ETH continues to see liquidity rotation, as smart whales and institutions are making a return. As ETH consolidated over $3,125, whales repositioned with expectations of further improvement.

ETH consolidated above $3,000, with recent whale activity showing more bullish sentiment. ETH traded at $3,104.96, after briefly rising closer to $3,200. The ETH fear and greed index is at 51 points, signaling neutrality.

The token is now seeking direction, with a potential boost from both spot-buying whales and long positions on derivative markets. ETH predictions include a breakout to a higher range, as the network remains crucial to DeFi and tokenization. ETH remains at 0.034 BTC, as the leading coin is still trading sideways.

Bitmine adds more ETH

Bitmine is one of the regular sources of support for ETH. The company bought another 138,452 ETH, mostly acquired between December 1 and December 7.

The company now holds 3.73M ETH, up 9.8% in the past month. Bitmine may continue buying until building a 5M ETH treasury.

Other treasury companies have not added more ETH, and remain a limited source of demand. Despite this, the ETH balance in accumulation wallets remains at an all-time peak above 27M tokens.

Institutions also added to the balance, though moving ETH at a slower pace compared to Bitmine. On-chain data shows that the Amber Group withdrew 6,000 ETH for self-custody, originating from a Binance hot wallet via an intermediary address.

Metalpha withdrew 3,000 ETH from the Gnosis Safe Proxy wallet and deposited the tokens to Aave.

ETH bounced from $2,800 in the past weeks, showing signs of whale intervention. Whales returned to buy the dip in that range, which coincided with the average acquisition price for large holders.

ETH whales show confidence in derivative trading

ETH open interest rose to over $17.4B, signaling increased confidence in an ongoing ETH rally. On Hyperliquid, nearly 59% of whales are taking long positions, with the highest one having a notional value of $162.41M. The leading trader, also known as the ‘Anti-CZ’ whale, has demonstrated success in previous trades.

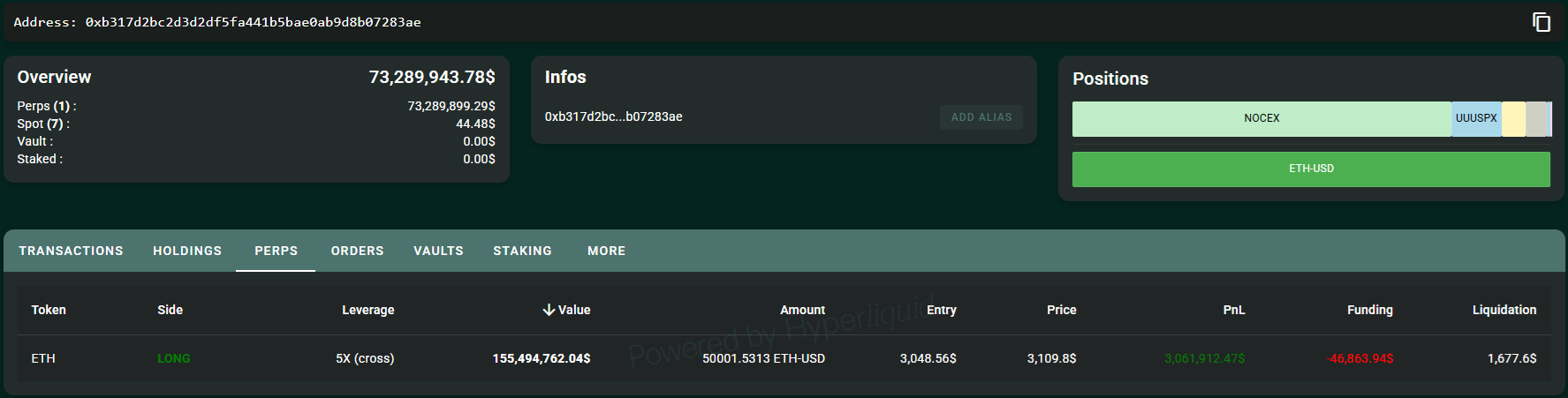

On-chain data reveals some of the most prominent whales have taken up long positions. The 1011 whale that shorted BTC is now bullish on ETH. The whale opened the second-biggest long position on Hyperliquid, at $155.12M, holding even after paying negative funding fees.

The whale achieved over $3M in unrealized gains after ETH extended its recovery. To hold this position, the whale has added over $70M in USDC liquidity in the past day. The whale already locked in $305K in profits from a smaller long position on ETH.

The active whales have a reputation for smart money choices, and at least in the short term, they have managed to accumulate gains on their positions. They are, however, also willing to take profits, rather than get liquidated.

Join a premium crypto trading community free for 30 days - normally $100/mo.