Key Takeaways

OpenLedger is an AI-blockchain project that records datasets, model training, and attribution on-chain, rewarding contributors with the OPEN token.

The OpenLedger airdrop is closed, but early users earned rewards by joining testnets, running nodes, and completing social tasks.

The OpenLedger token launched in September 2025, debuting on Korean exchanges, with a roadmap leading to full mainnet stability in 2026.

Artificial intelligence is now the most critical technology of our generation, but its power is overwhelmingly concentrated within private companies. This corporate control leads to a lack of transparency: data is harvested secretly, models are built behind closed doors, and users are left unaware of the sources behind the content they get. OpenLedger was created to address this problem.

If you’ve been asking what OpenLedger is, the answer is straightforward: it’s a project designed to put intelligence itself on the blockchain. Instead of hiding data and models in corporate silos, OpenLedger records every contribution on-chain, rewarding participants with tokens and ensuring full transparency. From dataset uploads to model training, attribution, and governance, every step is verifiable.

What Is OpenLedger?

If you’ve been following the crypto and AI space, you’ve probably seen people asking what is OpenLedger. In short, OpenLedger is a new project that brings artificial intelligence and blockchain together. Instead of keeping AI models hidden inside corporate labs, it puts everything on-chain, datasets, model training, and even attribution. That means if you contribute data or computing power, you get recognized and rewarded.

The vision behind OpenLedger crypto is bold. It wants to be more than another DeFi marketplace. While Ethereum showed us smart contracts, OpenLedger is trying to become the ledger of thought itself. By anchoring AI to blockchain, the project ensures provenance, transparency, and fair economic rewards.

AI has long operated as an opaque “black box.” OpenLedger is the first AI-native ledger built to change that. Through its DeFi framework, it makes artificial intelligence public, accountable, and economically valuable.

OpenLedger Team

The OpenLedger founder and the wider team come from both AI and blockchain backgrounds. Their core belief is that intelligence itself should be ledger-native. They are engineers, researchers, and crypto veterans who understand both the technical and economic challenges. OpenLedger highlights its builders openly, and among the early names are Kamesh and Ramkumar Subramanian, both listed as core contributors.

From the early days, the OpenLedger project overview showed a clear commitment: build a system where contributors, whether they upload datasets, run models, or deploy agents, are fairly compensated. The OpenLedger release date of its testnet was an early milestone, and since then, the team has been expanding rapidly.

They’ve also made a strong push into the Korean market, listing on exchanges like Upbit and Bithumb right after launch. This move gave OpenLedger crypto legitimacy and liquidity in one of the most active regions for AI + blockchain projects.

