The Bitcoin price prediction landscape has shifted dramatically ahead of the FOMC meeting, with macro traders watching both the Federal Reserve and alternative plays like Bitcoin Hyper – a rising low-cap presale with deflationary potential – for cues on where the next rally might come from.

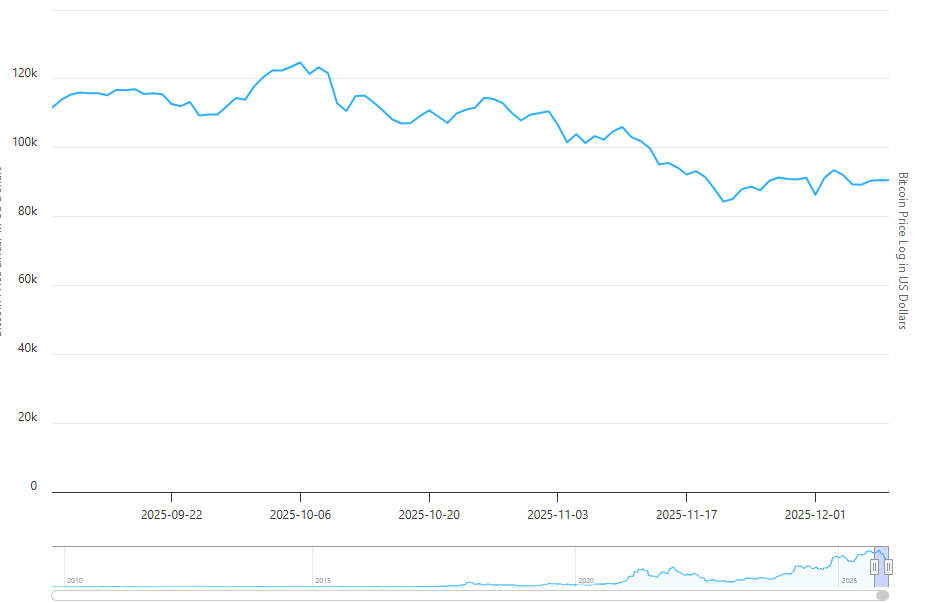

Bitcoin is currently holding above $90,000, down 1.92% on the day, but still showing strength after surging to $92,300 earlier this week. The move reflects a growing consensus that the Federal Reserve may pivot its monetary stance, with market participants aggressively front-running a possible rate cut.

That expectation has put Bitcoin in focus as a liquidity magnet, setting up the next move in the broader Bitcoin price prediction trendline.

Rate Cut Odds Trigger Institutional Rotation

As of Monday, the odds of a 25-basis-point rate cut have jumped to 86.2%, according to CME FedWatch data. For large funds, this is more than just speculation – it’s a green light to rotate capital out of bonds and into asymmetric upside assets.

Bitcoin price prediction models have begun recalibrating toward new highs as this potential liquidity wave unfolds.

William Stern, founder of Cardiff, described the current rally as a convergence of three macro forces: institutional bets on a policy pivot, an ongoing supply shock caused by record exchange outflows, and a flight to quality ahead of what many see as a volatile 2026.

BTC’s 24-hour volume rose to $56.6 billion, reflecting surging participation as investors shift their posture from defensive to opportunistic.

Meanwhile, Bitcoin’s market cap stands at $1.8 trillion, while circulating supply is nearing the cap, with 19.95M BTC now in the market out of a maximum 21M. This narrowing gap continues to fuel long-term bullish sentiment across most Bitcoin price prediction frameworks.

Whale Activity Signals Quiet Accumulation

On-chain analysts point to one of the most notable patterns in this cycle: whales have been quietly accumulating while retail hesitates.

Jonatan Randin from PrimeXBT noted that large wallets absorbed over 240% of Bitcoin’s yearly issuance in recent weeks. In December alone, major holders reportedly added nearly 48,000 BTC.

At the same time, BlackRock’s IBIT product saw over $2.7 billion in redemptions, highlighting a strategic shift by sophisticated players who appear to be transitioning from passive exposure to direct spot accumulation.

This divergence – between aggressive whale accumulation and retail hesitation – is a powerful signal in any Bitcoin price prediction framework.

