Curious about how far Virtual Protocol (VIRTUAL) could go in the coming years? In this article, we’ll dive into VIRTUAL price prediction from 2025 to 2030 and explore how its innovative AI-powered ecosystem and G.A.M.E. framework could shape the future of decentralized AI and digital ownership.

What Is Virtual Protocol (VIRTUAL)?

Virtual Protocol (VIRTUAL) got started in October 2024. The project is running on the Base (Ethereum L2) network. It’s all about letting people create, use, and earn from AI agents.

The project’s core product is its “G.A.M.E.” framework (Generative Autonomous Multimodal Entities), which allows these AI agents to be autonomous—they can talk, move in 3D spaces, and even make on-chain transactions. The development team behind Virtuals is focused on simplifying this whole process.

Their main goal is to build an AI economy that everyone can “co-own.” This unique focus on democratizing AI access is a huge advantage for its ecosystem and a key factor for any long-term VIRTUAL price prediction.

Use our referral codes below to trade VIRTUAL on leading exchanges for the lowest fees, making it cheaper and easier to start investing.

VIRTUAL Price Prediction: How Do VentureBurn Experts Analyze It?

VentureBurn analysts use a combination of fundamental and technical factors to forecast VIRTUAL’s price. Their projections are based on historical price movements, statistical data, and a range of technical indicators such as RSI, MACD, support and resistance levels, trendlines, Fibonacci retracements, and momentum metrics.

To enhance accuracy, the team integrates AI-powered models with manual expert assessments. As always, this analysis is intended for informational purposes only and should not be considered financial advice—investors are encouraged to conduct their own research (DYOR) before making any investment decisions.

The report also notes that growing expectations of a potential Federal Reserve rate cut, coupled with a stronger risk-on sentiment across global markets, are channeling more capital into cryptocurrencies, including VIRTUAL.

Current Market Background

Before we get into this project, we have to look at the bigger economic picture. The crypto market is heavily tied to these macro forces. The Federal Reserve actually cut its key interest rate by 0.25% back on September 17, and the market is now expecting one or two more cuts before the year is out. This matters because lower rates tend to push investors toward ‘risk-on’ assets, including crypto, as holding cash becomes less attractive.

There’s also a record $7.6 trillion piled up in money market funds. Now that the Fed has started its cutting cycle, investors are watching those cash yields drop. This shift could trigger a significant reallocation of capital into digital assets, which can catalyze substantial rallies.

VIRTUAL Fundamental Analysis

Tokenomics

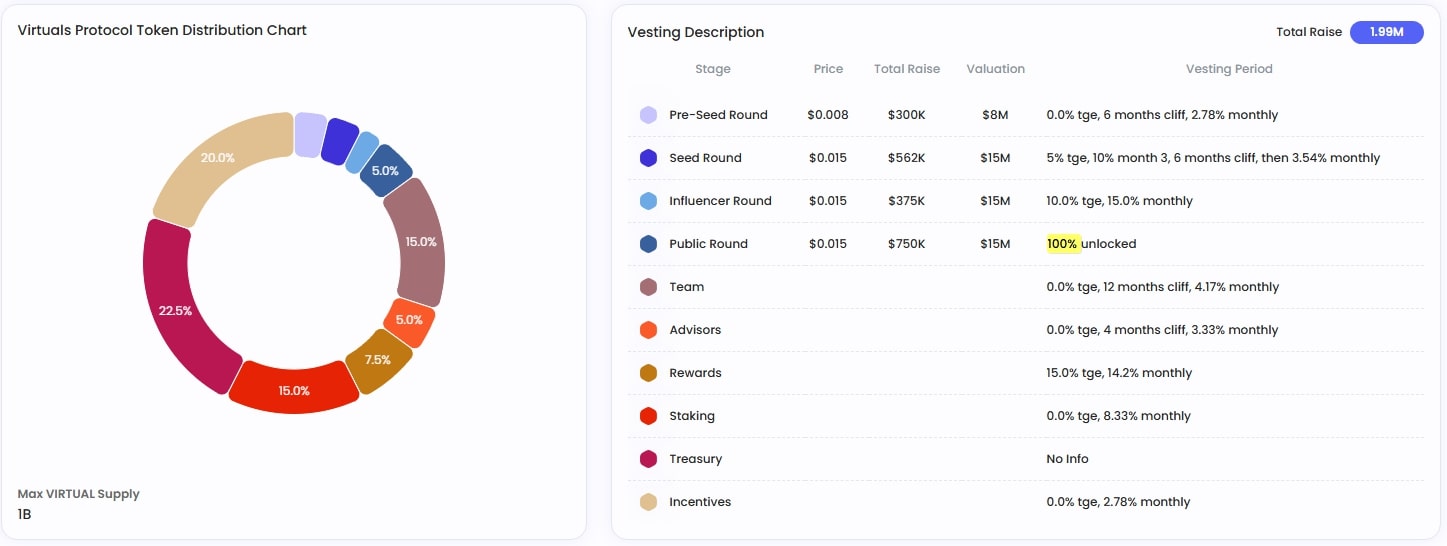

VIRTUAL has a total supply capped at 1B token (with ~66% circulating). Its core utility is being the required currency for platform fees – such as buying the agent tokens and paying for AI tasks. This creates a direct, utility-driven demand as the platform grows

