Bitcoin holds above $90,000, paring losses as ETF outflows return.

Ethereum faces headwinds below the 50-day EMA, reflecting risk-off sentiment among institutional investors.

XRP trades sideways above its $2.00 support, as cumulative ETF inflows near $1 billion milestone.

Bitcoin (BTC) is trading above $90,000 at the time of writing on Tuesday amid sticky risk-off sentiment in the broader crypto market. Since the October 10 flash crash, shaky institutional interest and low retail demand have significantly weighed down the largest cryptocurrency by market capitalization, capping steady recovery toward $100,000.

Altcoins, including Ethereum (ETH) and Ripple (XRP), are paring losses, holding above key support levels. Ethereum is back above $3,100 but holds below a short-term resistance at $3,200, while XRP is trading sideways above its immediate $2.00 support.

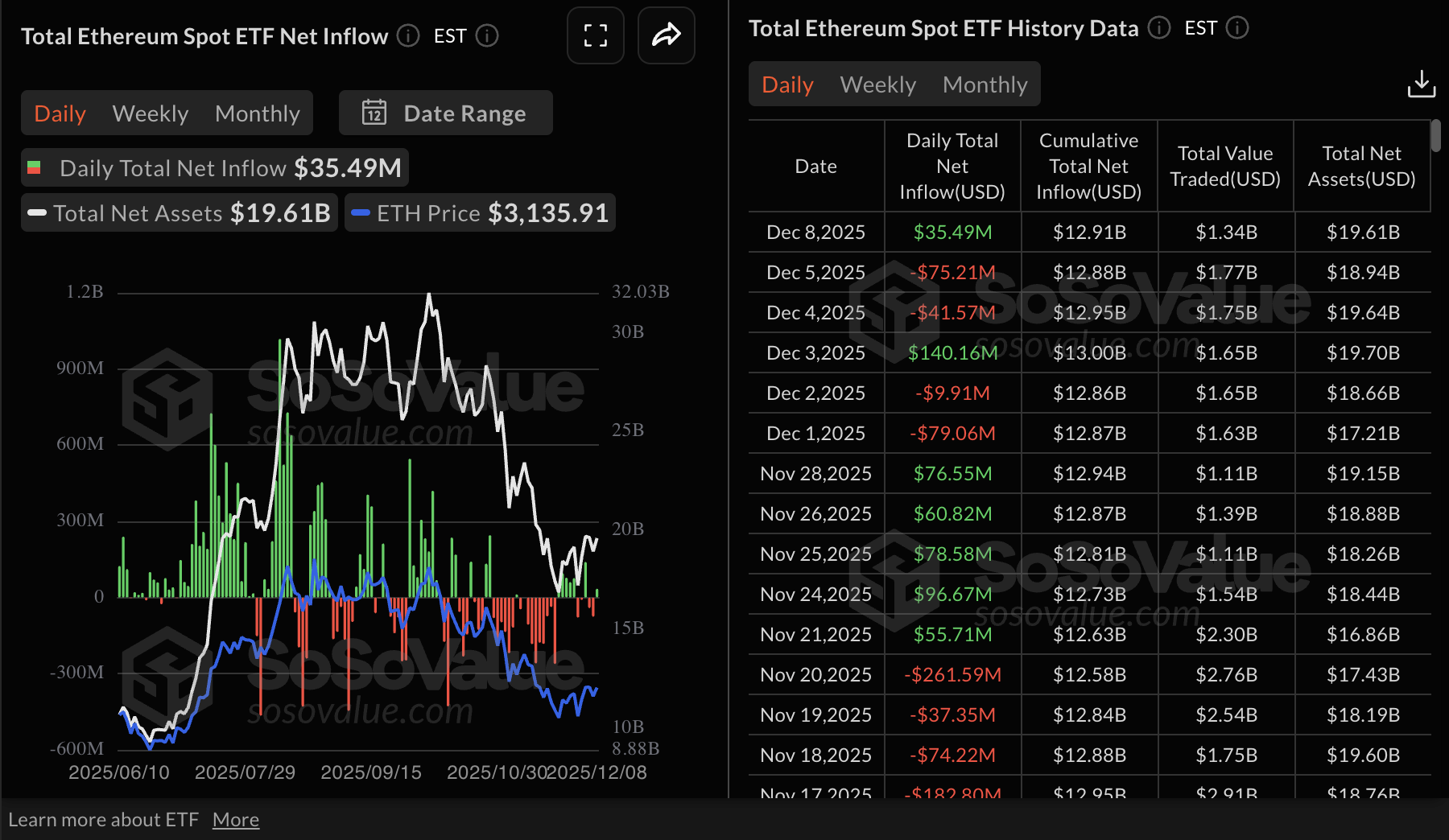

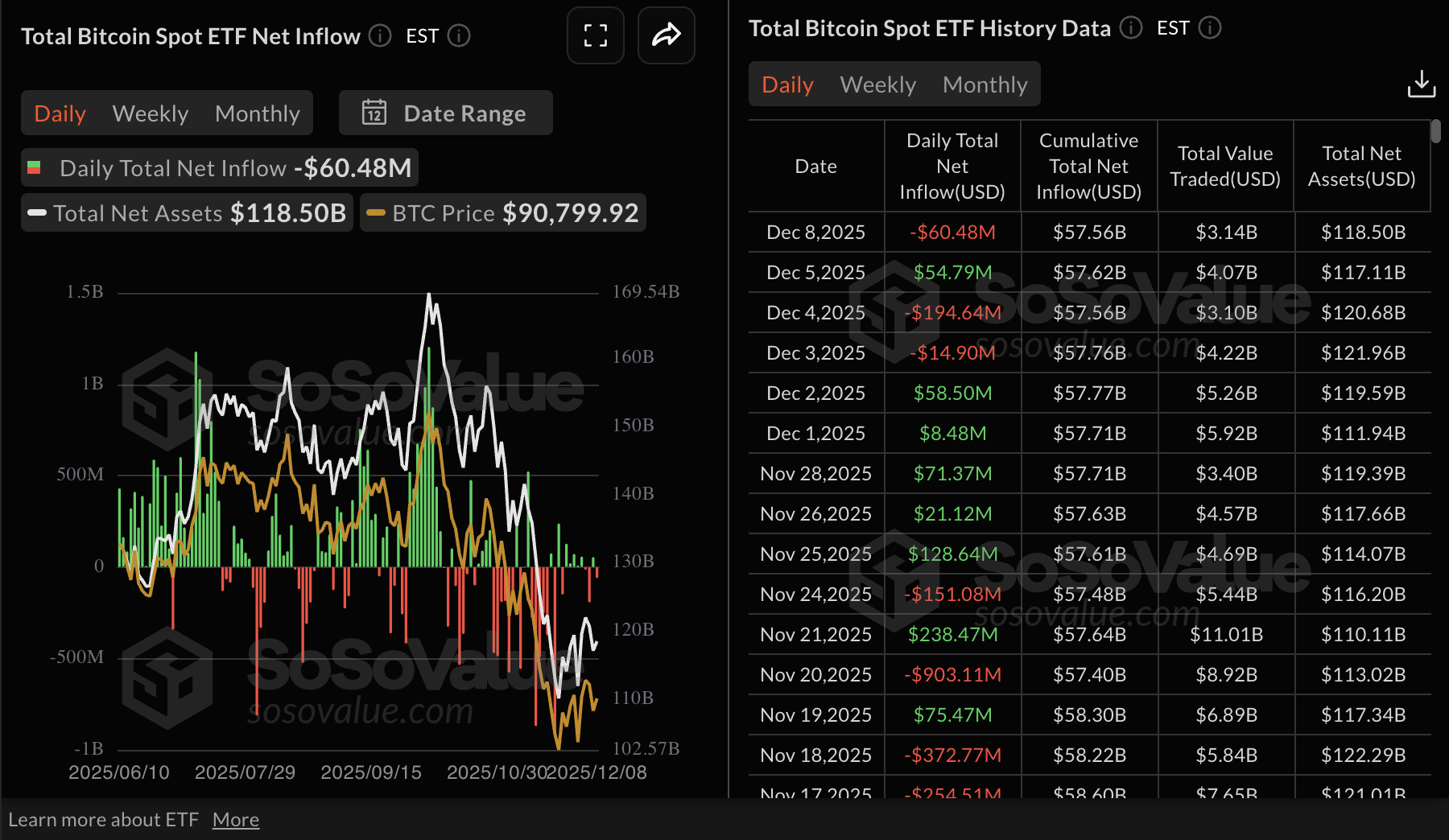

Data spotlight: Ethereum, XRP ETFs see inflows as Bitcoin outflows return

Ethereum spot Exchange Traded Funds (ETFs) recorded inflows of approximately $35 million on Monday, after posting outflows on Friday and Thursday. BlackRock's ETHA led with inflows of nearly $24 million, followed by Grayscale's ETH with almost $12 million. None of the US-listed ETH ETFs recorded outflows, bringing the cumulative inflow to $12.91 billion and net assets to $19.61 million, according to SoSoValue data.

