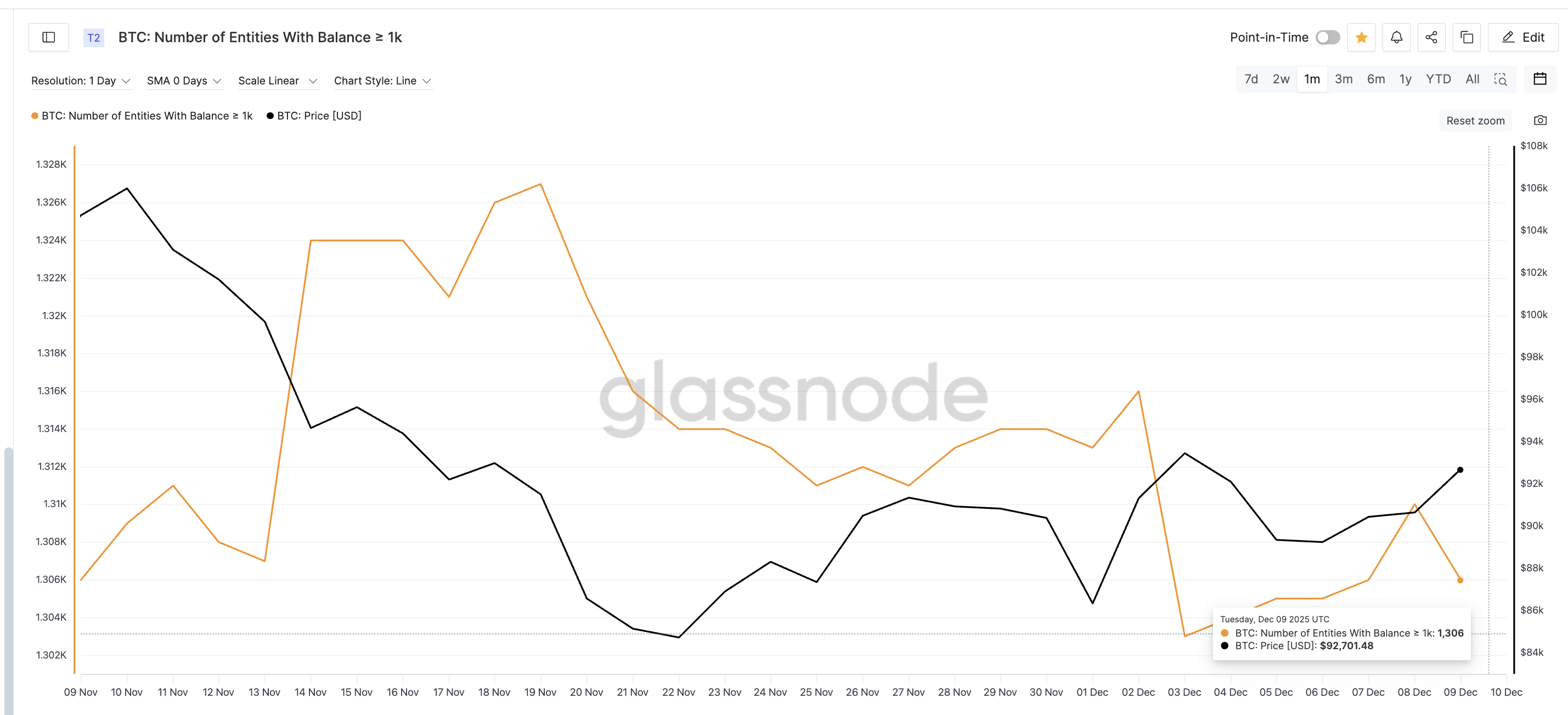

Bitcoin price is up about 2.8% in the past 24 hours and trades near $92,500. The daily chart still shows a clean inverse head and shoulders structure pointing toward $108,500, but every attempt to break higher has stalled.

Two clear reasons explain why the breakout keeps failing — and the good news is that both can still shift in Bitcoin’s favor.

A Stubborn Level and Weak Whale Support Keep Blocking the Move

Bitcoin continues to respect the inverse head and shoulders pattern that formed on November 16. The structure stays valid, but the neckline at $93,700 has rejected every clean breakout attempt so far. Until the Bitcoin price closes above this line, the pattern cannot activate.

