Ethereum price today: $3,320

Ethereum whales accumulated nearly 400K ETH between Sunday and Monday.

The jump in whale interest comes as the Federal Reserve is expected to cut interest rates by 25 bps on Wednesday.

ETH could test the $3,470 resistance but risks a rejection near the 50-day EMA.

Ethereum (ETH) is up 6% on Tuesday following increased whale buying activity and President Donald Trump's remarks concerning the next Federal Reserve (Fed) Chair.

Whales resume buying pressure amid potential Fed rate cut

Ethereum whales have stepped on the gas ahead of the Federal Open Market Committee (FOMC) meeting on Wednesday. With the Fed expected to cut interest rates by 25 basis points (bps), sentiment among whales is improving.

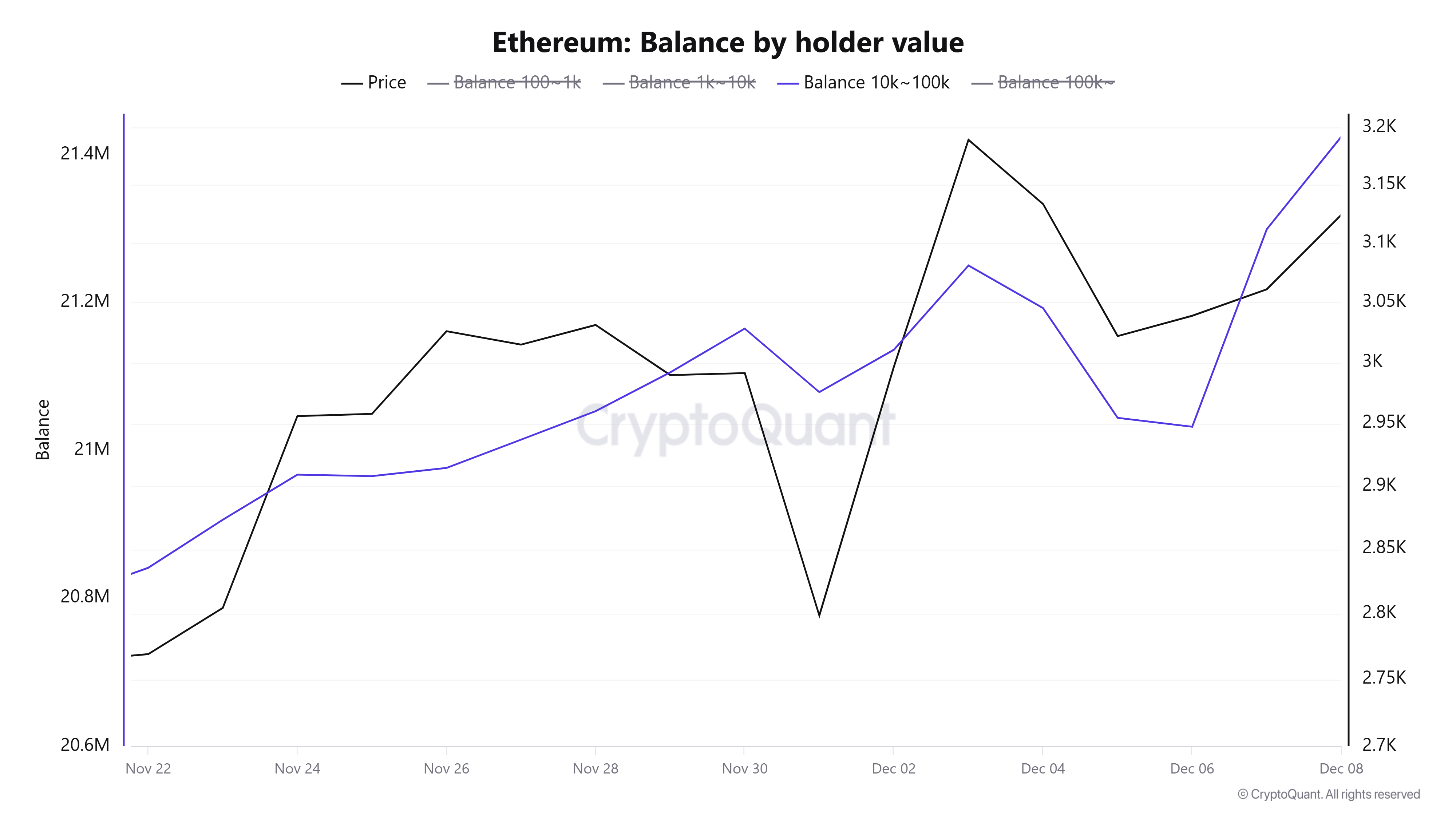

Whales with a balance of 10K-100K ETH have increased their collective holdings by nearly 400K ETH between Sunday and Monday, per CryptoQuant data. This is in stark contrast to mid-last week through the weekend, when they distributed about 220K ETH.

