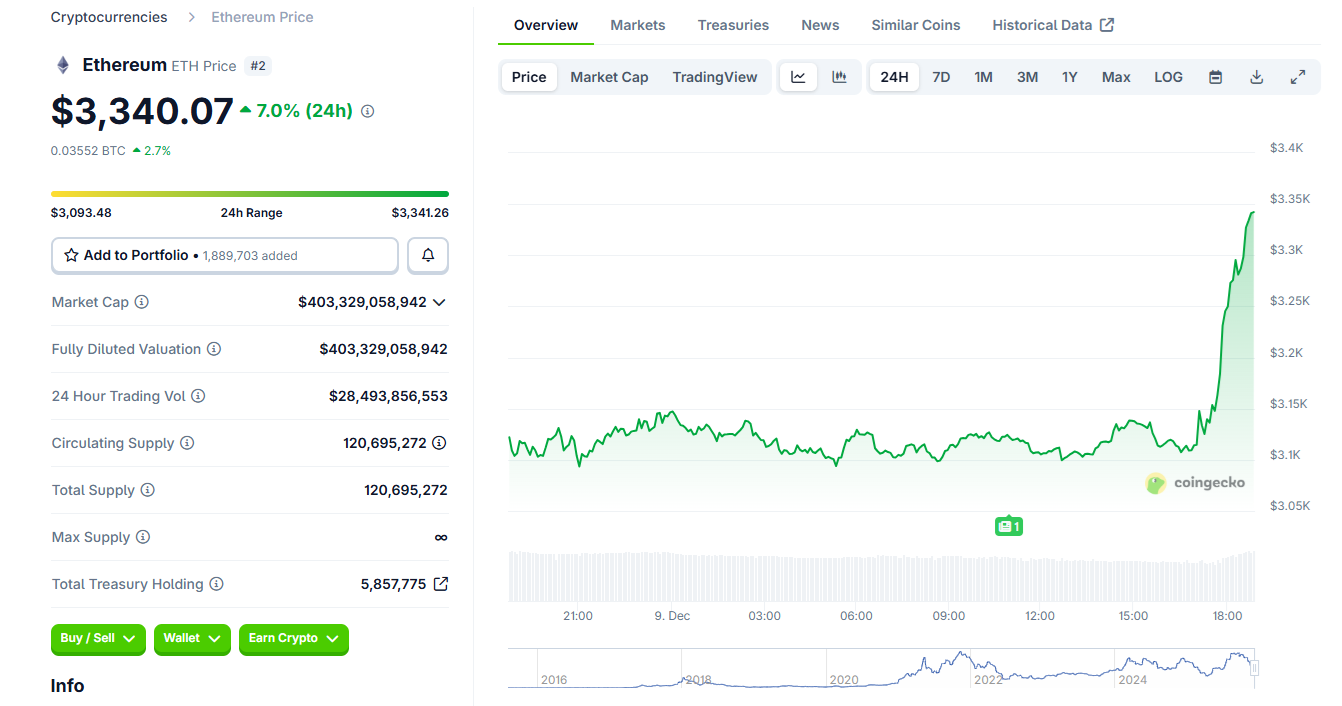

ETH rallied above $3,300 after a mostly positive day for the crypto market. The token kept seeing inflows from whales, as well as another big purchase from Bitmine.

ETH continues to see interest from large-scale players, including whales, in both spot and derivative markets.

ETH recovered above $3,200 after a short squeeze, following a day of rebuilding short liquidity. The token continued its expansion to $3,342.21. The last price move caused $36.3M in long liquidations for the past 24 hours, of which close to 50% were on Binance.

The latest price moves showed a quick return to speculation, as traders opened new positions just as the token showed signs of a directional move. Open interest spiked within a short timespan, from $17.6B to $18.5B. However, traders opened new positions on the short side, suggesting the rally may be short-lived.

Bitmine has $1B to buy more ETH

Bitmine revealed it had been buying more ETH in the past week, expanding its treasury to $12.05B.

The treasury company has $1B remaining to make more purchases, after last week’s addition of over $138K ETH. Bitmine expanded its treasury by 13.8% in the past month, resuming more frequent purchases in December.

Treasury companies have slowed down their buying, but still added more ETH to their balance in December. BMNR shares responded by bouncing off their lows, rising to $38.60, around the middle of their range for the past few months. BMNR has secured its financing and is one of the predictable buyers of ETH.

Hyperliquid whales go long on ETH

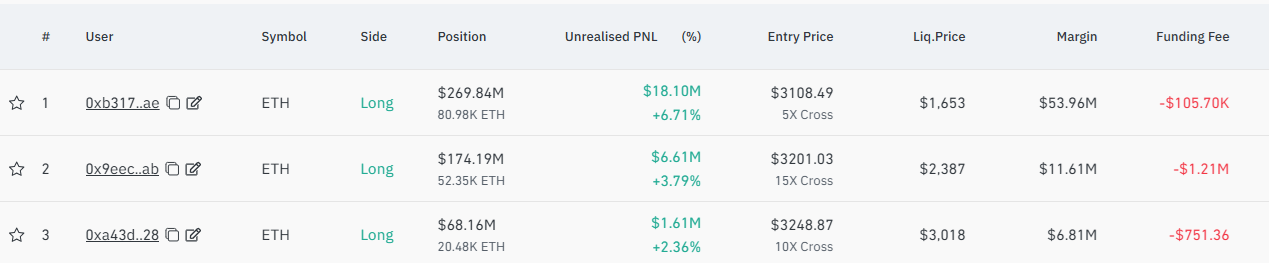

Hyperliquid whales also took high-profile positions in ETH, currently sitting on outsized unrealized gains.

The 1011 whale, who was known for shorting BTC just before the October drop, expanded the unrealized gains from $3M to over $18M. The whale keeps paying fees of over $100,000 to retain the position, and has not closed to take profits.

On-chain data shows whale currently holds the biggest long position on Hyperliquid, with a notional value of $269M.

The second position was built by the ‘Anti-CZ’ whale, and is valued at $174M, with unrealized gains of over $6M. In the third spot is an older whale that quickly aped into ETH, with $1.6M in unrealized gains. Machi Big Brother, another notorious Hyperliquid trader, also increased his ETH long position.

The latest climb erased most of the available ETH short liquidity, with few positions remaining up to $3,400. The short squeeze may be followed by a reversal, as ETH has accumulated long positions just above $3,000. At the current price range, ETH retains the support level at $3,000, in addition to the $2,800 range, which is the cost basis of multiple whales.

The ETh fear and greed index rallied from 51 points to 66 points within a few hours, signaling a rapid shift in sentiment.

Join a premium crypto trading community free for 30 days - normally $100/mo.