The altcoin market in December no longer shows the heavy losses seen last month. It is now moving into a new sideways phase. Several altcoins with unique catalysts and news flows have pushed many derivatives traders to take one-sided positions.

However, this week also brings several important macro events. These events may expose their positions to significant liquidation risks.

1. Zcash (ZEC)

From the all-time high of $748 set last month, ZEC has dropped by 50%. Such a deep decline tends to attract investors who believe they missed earlier opportunities. This sentiment encourages derivatives traders to expect a rebound in December. As a result, accumulated liquidation volume on the Long side has surged.

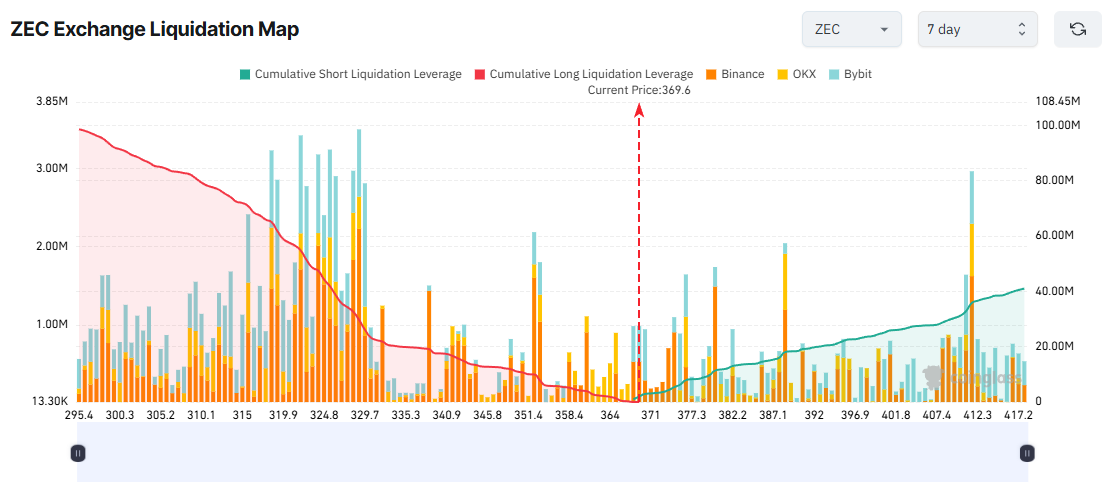

ZEC Exchange Liquidation Map. Source: Coinglass

Traders also gained another reason to bet on Long positions. Zooko Wilcox, the founder of Zcash, will join a December 15 discussion hosted by the SEC on crypto, financial oversight, and privacy. Investors expect his appearance to amplify support for privacy altcoins, including ZEC.

If Long positions remain overly confident without stop-loss plans, Long traders may face up to $98 million in liquidations if ZEC falls toward $295 this week.

A recent analysis by BeInCrypto shows that ZEC remains in a broader downtrend after the earlier FOMO rally. Its technical structure continues to resemble a bubble pattern.

2. Aster (ASTER)

Aster, a leading derivatives DEX on BNB Chain, benefited from soaring trading activity during the Perpetual DEX boom in September. However, its price has since dropped by more than 60% and now fluctuates below $1.