XRP ETFs extended their steady positive streak with inflows totalling $38 million on Monday. Since their debut on November 13, XRP ETFs have not posted outflows, signaling growing institutional interest in altcoin-related crypto investment products. The cumulative inflow averages $935 million with net assets of $924 million.

Bitcoin ETFs, on the other hand, resumed outflows with over $60 million drawn on Monday. The resumption of outflows could imply that institutional investors remain uncertain about Bitcoin's short-term outlook ahead of 2026. Bitcoin ETFs have cumulatively attracted $57.56 billion in inflows, with net assets of $118.5 billion.

Chart of the day: Bitcoin holds $90,000 as risk-off sentiment persists

Bitcoin is trading above $90,000 at the time of writing on Tuesday, as buyers and sellers battle for control. Bitcoin's position below the declining 50-day Exponential Moving Average (EMA) at $96,913, the 100-day EMA at $102,322 and the 200-day EMA at $103,803, undermines its bullish potential.

The Relative Strength Index (RSI) on the daily chart is at 44 and points downward, indicating that bearish momentum could increase in upcoming sessions.

The RSI must flip the 50 midline into support to affirm Bitcoin's bullish case alongside the Moving Average Convergence Divergence (MACD), which has maintained a buy signal on the same chart since November 26.

Still, traders should be cautious, as the green histogram bars above the mean line in the MACD are fading, which could signal bearish momentum and increase the odds of an extended correction below $90,000.