The resumption in whale interest coincides with President Trump's remarks that the next Fed Chair is expected to cut interest rates immediately. Trump's comments have sparked bullish sentiments across top cryptocurrencies.

Hence, US investors are again leading the buying pressure. The ETH Coinbase Premium Index, a measure of US investors' interest, remained positive over the past week after being negative for about a month.

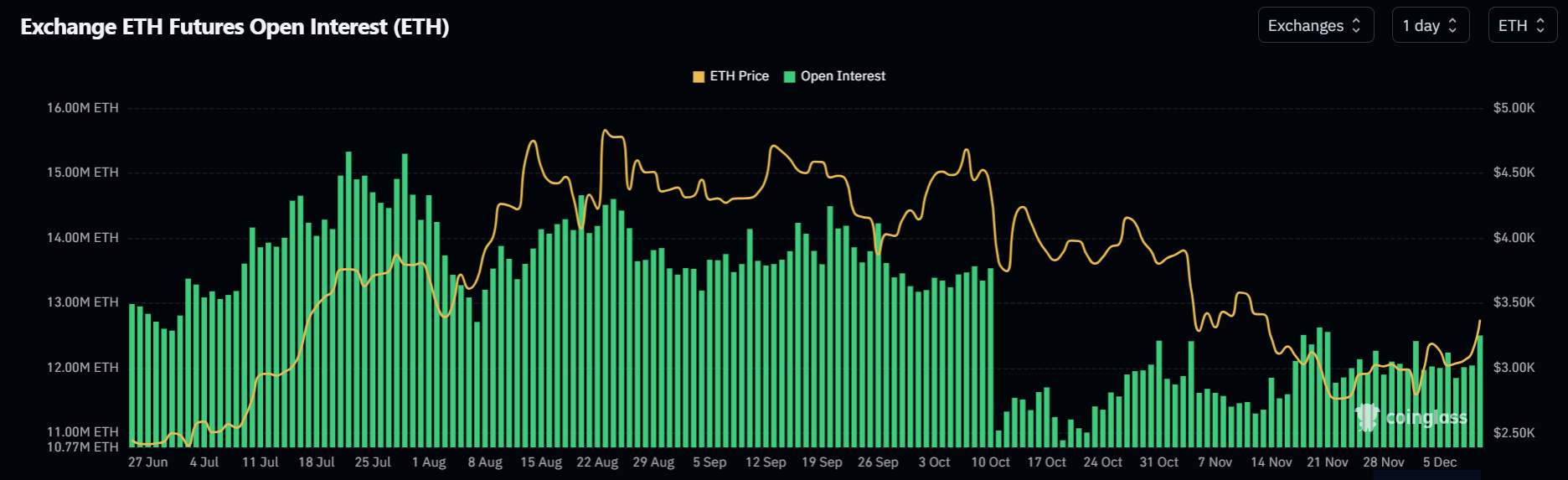

On the derivatives side, Ethereum's open interest (OI) has jumped by 440K ETH to 12.48M ETH on Tuesday following Trump's remarks, according to Coinglass data. However, it remains far from pre-October 10 crash levels.

The rise has sparked $120.1 million in liquidations over the past 24 hours, led by $105 million in short liquidations.