<img alt="Bitcoin’s Breakout to 8,500 Keeps Failing for These Two Reasons —Both Fixable?" title="Bitcoin’s Breakout to 8,500 Keeps Failing for These Two Reasons —Both Fixable?" src="/d/file/articles/uploads/2025-12-10/pyruhxdvp2m_26462.png" s Bullish Structure">Bitcoin’s Bullish Structure: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

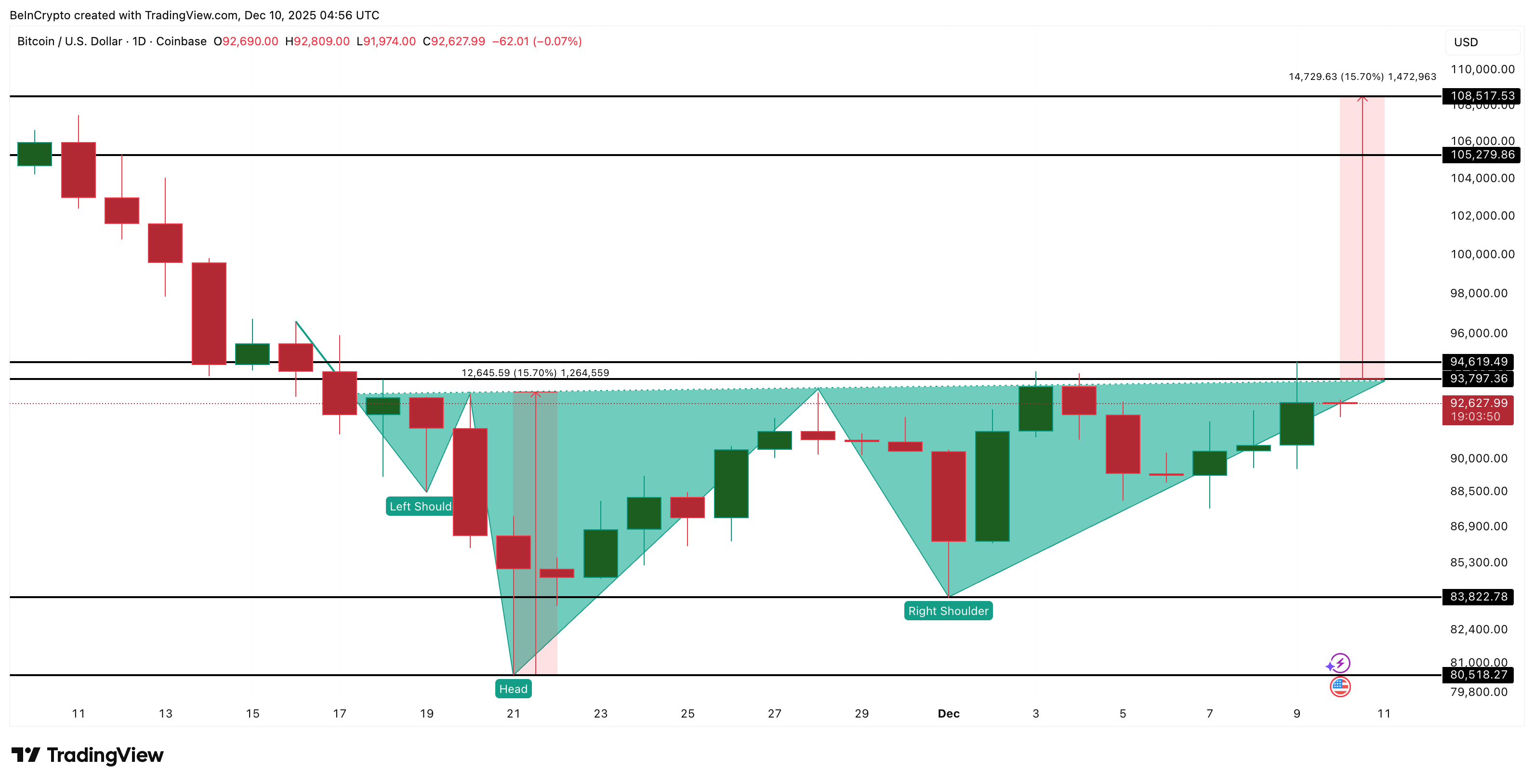

Whale positioning is the second issue.

Entities holding at least 1,000 BTC have been reducing their count since November 19. The metric fell to a monthly low of 1,303 on December 3 and remains close to that level now. This weakens every attempt to push through resistance because the group that normally confirms major breakouts is still cautious.

A similar setup appeared between December 2 and December 3.

Bitcoin price hit $93,400, but whales dropped from 1,316 to 1,303. Soon after, the price corrected to $89,300, a drop of about 4.4%.

Large Holders Still Distant: Glassnode

When the price rises and whales cut exposure, momentum often fades because big buyers are not supporting the move.