“The Fear and Greed Index has dropped to levels last seen in 2018 and 2022 bear markets,” Randin added. “Yet whales are positioning for upside while retail continues to panic sell.”

Fed Policy and 2025 Macro Tailwinds

Marc P. Bernegger, cofounder at AltAlpha Digital, emphasized that Bitcoin has historically rallied after Fed easing signals, since lower rates make high-yield assets like crypto more attractive than bonds.

He also noted that over 75% of institutional investors surveyed plan to increase crypto allocations in 2025, with many citing the shift in Fed stance and declining bond yields as key reasons.

This aligns with Bitcoin’s historical behavior in post-tightening environments and reinforces many bullish Bitcoin price prediction models projecting a $100K–$120K breakout zone in the first half of 2026.

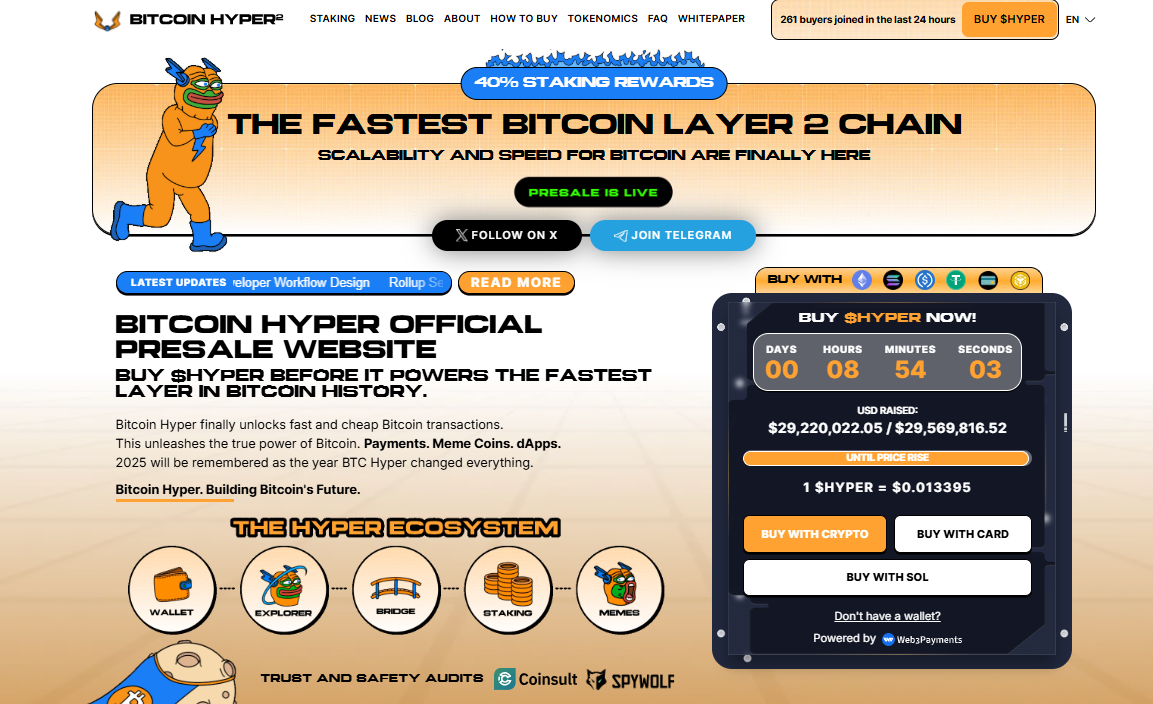

Bitcoin Hyper Taps Into Retail Momentum Ahead of Next Price Hike

While Bitcoin commands institutional attention, Bitcoin Hyper is emerging as the high-risk, high-upside counterpart retail investors are watching. With over $29.2 million already raised and a new price increase just minutes away, $HYPER is trading at $0.013395 – still early compared to Bitcoin’s $90K valuation.

What makes Bitcoin Hyper notable is its timing. It rides the same macro narrative as Bitcoin – monetary easing, supply scarcity, and a return of crypto appetite – but offers ground-floor entry pricing that Bitcoin no longer can.

For those priced out of BTC or looking for aggressive upside, $HYPER represents a retail-accessible bet aligned with institutional logic.