Bitcoin rises above $92,000 as ETF inflows resume while retail demand falters.

Ethereum edges up above $3,100 despite extended ETF outflows.

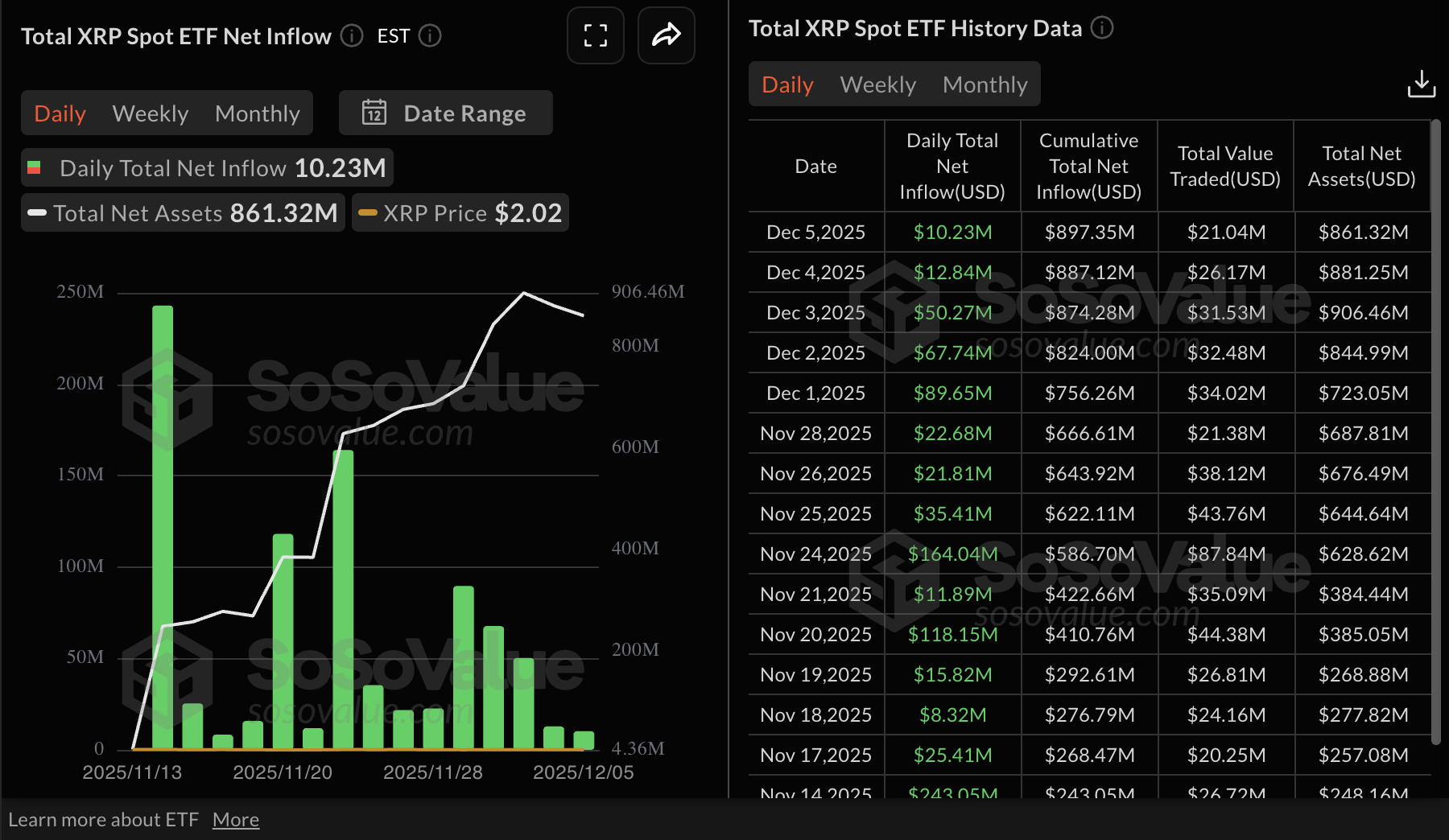

XRP springs from $2.00 support, supported by institutional demand as ETFs post 15 days of consecutive inflows.