These two issues — the $93,700 barrier and hesitant whales — explain why the BTC price breakout keeps failing. But because neither problem is structural, both can still be fixed if conditions shift.

A Fixable Path: The Short Squeeze Setup Can Help Bitcoin Price Breakout

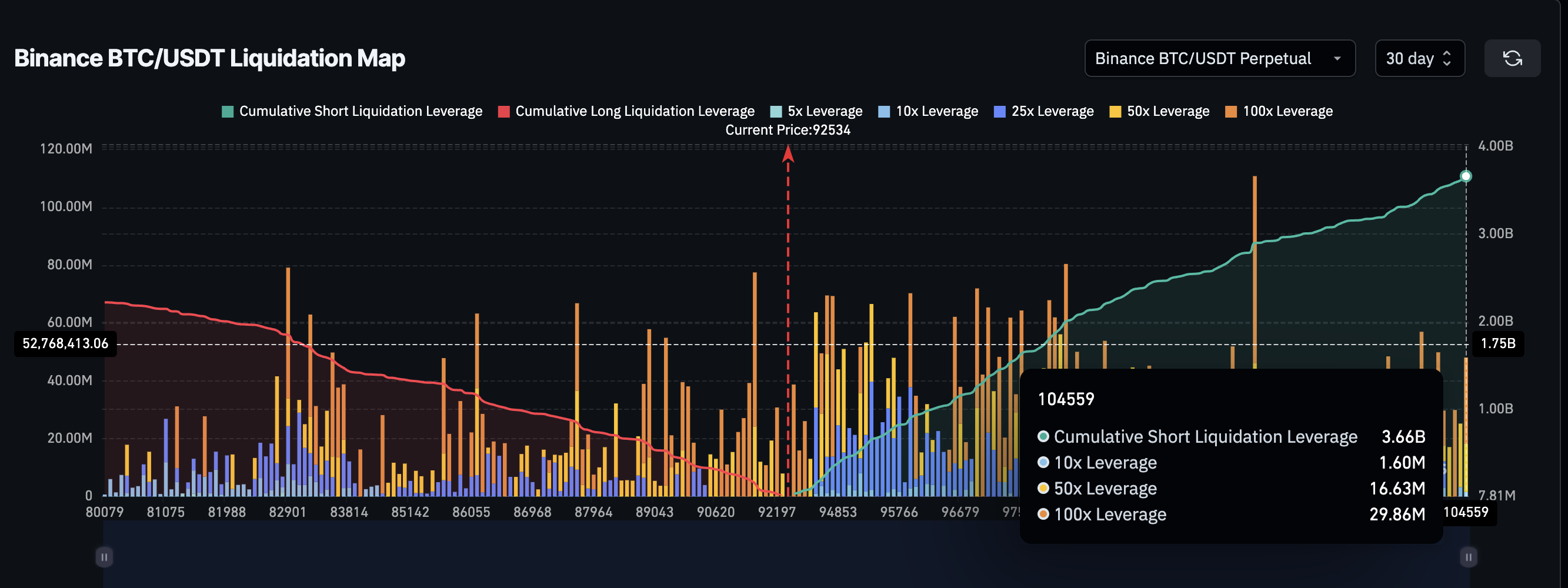

The second half of the story is more optimistic. Even without whale support, Bitcoin has a strong short squeeze setup that can still force a breakout.

On Binance, short liquidation leverage over the past 30 days sits near $3.66 billion, compared with $2.22 billion on the long side. Shorts are almost 50% higher, which creates pressure that can unwind quickly if Bitcoin price pushes above $93,700 again.

Short-Squeeze Setup Ready: Coinglass

This mechanism has already shown itself several times this month.

Small 1–2% price moves flipped into stronger rallies as short positions were liquidated.

If Bitcoin manages a clean daily close above $93,700, the squeeze can build enough strength to break through $94,600, the next major gateway. At that point, whales might no longer be required to trigger the move. Momentum alone could carry the price higher. And once the momentum arrives, whales might feel more convinced to join in.

Above $93,700 and $94,600, the breakout path opens toward $105,200. Clearing that region positions Bitcoin for the full measured target at $108,500, a gain of about 15.7% from the neckline.

Bitcoin Price Analysis: TradingView

The inverse head and shoulders pattern remains valid above $83,800. A drop below $80,500 invalidates the structure and raises the risk of a deeper pullback if whales continue to reduce their balances.

For now, the picture fits like this: two reasons are blocking the breakout — the resistance line and whale caution —, and both are still fixable if buyers push through $93,700 or the short squeeze takes over.