Paradigm researchers, led by Storm Slivkoff, have discovered that Polymarket’s trading volume figures, not related to wash trading, have been double-counted on almost every major dashboard. Slivkoff, who is a research partner at Paradigm, said this is because Polymarket’s on-chain data contains redundant blockchain events.

Slivkoff claimed that an analysis of Polymarket’s market structure, smart contracts, and event data revealed that the usual approach of summing the platform’s OrderFilled events is the primary reason behind the double-counting. The approach double-counts cash flow (in USD) and the number of traded contracts.

For instance, Slivkoff discovered that a simple YES/NO token sale of $4.13 is recorded as volume worth $8.26 because separate OrderFilled events represent the taker side and the maker side of the trade. The researcher emphasizes that volume on such prediction markets should be measured using either the taker side or the maker side, not both.

Slivkoff dissects Polymarket’s trade anatomy

The Paradigm research partner began by describing the on-chain data associated with each trade on the Polymarket platform. He pointed out that all the platform’s transactions follow a rigid template, which includes at most one group of matched Polymarket orders per Polygon transaction.

Slivkoff further explained that each set of matched orders has at least one maker and precisely one taker. He also noted that trade transactions are submitted by approximately 50 EOAs affiliated with Polymarket, and that each transaction on the platform follows the same event sequence.

“Polymarket’s on-chain data is quite complex, and this has led to widespread adoption of flawed accounting methods.”

–Storm Slivkoff, Research Partner at Paradigm

According to Slivkoff, the accounting bug inflates both commonly used types of volume metrics for cash flow volume and notional volume, as well as the prediction market. He noted that the platform’s data has been confusing for crypto data analysts who find it difficult to untangle the many interacting layers using a block explorer.

Slivkoff said this difficulty arises because trades on the platform can be either simple swaps or merges and splits, where both parties exchange opposing positions for cash. He also stated that the smart contracts present redundant events for tracking, which standard blockchain explorers often fail to distinguish clearly.

Paradigm builds a simulator to illustrate trading volume behavior

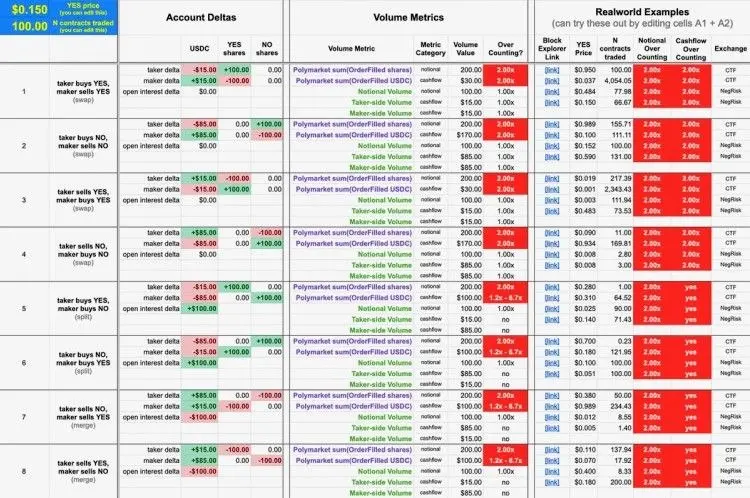

Paradigm revealed that its team has built a simulator to illustrate how different trading metrics behave under at least eight trading types. The simulator calculates maker/taker balance changes, open interest changes, and various volume metrics for each trade type.

Slivkoff further disclosed that the YES price and the number of traded contracts are the only two inputs required for the simulation. He also suggested that crypto data analysts can make copies of the spreadsheet and change the parameters to perform their own simulations.

However, Slivkoff pointed out that analysts using this simulator should take note of a few invariants. He clarified that for each trade type, the maker and taker always take opposite positions. One is a long YES resolution, and the other is a short YES resolution.

Slivkoff also noted that the maker and taker YES and NO deltas always have similar absolute values. However, he added that this is different from their USDC deltas, which can have differing absolute values.

The researcher also emphasized that split trades always increase open interest, while merge trades always decrease open interest. However, swap trades always leave open interest unchanged.

Slivkoff noted that calculating both notional volume and cash flow volume for swap trades is straightforward. He also observed that Polymarket’s OrderFilled sum presented a value that is twice the correct figure for both of these metrics. However, he emphasized that calculating these metrics for merge trades and split trades is more complex than for a conventional swap.

The smartest crypto minds already read our newsletter. Want in? Join them.