Bitcoin (BTC) is trading marginally above $92,000 at the time of writing on Monday, supported by improving market sentiment ahead of the Federal Reserve (Fed) monetary policy decision on Wednesday.

Altcoins, including Ethereum (ETH) and Ripple (XRP), are edging higher following in Bitcoin’s footsteps. Ethereum is closing in on $3,200, while XRP edges up above $2.10 after bouncing off support at around $2.00.

Data spotlight: Bitcoin rises amid ETF inflows, low retail demand

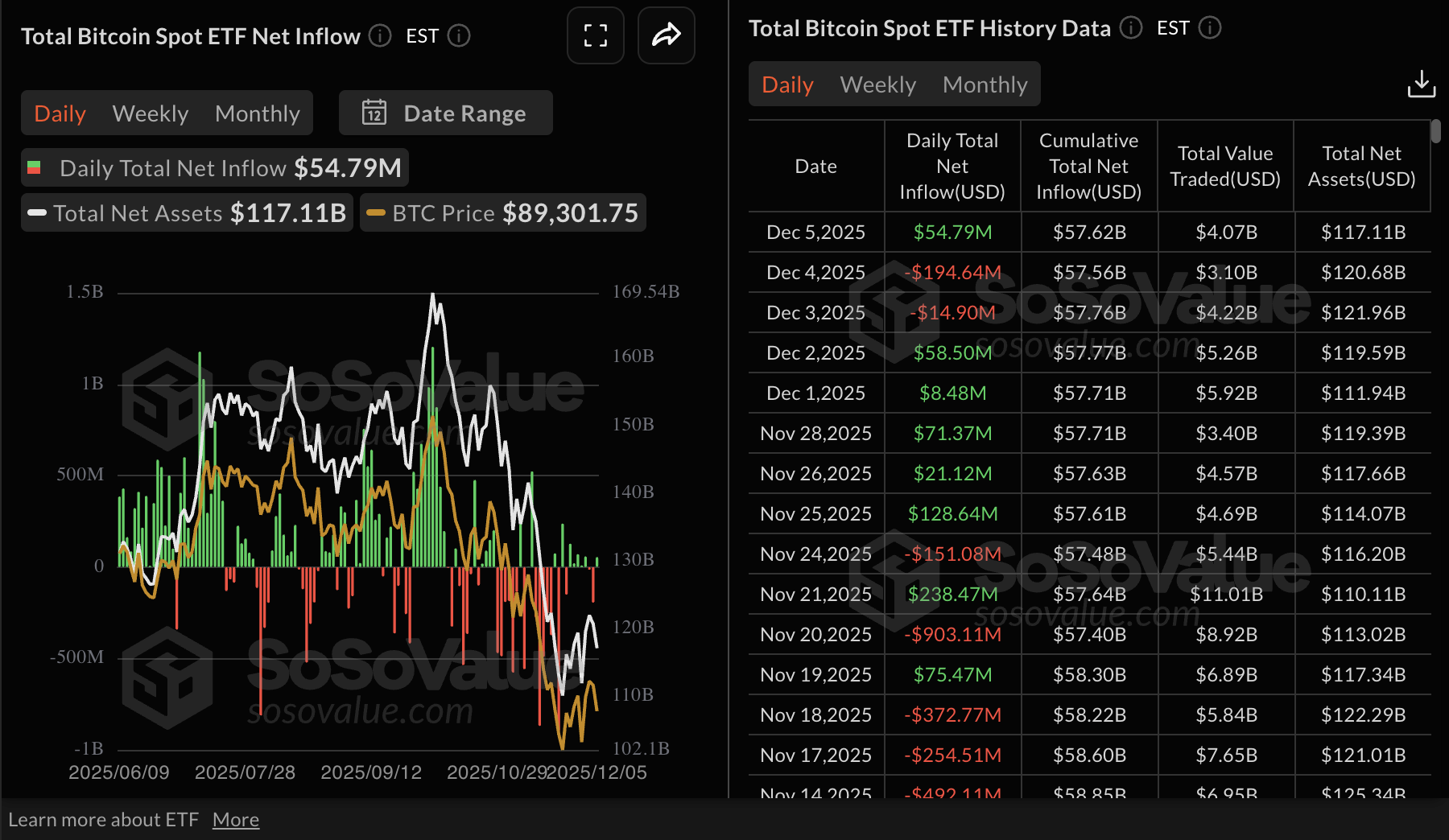

Bitcoin spot Exchange Traded Funds (ETFs) resumed inflows on Friday, with nearly $55 million streaming in after two days of consecutive outflows of $195 million on Thursday and $15 million on Wednesday, according to data from SoSoValue.

The cumulative total inflow volume stands at $57.62 billion, with net assets of $117 billion. Continued inflows underpin positive market sentiment, which helps bolster Bitcoin’s uptrend.