Ethereum Price Forecast: ETH could test $3,470 but risks rejection at 50-day EMA

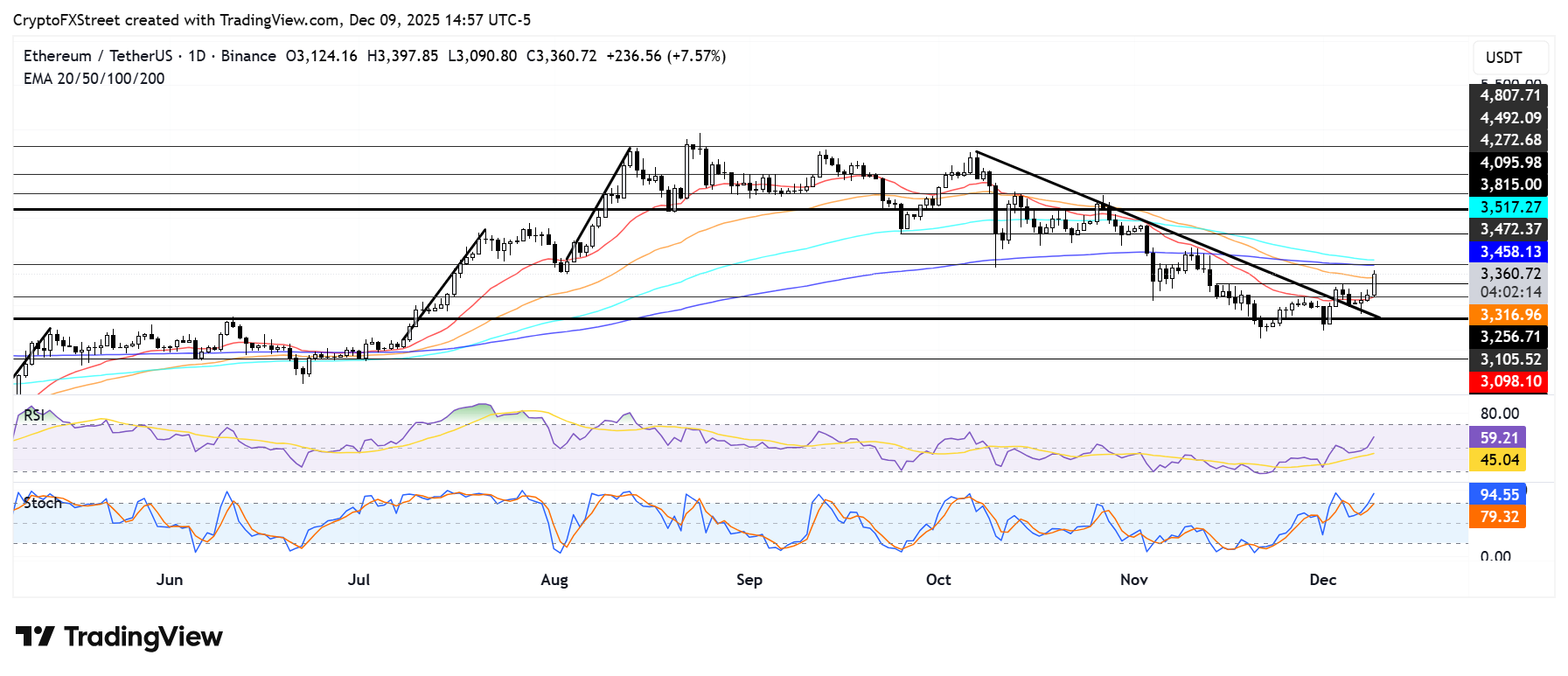

ETH cleared the short-term resistance at $3,250, gaining 6% on Tuesday, but faces a potential rejection near the 50-day Exponential Moving Average (EMA).

On the upside, ETH could rally toward $3,800 if it rises above the 50-day EMA and $3,470 resistance.

On the downside, ETH could find support around $3,100 if it sees a rejection near $3,470. Further down, the $2,850 support could hold if bulls fail to defend $3,100.

The Relative Strength Index (RSI) has crossed above its neutral level while the Stochastic Oscillator (Stoch) is in overbought territory. Overbought conditions in the Stoch could spark a short-term pullback.