Bitcoin traders are facing fresh on-chain signals that suggest older coins are re-entering the market as investors prepare for the upcoming Federal Reserve policy decision. Analysts expect the Fed to cut rates at its December meeting, and markets have already priced in a 25-basis-point move.

However, on-chain activity indicates uncertainty beneath the surface.

Dormant Bitcoin Supply Returns as Market Waits for Policy Clarity

Over 2,400 BTC aged more than ten years moved this week, activating long-dormant supply worth more than $215 million. These coins usually stay untouched, and movement often precedes distribution rather than accumulation.

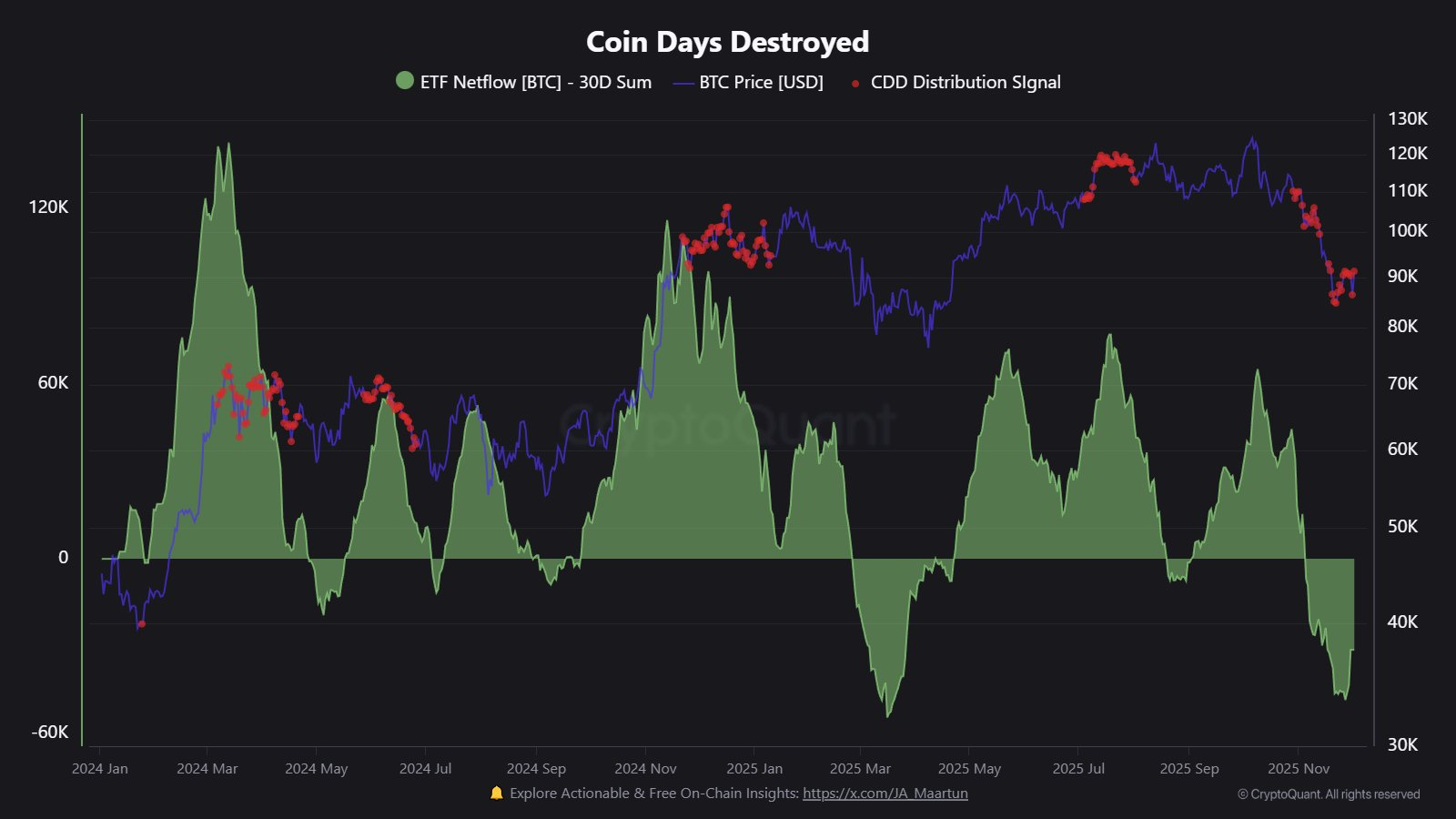

Another signal shows Coin Days Destroyed flashing again. This metric highlights old holders moving Bitcoins, often to sell into strength.

Demand absorbed this supply earlier in the year, but analysts now observe buyers stepping back while experienced holders send coins to market.

Bitcoin Coin Days Destroyed Metrics. Source: CryptoQuant

Older supply returning during weak demand has historically pressured price action. ETF inflows remain soft, and netflows show reduced institutional appetite compared with recent peaks. This suggests rallies may struggle unless liquidity returns.

Institutional analysts remain confident in the broader cycle. Bernstein argues Bitcoin may have broken the four-year halving rhythm and is entering an extended adoption phase.

The firm expects Bitcoin to reach $150,000 in 2026, with a potential 2027 peak near $200,000.

Yet market direction now depends on the Federal Reserve. If policymakers cut rates as expected, liquidity may improve and strengthen risk assets through early 2026.

A weaker dollar and lower capital costs could help support ETF demand and absorb long-term holder selling.

A delay or smaller cut could create volatility. Combined with revived supply, Bitcoin may face deeper corrections before recovering.

Analysts warn that strong bids will be necessary to offset aging supply reactivation.

For now, Bitcoin sits between shifting on-chain behavior and macro expectations. Investors will watch the FOMC signal closely to understand whether the next move strengthens market resilience or exposes further downside.