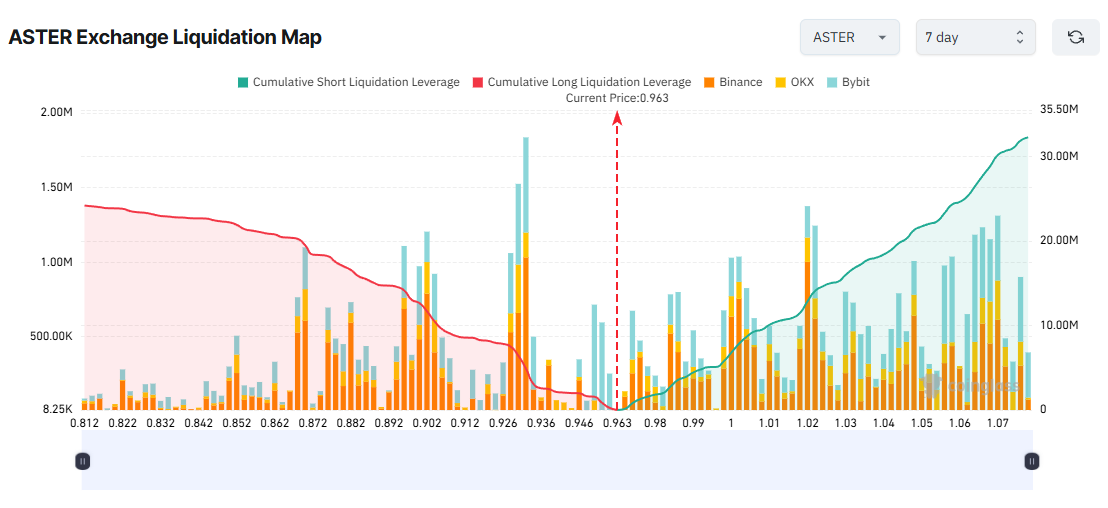

Liquidation maps show that total active liquidation volume for Short positions exceeds that of Long positions. Even so, Short sellers may face considerable risk this week.

ASTER Exchange Liquidation Map. Source: Coinglass

Aster recently announced an accelerated buyback program starting December 8, 2025. The new daily buyback pace is about $4 million, up from the previous $3 million.

This development could support a price increase this week. If ASTER rises to $1.07, the total Short-side liquidation volume may exceed $32 million.

Technically, analysts also note that the price has reached a strong support zone and has broken above a one-month trendline.

3. Bittensor (TAO)

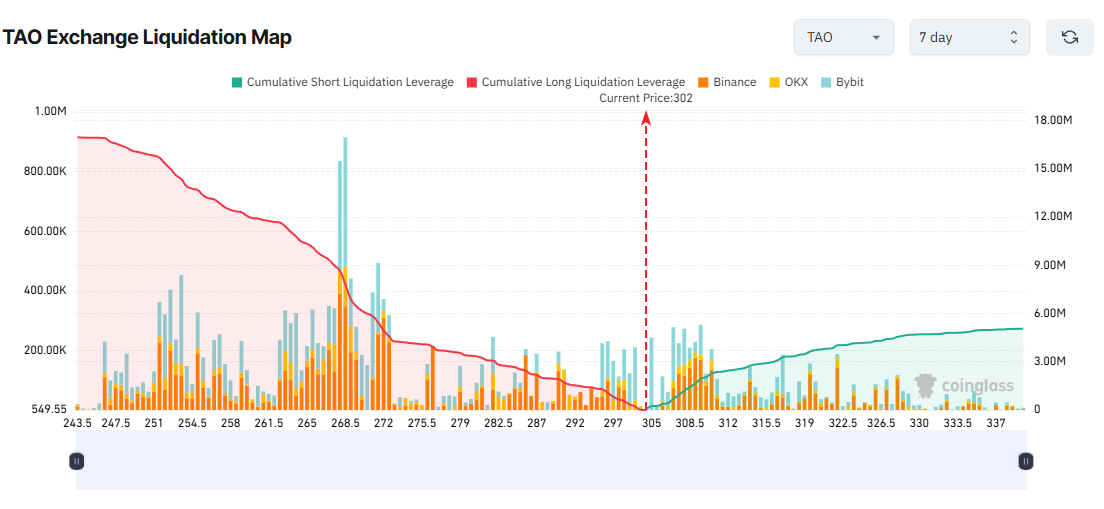

The liquidation map for Bittensor (TAO) shows a severe imbalance. Long-side liquidation volume far exceeds that of the Short side.

If TAO drops to $243.50, Long traders may face nearly $17 million in losses. Conversely, a rise to $340 could liquidate approximately $5 million in Short positions.

TAO Exchange Liquidation Map. Source: Coinglass

Why are so many traders betting on Long positions? Many expect the price to rise ahead of TAO’s first halving.

According to BeInCrypto, around December 14, Bittensor’s first halving will reduce daily issuance from 7,200 TAO to 3,600 once total supply reaches 10.5 million.

“This reduction in supply will lower emissions to network participants and increase TAO’s scarcity. Bitcoin’s history shows that reduced supply can enhance network value despite smaller rewards, as its network security and market value have strengthened through four successive halvings. Similarly, Bittensor’s first halving marks a key milestone in the network’s maturation as it progresses toward its 21 million token supply cap.” – Grayscale explained.

Grayscale’s report has strengthened bullish sentiment among Long traders. Without strict stop-loss planning, a “sell-the-news” effect may trigger widespread liquidations.

Additionally, the second week of December is the week the Federal Reserve announces its interest rate decision. Historically, this announcement has far greater market impact than most internal crypto news. Even if traders correctly predict the Fed’s move, they may still fail to avoid extreme volatility that triggers liquidations for both Long and Short positions.