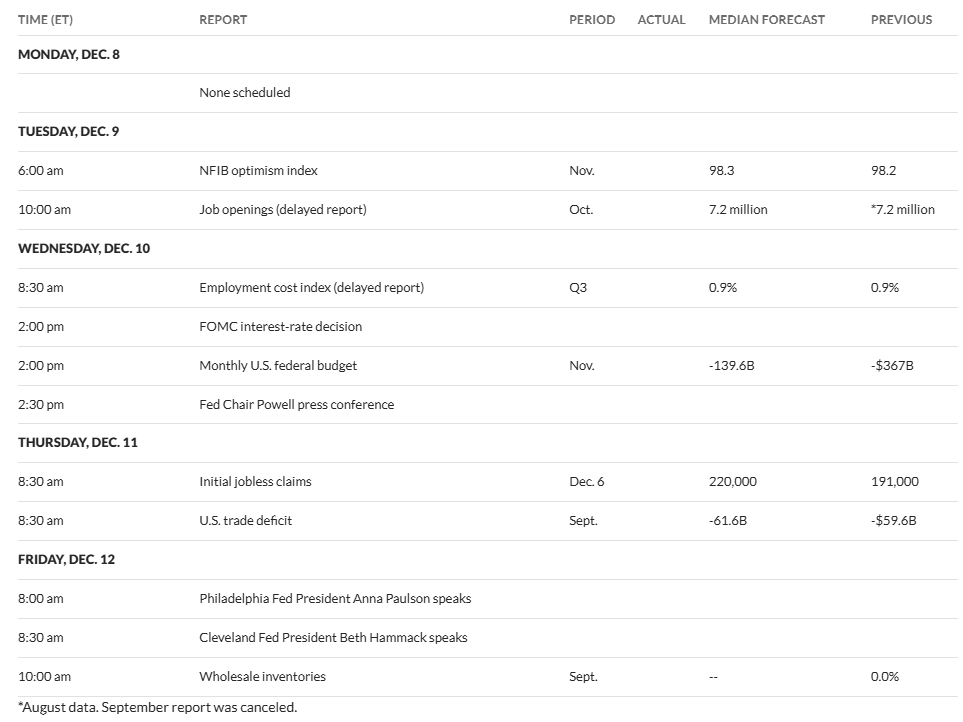

Job openings data for October will be released on Tuesday at 10:00 a.m. ET, with economists anticipating 7.2 million openings, unchanged from last month.

This data measures labor market tightness and influences Federal Reserve policy. Strong job openings could discourage aggressive rate cuts, possibly limiting Bitcoin’s short-term gains.

Initial jobless claims for the week ending December 6 will be published Thursday at 8:30 a.m. ET. Analysts expect 220,000 claims, up from the prior week’s 191,000, which was a near two-year low.

Large departures from this forecast could spark swift market moves as traders reassess economic strength and policy outlooks.

The jobs market’s status can cut both ways for Bitcoin. Strong figures can suggest economic health, which typically supports risk appetite, yet may lessen the push for monetary easing. Conversely, weaker data could prompt more rate cuts but signal risk-off sentiment in speculative markets.

Technical analysts are focusing on Bitcoin’s key levels in advance of these releases. The $86,000 mark is a crucial support; consistent moves below it may open a path toward $80,000. Conversely, reclaiming $92,000 could fuel momentum toward the headline $100,000 level.

Additional Federal Reserve officials, such as Philadelphia Fed President Anna Paulson and Cleveland Fed President Beth Hammack, are due to speak on Friday after the FOMC meeting. Their remarks could further clarify policy and influence how markets interpret recent decisions, extending the Bitcoin impact beyond Wednesday.

This Week’s Major US Economic Reports & Fed Speakers. Source: Market Watch

This compressed timeline of major economic updates sets the stage for amplified reactions. Bitcoin’s response will likely determine its path in December, impacting year-end investor positioning and testing the resilience of recent institutional interest.