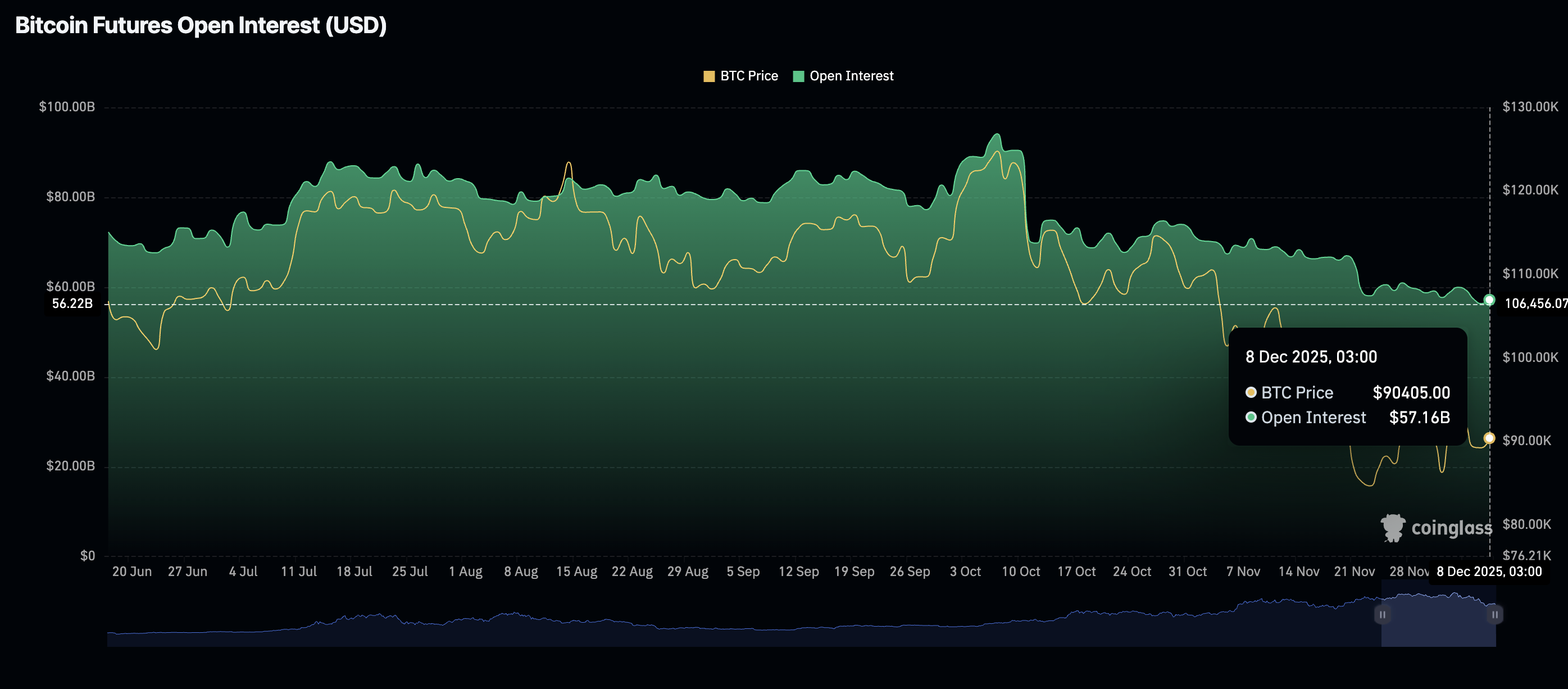

However, retail demand remains significantly low despite a slight increase in futures Open Interest (OI) to $57.16 billion on Monday from $56.32 billion the previous day. Still, OI is far from the record high of $94.12 billion seen on October 7, before the flash crash on October 10. Low retail demand often reflects a weak tailwind, as investors are not convinced that Bitcoin price can sustain an extended uptrend.

