Xom Stock Forecast: ExxonMobil Corporation, commonly known by its ticker symbol XOM, is a major player in the global energy sector.

As one of the largest integrated oil and gas companies, its stock performance is often seen as a barometer of the energy market’s health. This article delves into the current outlook and future forecast for Exxon stock by exploring multiple facets including its business model, historical performance, price drivers, and longer-term expectations.

The Exxon Stock Price Immediate Future

The immediate future of Exxon’s stock price is influenced by a range of factors, both internal and external. Market conditions such as crude oil and natural gas prices, global demand for energy, and geopolitical tensions can cause rapid price fluctuations. Additionally, investor sentiment toward the energy transition and regulatory developments can impact near-term movements.

Exxon’s recent operational updates, production forecasts, and financial results also play critical roles in shaping expectations. The company’s ability to manage costs, execute projects efficiently, and respond to market challenges remains essential for its short-term stock trajectory.

What Does Exxon Actually Do?

ExxonMobil is an integrated energy company with operations spanning upstream and downstream segments. Its upstream activities involve exploration and production of oil and natural gas worldwide. The downstream segment includes refining, marketing, and distribution of petroleum products.

In addition, Exxon is involved in chemical manufacturing and increasingly invests in lower-carbon technologies and energy solutions. This diversified portfolio enables Exxon to mitigate risks associated with commodity price swings and adapt to evolving energy demands.

The company’s scale and global reach provide it with competitive advantages, including access to resources, technological expertise, and a broad customer base.

Trading Exxon (XOM) Stock Online

Trading Exxon stock online is straightforward given its status as a widely listed and liquid asset on major stock exchanges. Investors and traders can access Exxon shares through various brokerage platforms offering stock trading, as well as derivatives like options and CFDs.

The stock’s liquidity ensures tight bid-ask spreads, which benefits active traders. Long-term holders often seek stable dividend payments and exposure to the energy sector’s potential rebound, while short-term traders may focus on price volatility and market news.

Understanding trading costs, platform features, and order types is important for successful participation in Exxon’s stock market.

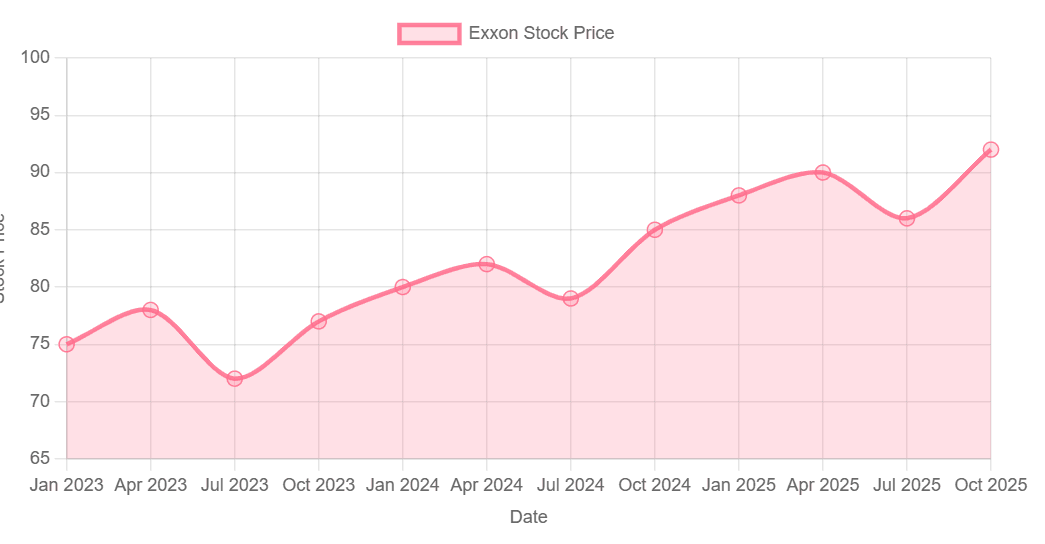

Exxon Price History

Exxon’s price history reflects decades of navigating the ups and downs of the energy markets. The stock has experienced periods of strong growth during oil booms and faced challenges during downturns caused by oversupply, demand shocks, or geopolitical conflicts.