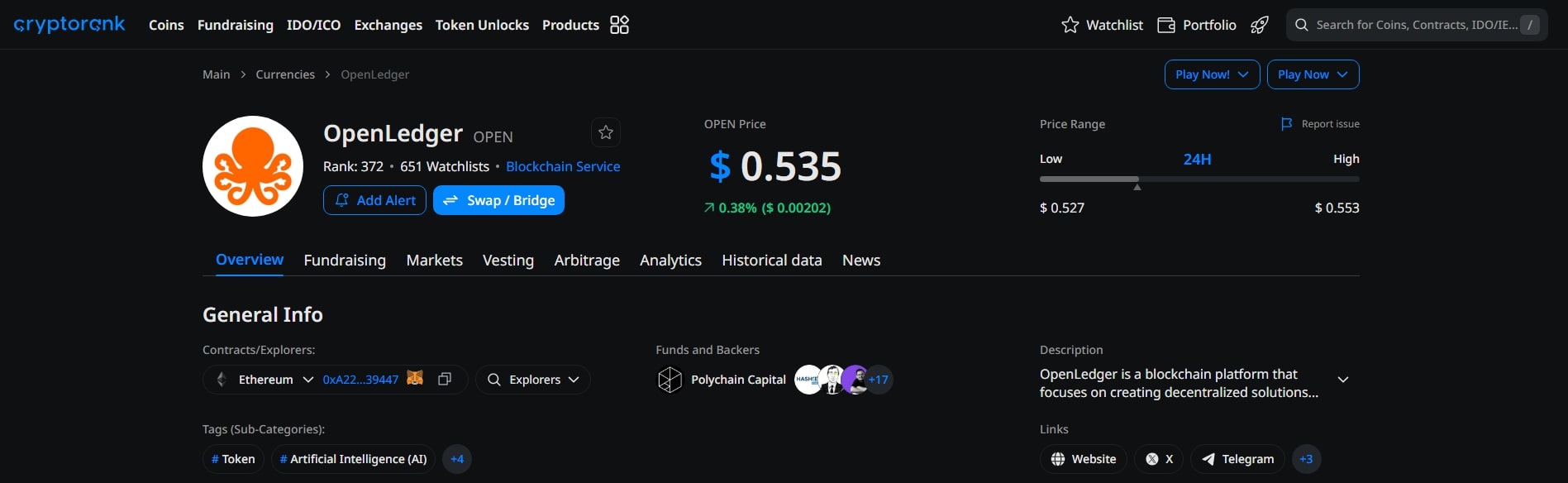

OpenLedger Token

At the heart of the ecosystem is the OpenLedger token known as OPEN. It’s not just a speculative coin, it actually powers the system. Every dataset uploaded, every model trained, and every AI agent deployed uses OPEN as gas.

For contributors, the token is also a reward. Upload data, train models, or provide computing resources, and you earn OPEN. Governance is another use case: holders can vote on proposals, upgrades, and direction.

Since the OpenLedger presale, demand for the token has been strong. The design is velocity-driven, meaning OPEN constantly cycles through Datanets, Models, and Agents. This makes it less of a passive store and more of a working currency inside the system.

If you’ve been wondering, what is the token used for? The answer is gas, rewards, and governance.