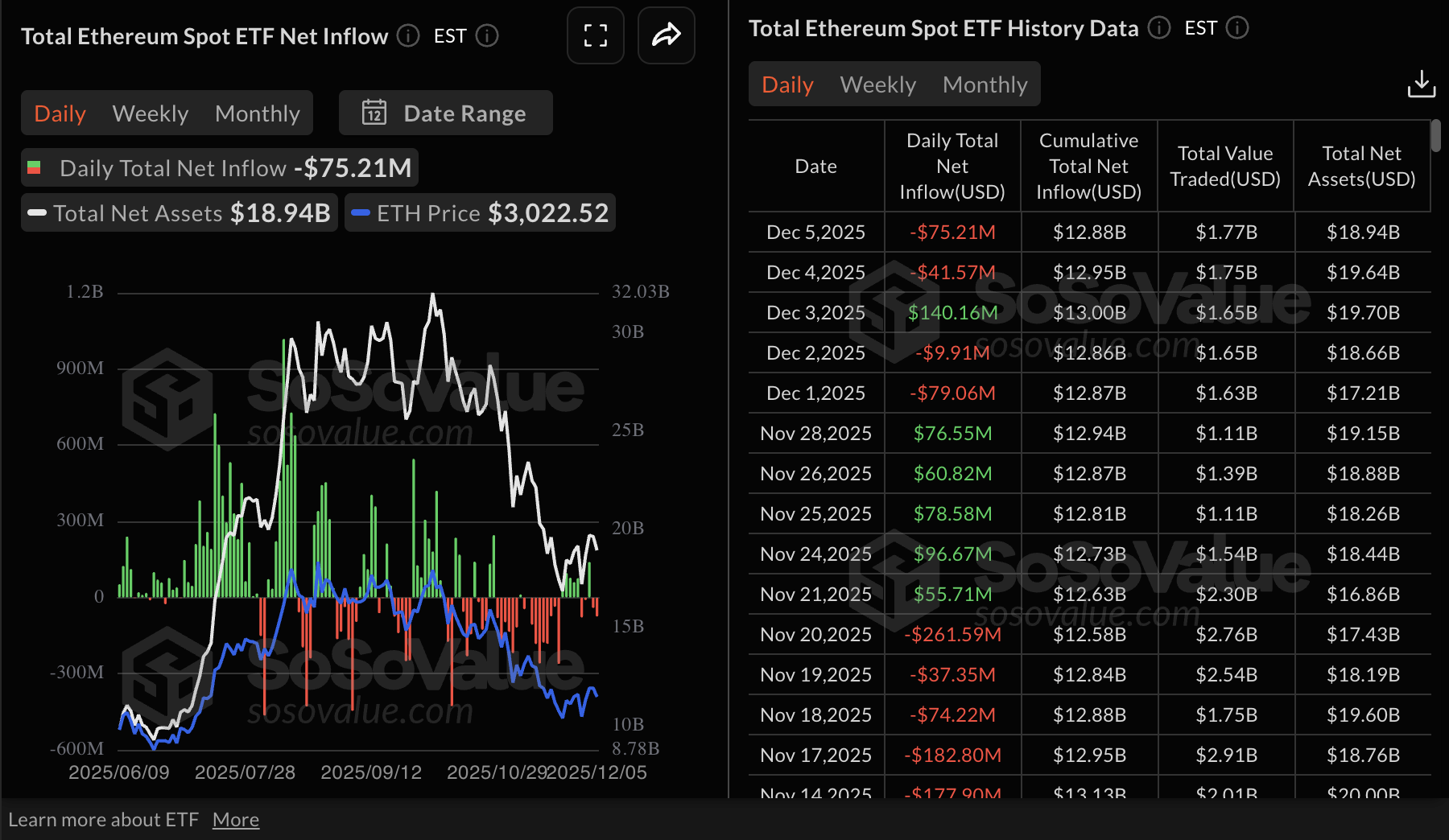

Ethereum, unlike Bitcoin, experienced outflows of $75 million on Friday and $42 million on Thursday. BlackRock’s ETHA was the only US-listed ETH spot ETF in the red on Friday, with the rest remaining quiet. Meanwhile, the cumulative inflow volume remains at $12.88 billion, with net assets of $18.94 billion.

XRP spot ETFs, on the other hand, are on a stellar performance streak, with 15 consecutive days of inflows. SoSoValue data shows that XRP ETFs recorded $10 million in inflows on Friday and have not experienced outflows since their debut on November 13. The cumulative total inflow stands at $897 million, with net assets of $861 million.

Chart of the day: Bitcoin bulls push to regain control

Bitcoin is trading slightly above $92,000 at the time of writing on Monday, as bulls aim to retain control of the trend. The upswing is supported by the buy signal from the Moving Average Convergence Divergence (MACD) indicator on the daily chart seen on November 26. Green histogram bars are expanding above the zero line, backing a positive thesis.

The Relative Strength Index (RSI) on the same chart is at 48, suggesting that bullish momentum is gradually increasing. An RSI extension above the midline would add to the positive outlook, increasing the odds of a swing toward $100,000.