Altcoins update: Ethereum, XRP consolidating above key support

Ethereum is trading above its short-term support at $3,100, while a descending trendline on the daily chart limits upside. The token remains below the 50-day EMA at $3,307, the 200-day EMA at $3,455 and the 100-day EMA at $3,512, emphasizing the bearish bias.

If bulls fail to take control and push above the descending trendline, a reversal toward $3,000 may take shape. The RSI on the same chart is neutral at 49 but leans slightly bearish, indicating that sellers could have the upper hand.

Conversely, the MACD indicator supports Ethereum's bullish outlook with a buy signal since November 26. As the indicator approaches the mean line, bullish momentum is likely to increase, boosting the chances of a recovery. Flipping through the 50-day EMA at $3,307 into support would affirm ETH's upside potential.

As for XRP, the price remains below the 50-day EMA at $2.26, the 100-day EMA at $2.42, and the 200-day EMA at $2.47, reinforcing a bearish outlook.

The descending trend line from XRP's record high of $3.66 also limits gains, with resistance at $2.60. A downward-facing RSI holds at 42 on the daily chart, signaling that bearish momentum is increasing.

A close above the 50-EMA at $2.26 could open the path toward the descending trendline barrier at $2.60. Holding the $1.98–$1.82 support band would allow a base to form a recovery, while a break below it would sustain the broader downtrend toward April's low of $1.61.