OpenLedger Fundings

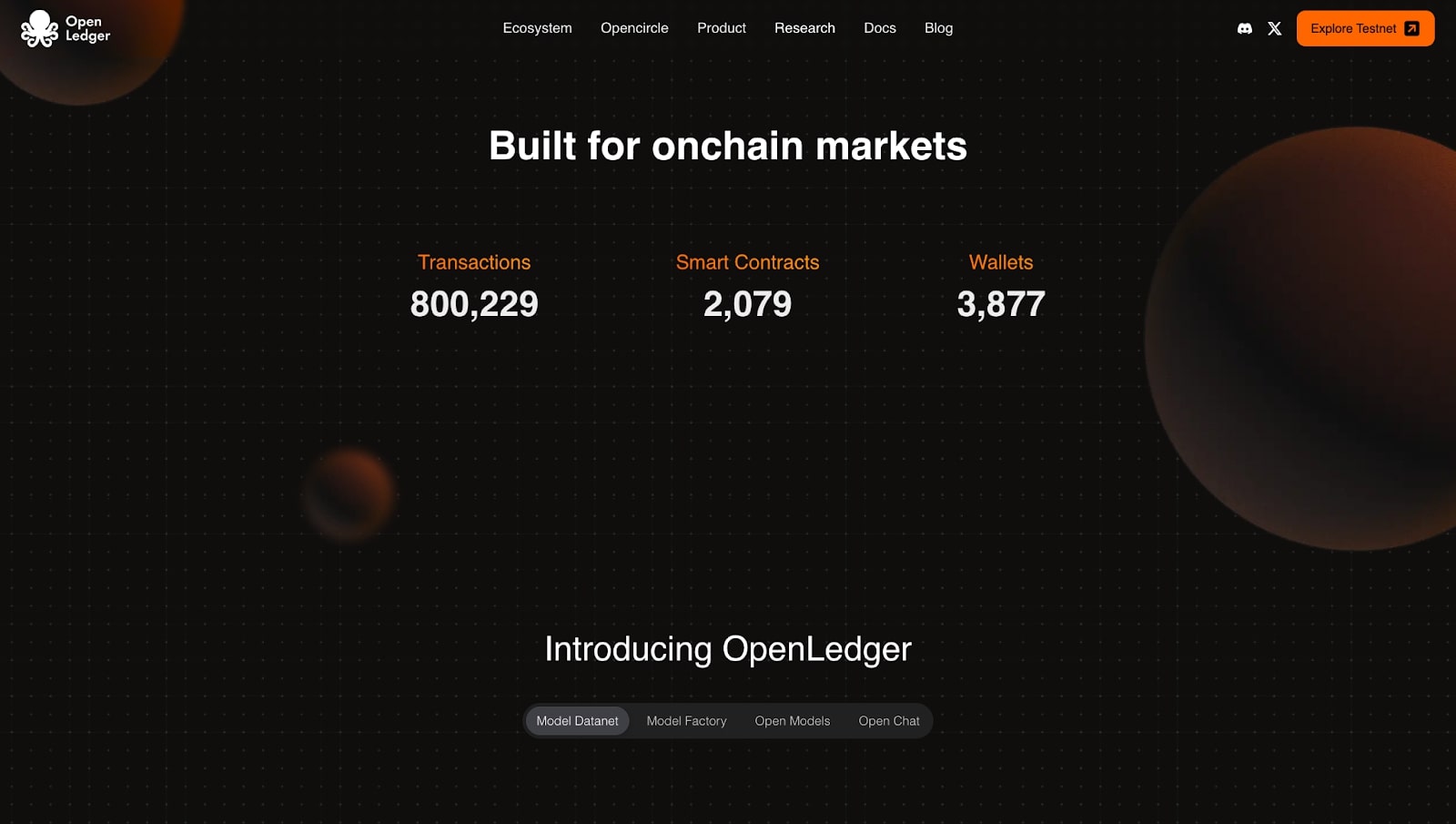

Funding has been one of the most important pillars of the OpenLedger project overview. When the OpenLedger launch date arrived in September 2025, the project made headlines by debuting on the top Korean exchanges. Within days, its fully diluted valuation crossed the $1 billion mark. That momentum wasn’t just retail-driven; institutional investors were watching closely as well. The scale of excitement showed that OpenLedger Crypto was tapping into a serious market demand, not just hype.

Investor Backing and Credibility

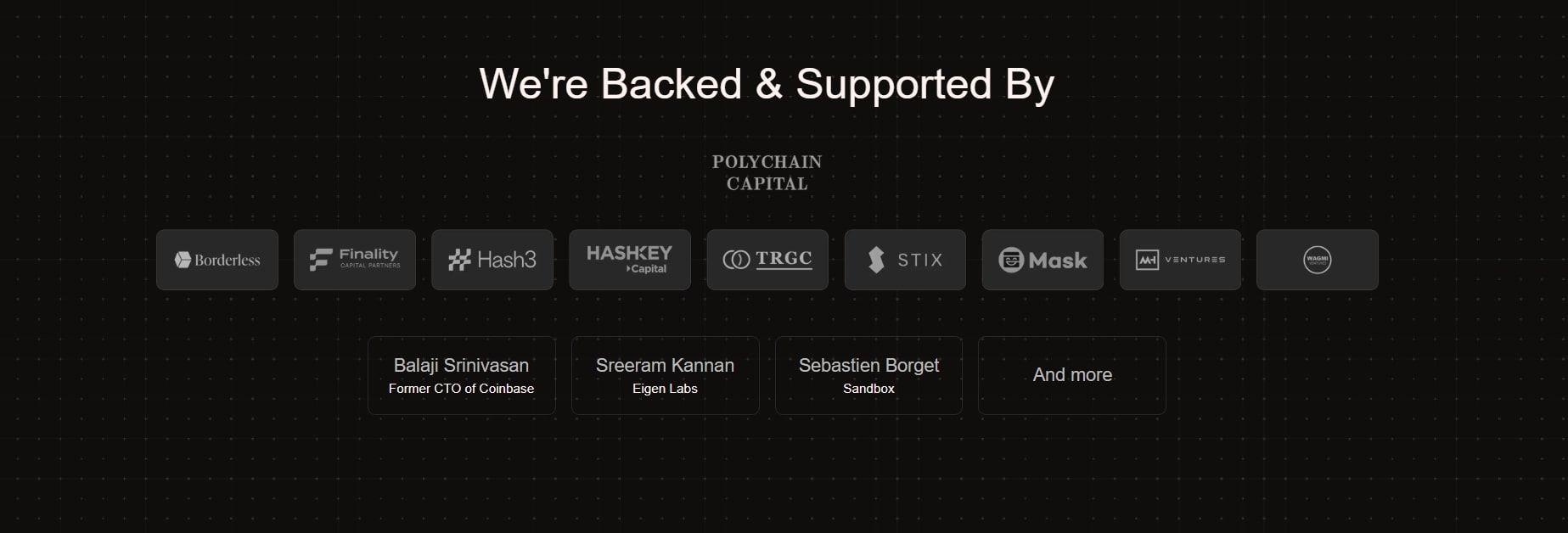

Early investors recognized that OpenLedger was not just another short-lived AI + blockchain experiment. Instead of being a simple marketplace token, OpenLedger positioned itself as an operating system for intelligence. This vision resonated with investors looking for long-term utility. Early funding rounds provided the resources to develop real, production-ready products like Datanets and Models.

