TradingKey - While the market broadly anticipates a 25 basis point Federal Reserve rate cut in December, investors remain divided on Bitcoin's future price trajectory.

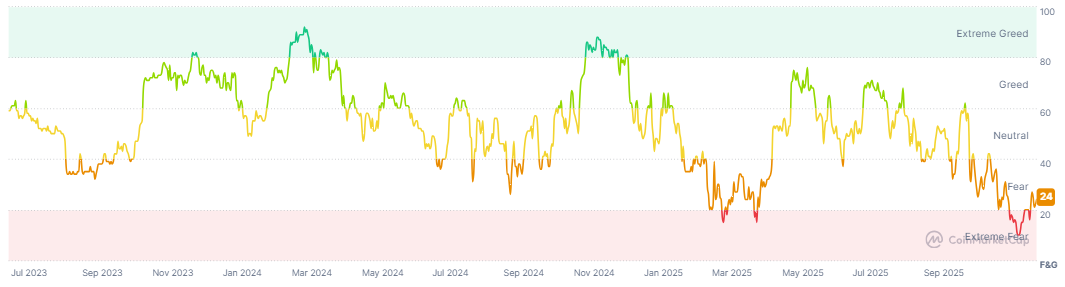

Bitcoin (BTC) traded erratically on Monday, December 8, hovering near $95,000 and last reported at $91,970. The cryptocurrency's weaker price weighed on the broader crypto market, with the sentiment index registering 24, indicating a continued state of fear.

[Crypto Market Fear & Greed Index, Source: CoinMarketCap]

On November 21, the crypto market experienced another "Black Friday" as Bitcoin plummeted, nearing the $80,000 mark and hitting a low of $80,659. This marked its lowest level since April 2025. Concurrently, Ether (ETH) also fell, breaching the $2,800 threshold, while Binance Coin (BNB) dropped below $800.

[Bitcoin Price Chart, Source: TradingView]

Bitcoin's latest plunge triggered a widespread downturn in the crypto market, resulting in significant liquidations. According to the latest data from Coinglass, over 370,000 individuals were liquidated across the crypto market that day, with total liquidation value exceeding $1.8 billion. Nearly $1.6 billion of this involved long positions.

This recent Bitcoin downturn was primarily influenced by the Federal Reserve's high interest rates, which tightened liquidity. Furthermore, the U.S. October core PCE inflation rate surpassed 2%, and Fed officials issued a series of hawkish signals, further dampening rate cut expectations. Additionally, the People's Bank of China reiterated its crackdown on virtual currency trading at the end of November, contributing to Bitcoin's weak rebound.

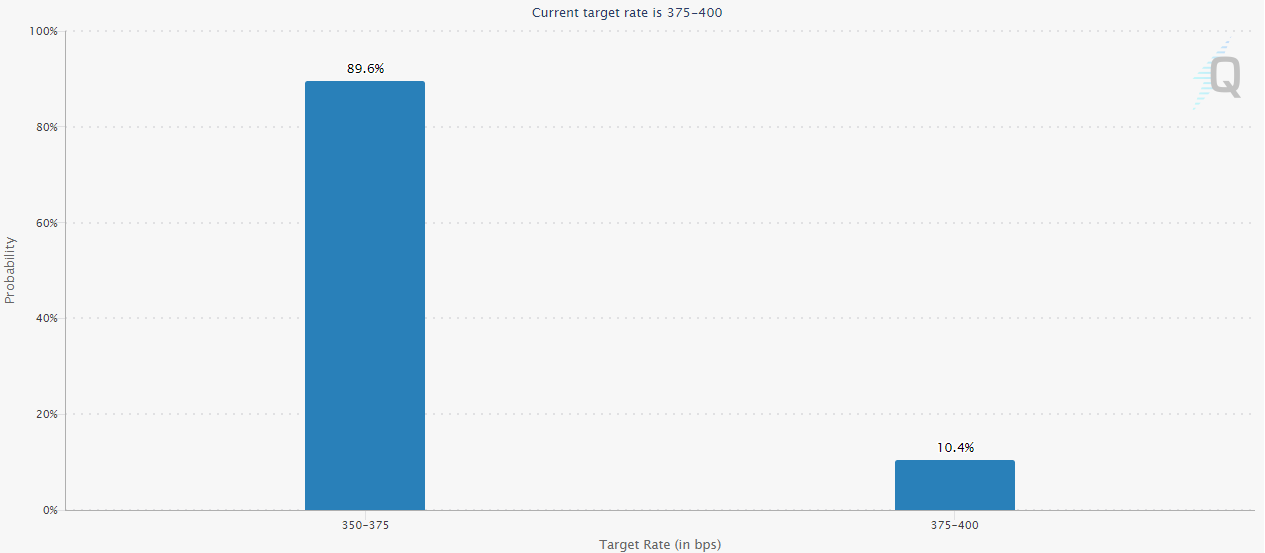

However, market expectations for a continued Fed rate cut in December have gradually risen. Data from the CME FedWatch Tool indicates that the likelihood of the Federal Reserve cutting rates by 25 basis points in December is nearly 90%, while the probability of maintaining rates remains around 10%. Furthermore, data from crypto prediction platform Polymarket also shows a 94% chance of the Fed enacting a 25 basis point rate reduction in December.

【Market Expectations for Fed Rate Cut Probability, Source: CME】

Additionally, major institutions including Bank of America, Morgan Stanley, and Nomura Securities have reversed their previous forecasts for the Federal Reserve to hold rates steady in December. They have unanimously shifted towards anticipating a continued 25 basis point rate cut.Goldman Sachs went further, stating, "A Fed rate cut at the December policy meeting is virtually certain."

While the market largely views a Fed rate cut as imminent, will Bitcoin's price necessarily rise? Bank of New York Mellon offered a negative assessment, with its analysts noting in a December report that "the market has already fully priced in expectations of a December Fed rate cut."

In contrast, analysts at the London Crypto Club adopted a positive stance, suggesting that the Fed could expand the money supply through an innovative bond-buying program. This, they believe, would provide a "strong structural impetus" for the cryptocurrency market.

The Federal Reserve's FOMC will announce its interest rate decision this Wednesday. Bitcoin's price is therefore expected to continue its strong rebound, potentially even breaching the $100,000 mark.This forecast is based on Bitcoin's robust performance since its late-November plunge, with rebounding lows and highs consistently rising despite market skepticism. Bearish sentiment appears to be weakening, and bulls intend to dominate the market.