XRP is approaching a key decision zone, and analysts are watching whether the price can break major resistance to confirm a Wave-3 move toward $2.73.

At the time of writing, XRP trades near $2.07, while traders assess tightening chart structures, Ripple’s evolving regulatory position, and a cautiously improving macro backdrop. With market volatility compressing across multiple timeframes, XRP is now approaching an inflection point that traders have been anticipating for weeks.

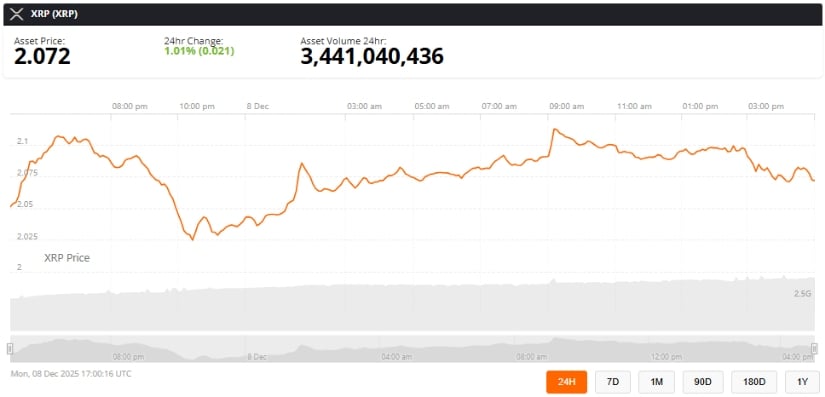

XRP Price Chart Today

XRP remains steady near $2.07, reflecting a 1% daily gain as it continues to defend short-term support. According to Brave New Coin’s latest chart data, XRP’s 24-hour trading volume stands at $3.44 billion, signaling active participation despite lower volatility across major altcoins.

XRP was trading at around 2.07, up 1.01% in the last 24 hours at press time. Source: XRP price via Brave New Coin

XRP continues to draw attention following Ripple’s recent procedural progress in the SEC lawsuit and renewed focus from institutional participants exploring the XRP Ledger for cross-border liquidity solutions.

What Analysts Are Seeing on the Charts

Crypto trader PrecisionTrade3, known for applying Elliott Wave analysis across Bitcoin and large-cap altcoins since 2019, outlines a potential five-wave impulse structure forming on XRP’s 4-hour chart. “My next target is $2.73 for Wave 3, but we need to break the two local resistances at $2.18 and $2.30 first,” he wrote on X.

XRP eyes a Wave-3 move toward $2.73, needing to break $2.18 and $2.30 resistance while holding support at $2.07. Source: @PrecisionTrade3 via X

His analysis shows XRP potentially completing a corrective Wave 2 and preparing for an expansion phase—if price can reclaim overhead resistance with supporting volume.The post has accumulated more than 26,000 views, indicating strong community interest.

Triangle Breakout Setup Signals 16% Upside Potential

Market analyst Ali Martínez (@ali_charts)—followed by over 50,000 traders for his pattern-based analytics—identified a descending triangle on the XRP 1-hour chart, showing price tightening between $2.05 support and the upper trendline near $2.10. “XRP is set up for a 16% move once it breaks out of this triangle,” Ali noted.

XRP could gain 16% on a breakout from its current triangle pattern. Source: @ali_charts via X

A breakout above the trendline could target $2.38, with potential to revisit the price zone that historically produced strong volatility spikes in earlier cycles.

Ali also noted XRP’s 25% monthly rally, partly influenced by positive developments in Ripple’s legal case and increased institutional flows.

Mixed Intraday Signals as XRP Trades Inside a Compression Zone

A separate review from TradingView analyst MonoCoinSignal shows XRP struggling beneath a tight cluster of moving averages on the 1-hour chart, including the EMA50 at $2.07 acting as support, and the EMA20, EMA200, and HMA55 all stacked between $2.08–$2.09 as resistance. This compression suggests sellers continue to defend the upper band aggressively.

XRP trades in a tight $2.07–$2.09 compression zone, with key moving averages and low volume hinting at a potential short-term breakout or breakdown. Source: MonoCoinSignal on TradingView

MonoCoinSignal adds that trading volume is nearly 50% below the daily average, signaling a lack of strong buyer commitment. Until XRP reclaims the $2.09 level with convincing volume, the short-term bias remains neutral to slightly bearish.

Key Indicator Readings

Stochastic: Oversold at 12.2 (may support short-term bounce potential)

MACD: Bearish alignment remains intact

RSI: Neutral at 48.5

ADX: 33.5, signaling a directional trend rather than consolidation

The presence of lower-high structures supports a mildly bearish near-term bias.A breakdown below $2.07 could open the path toward $2.03 or the $2.01 session low, while reclaiming $2.09 with strong volume would be the first sign of bullish momentum rebuilding.

Market Backdrop: Ripple, SEC, and Broader Sentiment

While Ripple’s legal battle with the SEC remains ongoing, recent procedural steps—including rulings limiting the SEC’s ability to classify XRP as a security in secondary markets—have contributed to improved sentiment. However, final outcomes remain uncertain, and legal risk is still an active factor in XRP volatility.

Institutional interest in the XRP Ledger has also increased in 2024–2025, with new pilots in remittance corridors and liquidity-on-demand use cases, particularly in Asia. These developments support longer-term utility discussions but do not guarantee short-term price performance.

Bitcoin’s approach toward key resistance levels above $100,000 continues to shape broader market confidence. Historically, XRP has reacted strongly during periods when Bitcoin stabilizes after major runs.