In July 2024, during its seed round, OpenLedger raised $8 million. The round was led by major investors such as Polychain Capital and Borderless Capital, alongside prominent individuals like Balaji Srinivasan and Sandeep Nailwal. The involvement of these reputable investors signaled trust from the very start.

OpenLedger Tokenomics

From that foundation, the project grew quickly. At its peak, OpenLedger crypto reached a valuation of $635 million, with a fully diluted valuation (FDV) of $136.85 million and a market cap that reflected strong demand for the token. These numbers showed that the fundraising was not just about capital.

The tokenomics also reveal a careful balance. With a total supply of 1 billion OPEN tokens, more than half (51.71%) was allocated to the community, ensuring wide distribution and decentralization. Investors held 18.29%, the team reserved 15%, and the ecosystem was assigned 10%. The final 5% was categorized as “other.” This breakdown demonstrates that the project founder and team wanted to align incentives between developers, investors, and the community.

In short, the funding story gives weight to the entire vision. Backed by respected investors, led by $8 million in seed capital, and structured with fair tokenomics, OpenLedger Defi is standing out in the crowded AI-blockchain field. Similar to how AI is transforming the real estate industry.

OpenLedger Roadmap

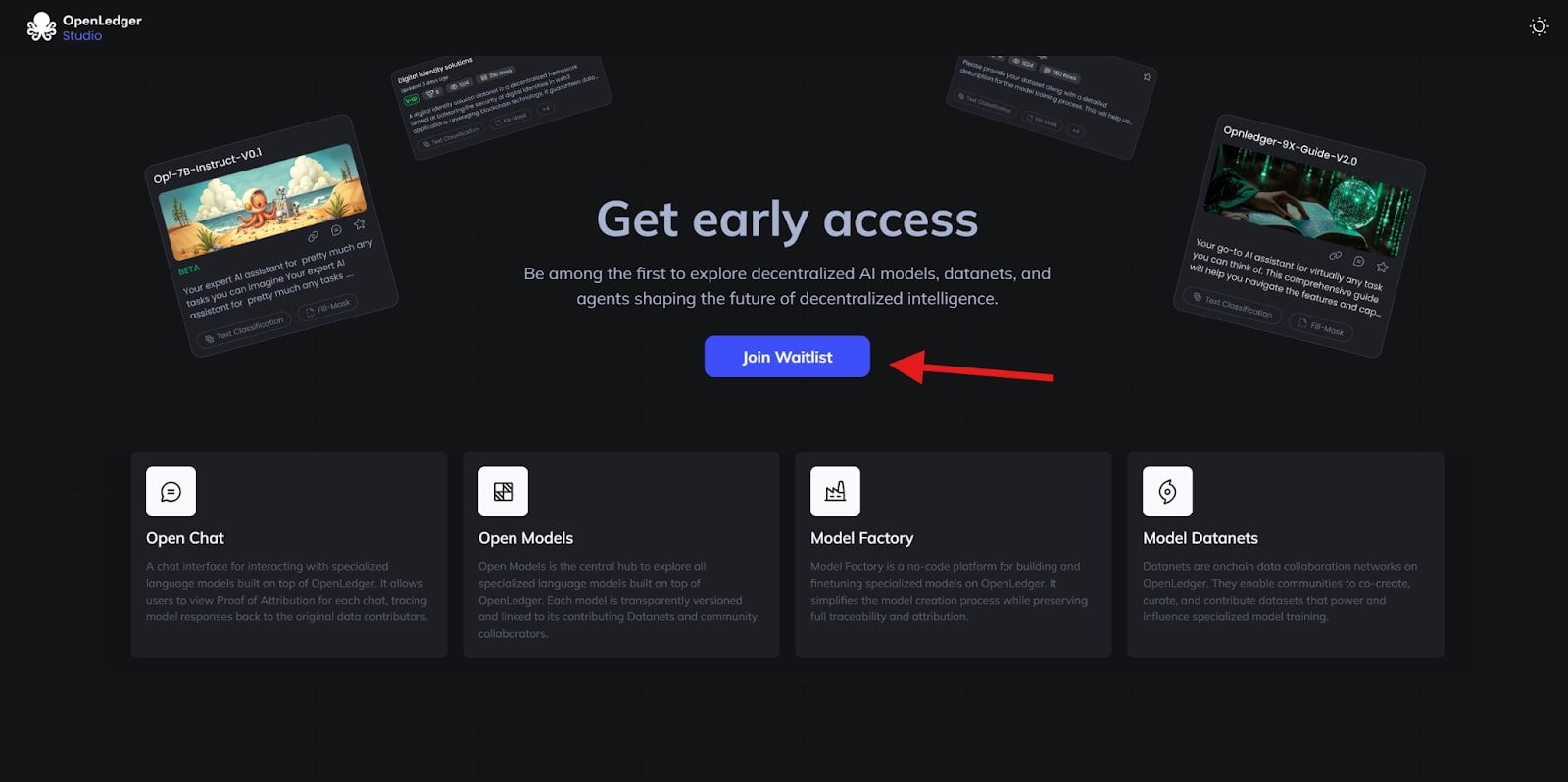

The OpenLedger roadmap is deliberate. In 2025, the focus was on rolling out the AI Studio and Model Hub on testnet. This allowed contributors to experiment with Datanets and Models without risking live capital.

By 2026, the goal is a hardened mainnet where attribution, validation, and economic flows can handle production workloads. Unlike many projects that chase hype, OpenLedger is prioritizing stability and trust.

The OpenLedger release date for the mainnet is tied to these milestones. For developers, this means you can start experimenting today with testnet tools, knowing they’ll mature into full-scale primitives by launch.

OpenLedger Airdrop Participation Guide

Now let’s talk about the OpenLedger airdrop. First, it’s important to note that the airdrop is closed. But here’s how users were able to participate:

Private Mainnet Waitlist: Users joined through Gmail verification and were added to the queue for early mainnet access.

Android Node Program: People installed the node app from Google Play. As long as it stayed open, points called “Heartbeats” accumulated.