Historical price trends often correlate with global oil prices and broader economic cycles. External shocks such as financial crises, pandemics, or shifts in energy policy have also left marks on Exxon’s stock performance.

Despite volatility, Exxon’s established position and dividend track record have attracted a loyal shareholder base over time.

What Drives Exxon’s Stock Price

source: tradingview

Several key factors drive Exxon’s stock price:

Commodity Prices: The prices of crude oil, natural gas, and refined products are primary drivers. Fluctuations in these markets directly impact Exxon’s revenues and earnings.

Production Levels: Changes in Exxon’s output volumes from existing fields and new projects affect its financial outlook.

Operating Costs: Efficiency in managing operational expenses influences margins and profitability.

Capital Expenditure: Investment decisions regarding exploration, development, and technology deployment shape future growth potential.

Regulatory Environment: Environmental regulations, taxes, and energy policies affect operating conditions and costs.

Global Economic Activity: Demand for energy correlates with economic growth, industrial activity, and transportation needs.

Energy Transition Trends: Market perception of Exxon’s strategy toward renewable energy and emissions reduction can impact valuation.

Exxon Stock Price Volatility and Accounting Rules

Exxon’s stock price can exhibit volatility due to factors specific to the energy sector and general market conditions. Sudden shifts in oil prices, unexpected geopolitical events, or changes in regulatory frameworks can cause sharp price swings.

Accounting rules related to asset valuation, reserve reporting, and impairment charges also influence reported earnings and investor perceptions. For example, write-downs of oil reserves or project costs may affect reported financial results, thereby impacting stock prices.

Understanding these elements helps interpret Exxon’s reported financials and market reactions.

Exxon Stock Dividend Payments

Dividend payments are a significant aspect of Exxon’s shareholder appeal. The company has a long history of distributing dividends, which provides steady cash flow for those holding the stock.

Dividend policy is influenced by Exxon’s cash flow generation, capital expenditure needs, and overall financial health. Maintaining or growing dividend payments often reflects management confidence in the company’s earnings prospects.

For many market participants, dividends serve as a key factor in evaluating the attractiveness of Exxon stock, particularly in a sector known for cyclical earnings.

Exxon Stock Price Predictions

Price predictions for Exxon stock rely on a combination of fundamental analysis, market conditions, and broader energy trends. Expectations vary depending on assumptions about commodity prices, global energy demand, and Exxon’s operational execution.

Some anticipate that as the global economy recovers and energy demand rises, Exxon’s revenues and cash flows will strengthen, supporting upward price trends. Others caution that the increasing push toward renewable energy and climate policies may pressure traditional oil and gas companies over the medium to long term.

Analyses also consider Exxon’s ability to innovate, reduce emissions, and diversify its energy portfolio as critical to sustaining value amid evolving market dynamics.

What About the XOM Stock Price in 2026 to 2027?

Looking toward 2026 to 2027, Exxon’s stock price outlook depends on several potential scenarios:

Energy Market Recovery: If global energy demand grows steadily and oil prices remain robust, Exxon could benefit from higher earnings and cash flow, potentially driving stock appreciation.

Energy Transition Impact: Increased adoption of renewable energy and stricter environmental regulations may challenge Exxon’s traditional business model, requiring adaptation and investment in cleaner technologies.

Technological Advances: Breakthroughs in energy efficiency, carbon capture, or alternative fuels cou

ld position Exxon as a leader in the transition, enhancing long-term value.Geopolitical and Economic Factors: Stability in key oil-producing regions and global economic conditions will continue to influence Exxon’s operational environment and market sentiment.

Overall, the mid-term outlook incorporates both opportunities and risks, with Exxon’s strategic decisions playing a pivotal role in shaping its future stock performance.

Conclusion

ExxonMobil remains a cornerstone of the global energy industry, and its stock reflects the dynamics of one of the most vital sectors worldwide. The immediate and longer-term forecast for Exxon stock hinges on commodity price trends, operational execution, regulatory changes, and the company’s adaptation to the evolving energy landscape.

While historical volatility and market uncertainties persist, Exxon’s integrated business model, dividend history, and global presence provide a foundation for navigating future challenges. Monitoring global energy developments and Exxon’s strategic responses will be key to understanding the stock’s potential trajectory through 2026, 2027, and beyond.