Still, Bitcoin price holds below the down-trending 50-day Exponential Moving Average (EMA) at $97,238, the 100-day EMA at $102,593 and the 200-day EMA at $103,953, all of which may cap rebounds. A reversal below $90,000 could accelerate the downtrend and test a short-term support level at $87,719, which was tested on Sunday.

Altcoins update: Ethereum, XRP rise above key support

Ethereum is extending its recovery above $3,100, as bulls push to tighten their grip and break a descending trendline resistance. The RSI on the daily chart crossed above the 50 midline.

The MACD on the same chart has maintained a buy signal since November 25. ETH’s trend could remain bullish if the histogram bars continue to expand above the mean line and the indicator crosses into the bullish region.

A break above the 50-day EMA at $3,316 could bolster Ethereum’s bullish bias. However, traders must be aware of the 200-day EMA at $3,459 and the 100-day EMA at $3,521, where ETH could encounter resistance and slow down the uptrend toward $4,000.

Meanwhile, XRP rises above $2.10 on Monday after bulls defended support at $2.00 on the previous day. Buyers are pushing to retain control as the RSI on the daily chart tries to reach the neutral level of 50.

The 50-day EMA is holding at $2.27, the 100-day EMA at $2.43 and the 200-day EMA at $2.47, all of which could slow down XRP’s uptrend. Buyers must flip the moving averages into support to reinforce the bullish grip, and an extended move above the descending trendline would further bolster it. Still, XRP is not out of the woods yet amid the growing risk of another swing below the pivotal $2.00 level.