Testnet Epoch 2: Starting March 11, 2025, users could log in daily, complete social tasks, and run Android nodes. Suspicious activity was blocked by IP.

Testnet S2 Whitelist: Participants filled out forms to join Season 2 of the incentivized testnet.

Browser Node: A Chrome extension allowed farming points directly in the browser.

OpenLedger Node: Windows and Android users could install nodes to earn even more points.

Testnet S1: Early tasks included social engagement, daily check-ins, and running nodes.

Every step was recorded on-chain. Points collected from these activities will be converted into OpenLedger token rewards.

So while you can’t join the airdrop now, the process shows how active the community was. Anyone asking what the OpenLedger airdrop is can see it as a way to test the system, reward early users, and build trust. You can also check out other airdrops.

How To Withdraw Airdrop From OpenLedger?

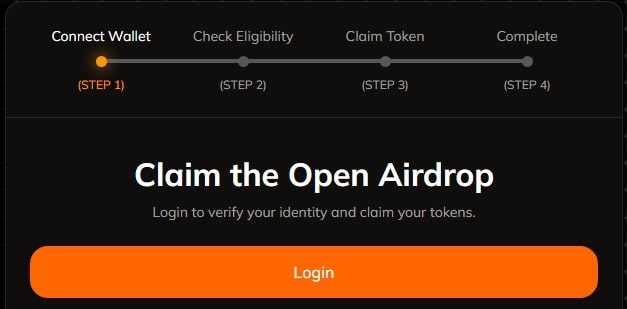

Even though the token airdrop has ended, users who earned rewards can still claim them. The process is straightforward:

Visit the OpenLedger Testnet portal.

Log in using the same Web3Auth or Gmail account used during participation.

Connect your wallet and check your eligibility.

Claim the rewards, which are distributed as OpenLedger token allocations.

What Is the Date of OpenLedger TGE?

For anyone asking what is OpenLedger TGE date, the Token Generation Event already happened. The token launch date on Korean exchanges was in September 2025. That’s when OPEN tokens first became tradable.

The TGE was strategiacally timed. By debuting on Upbit and Bithumb, the token gained exposure to a huge audience of retail and institutional traders. This made the listing one of the most talked-about events in AI + blockchain.

While the OpenLedger presale offered early access, the TGE cemented the project’s legitimacy. From that point on, OPEN has been the currency of intelligence on-chain.

OpenLedger: Final Thoughts

The airdrop may be closed, but it played a vital role in growing the community. By rewarding early testers, node operators, and social contributors, the project distributed ownership in a fair way.

Today, anyone researching “what is OpenLedger” can see that it’s more than hype. It’s a working system with real contributors, a live token, and a roadmap aimed at mainstream adoption.

If the team delivers on its goals, the OPEN token could become a key asset in the AI-blockchain industry