AI narrative and adoption

This is the core fundamental driver. The project’s success is directly linked to the rapid growth and adoption of the entire AI agent market. As more industries (like gaming) start using AI agents, the demand for a platform like Virtuals is expected to increase, acting as the primary long-term catalyst.

Virtual Protocol Technical Analysis

The weekly chart for VIRTUAL provides a clear long-term picture. It shows a massive parabolic rally (backed by huge volume) that started in late 2024, peaking at an all-time high of over $5.00 in early 2025.

Following that deep correction, VIRTUAL showed a significant recovery rally from the second half of April through May. After that recovery failed, the token entered a “slow dump” trendline, bleeding out over several months on fading volume. The price has now established two very clear, long-term support zones.

Key Price Levels

Support Level

The chart highlights two distinct support zones, marked by the purple boxes :

0.80 – $0.95: This zone acts as the immediate defense line for buyers. It represents the March 2025 bottom and has previously served as a pivot for rebound attempts. Holding this level is the first test of renewed bullish strength.

$0.40 – $0.50: This is the stronger, long-term support floor. It represents the key psychological threshold that bulls must protect. The September shakeout wick tapped directly into this zone, attracting strong demand. When the price remains above this floor, the long-term bullish structure remains intact.

Resistance Levels

On the way up, the first minor resistance hurdle is around $2.00. The next major resistance is the peak of that April-May ‘echo rally,’ around $2.50 – $2.80. The final target is the all-time high of over $5.00.

What to watch closely

The key event on this weekly chart is the long ‘shakeout’ wick in late September. This wick broke Support 1 and tapped directly into the Support 2 zone (on a spike of volume) before reversing hard to close back above S1. This often signals a long-term capitulation bottom.

The price is now consolidating, and as the blue line illustrates, a break past $2.00 could signal the start of a new, sustained uptrend.

>>> Read more: XRP (XRP) Price Prediction 2025, 2026 to 2030

VIRTUAL PRICE PREDICTION 2025

| Year | Expected Price | Potential ROI |

| October 2025 | $1.4688000 | 0.00% |

| November 2025 | $1.8000000 | 22.55% |

| December 2025 | $1.6500000 | 12.34% |

VIRTUAL PRICE PREDICTION 2026

| Time | Expected Price | Potential ROI |

| Q1 2026 | $2.6000000 | 77.02% |

| Q2 2026 | $3.5000000 | 138.29% |

| Q3 2026 | $3.2000000 | 117.86% |

| Q4 2026 | $4.5000000 | 206.37% |

VIRTUAL PRICE PREDICTION 2027

| Time | Expected Price | Potential ROI |

| Q1 2027 | $5.2000000 | 254.03% |

| Q2 2027 | $7.0000000 | 376.58% |

| Q3 2027 | $5.5000000 | 274.46% |

| Q4 2027 | $4.0000000 | 172.33% |

VIRTUAL PRICE PREDICTION 2028

| Time | Expected Price | Potential ROI |

| Q1 2028 | $3.0000000 | 104.25% |

| Q2 2028 | $2.5000000 | 70.21% |

| Q3 2028 | $2.0000000 | 36.17% |

| Q4 2028 | $2.2000000 | 49.78% |

The forecasts are based on statistics, historical price patterns, and a variety of technical indicators, including RSI, MACD, support and resistance, trendlines, Fibonacci levels, and momentum.

Trained AI models and manual reviews are also utilized to improve prediction accuracy. This information is provided for informational purposes only and does not constitute financial advice—always do your own research (DYOR).

Conclusion

When all is said and done, VIRTUAL is a high-risk, high-reward bet on the AI narrative. While the hype is a huge factor, the technical chart might be the most honest guide for its long-term path.

The weekly chart shows a strong, two-level support floor (between $0.40 and $0.95) and a classic ‘shakeout’ wick. This suggests a long-term bottom may be in. This technical structure supports our forecast for a new uptrend into 2026. Of course, our 2028 forecast reflects the reality of crypto’s 4-year cycle. We expect a major bear market correction after the 2026-2027 peak, which is a normal, healthy part of the market before the next wave of growth.