Bitcoin moved past $93,000 earlier today. The jump pushed the whole crypto market higher. This comes only a week after BTC slid near $83,800 on December 1.

Traders are now hopeful ahead of the Federal Reserve’s decision this week. The big question is simple: Is this a real trend shift, or only another sharp rebound that fades fast?

Bitcoin Reclaims $93,000 Amid Fed Rate Optimism

Bitcoin had a rough start to the week. Even so, it climbed back above $93,000, which many traders watched closely. The bounce from Monday’s mid-$80K lows came faster than expected. By Tuesday evening, BTC moved between $92K and $93K, up about 10% from the recent low.

This renewed talk of a “Santa rally,” since this zone capped price several times in the past days.

Broader markets turned risk-friendly too. The S&P 500 hit a six-week high. The U.S. dollar index weakened. These conditions often support Bitcoin.

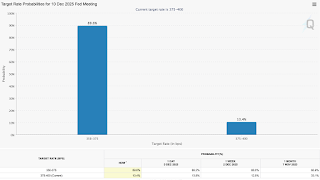

CME FedWatch now shows that futures traders see about an 89% chance of another rate cut at the next FOMC meeting. It would be the third cut of 2025.

Bitcoin reacts fast to shifts in policy expectations. That seems to be happening again.

The past day brought sharp swings. BTC dipped toward $90K before jumping near $94.4K. These large intraday moves have become common this quarter. Many traders say the fast turnarounds are hard to manage.

Monday’s range — high $89Ks to low $94Ks — shows how thin liquidity still is.

Source: CME Group

Crypto Markets Flash Green — But How Strong Is the Bounce?

Bitcoin’s rise pulled most of the market higher. Many top coins bounced hard, though traders disagree on how strong this move really is.

ETH, SOL, XRP, and memecoins show quick recovery

Ethereum climbed back to the $3,300 area with a 7% gain.

Solana, Cardano, and XRP all beat BTC in percentage terms. ADA jumped almost 9%.

Several smaller tokens inside the top 100 moved even more. Celestia (TIA), Polkadot (DOT), and FET all saw double-digit gains as traders looked for oversold names.

Even memecoins showed life again. DOGE rose about 6%. Tokens like PENGU and WIF also saw some relief after weeks of selling.

Fear & Greed Index ticks up

Sentiment is off the lows. The Fear & Greed Index was at 16 last week. It now sits in the mid-20s.

This shift does not show full confidence, but it does show the market is no longer in panic. Moves from “extreme fear” often lead to short bursts higher, though they do not always last.

What Sparked Today’s Move?

Two drivers stand out: macro hope and a wave of liquidations.

Fed’s rate stance improves risk sentiment

More traders now expect a softer tone from the Fed this week. The weaker dollar and stronger equities add to that view.

Hopes for a rate cut — or at least no harsh message — pushed traders back into Bitcoin before the meeting. If the Fed stays soft, this story strengthens. If not, many risk assets may be caught off guard.

Liquidations triggering upside volatility

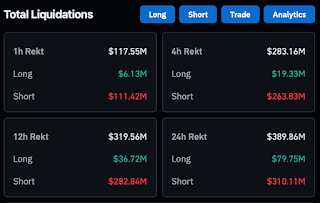

A large part of the move seems mechanical.

As Bitcoin pushed through levels in the low $90Ks, short sellers were forced to close.

About $310 million in shorts were wiped out in one day, based on CoinGlass data. This chain reaction helped BTC gain around $81 billion in market value in a short span.

This is the classic setup for a short squeeze: thin liquidity, heavy short exposure, and a clean break through a key level.

Source: CoinGlass

Analysts Split: Is Bitcoin Heading to $95K or Retesting $88K?

Analysts are divided. Some expect more upside. Others see a weak bounce inside a larger downtrend.

Bullish calls

Traders who lean bullish view the reclaim of $91K–$92K as a good sign. A break above $94K may open the path toward $95K–$96K. Some even talk about a move toward $100K before 2026.

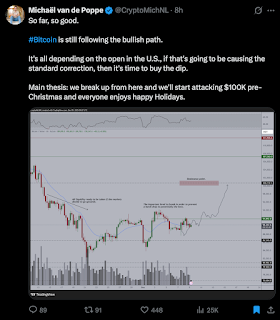

A prominent crypto analyst, Michaël van de Poppe, pointed to strong buyer demand. He said that holding above $92K keeps the larger goal of six-figure levels in play.

Rotation from altcoins back into BTC also interests traders. This often happens before large upside moves. Large Bitcoin funds have seen fresh inflows, which supports this view.

Bearish calls

Skeptics see a simple relief rally. To them, the trend still leans down. Trading volume remains weak. Liquidity is thin. Technical indicators do not show a clear trend change.

The November death cross — where the 50-day MA fell below the 200-day — also worries chart watchers.

Many bears watch the $88K area, which marked the last major swing low. A return to that zone would not surprise them.

Market analyst Merlijn flagged a hidden bearish divergence on higher timeframes. Price is rising, but momentum is not. He noted that the same pattern appeared in 2021 before the market broke down. He warned that if momentum keeps fading, “this setup can get ugly fast.”

Key Levels to Watch

Resistance — $94,500+

This zone aligns with the yearly open and several failed breakouts. A strong move above $94.5K may force bears to retreat and spark more liquidations.

Support — $90,000 and $88,000

$90K is the first support.

Below that sits $88K, which is far more important. Losing $88K may weaken the bullish case in a big way.

Range dynamics

Bitcoin is stuck between $88K and $94K. Until this range breaks, expect large swings and fakeouts instead of a steady trend.

Market Sentiment: What Traders Are Saying

Crypto Twitter is active again. Many talk about a “Santa rally,” though most remain cautious.

Funding rates have turned positive, which shows more long positions. These levels are not stretched yet, but traders keep a close eye. High funding has punished bullish traders many times.

Most describe the mood as hopeful but nervous. Trust has not fully returned. Many remember the failed rallies from recent weeks. Price swings remain sharp.

Outlook: Bullish Reversal or Short-Lived Bounce?

Nothing is settled.

The Fed meeting is the biggest event this week. A soft message may push Bitcoin higher. A harsh tone may unwind the entire move.

Beyond that, Bitcoin must hold above $92K–$94K with strong follow-through. Weak volume or a move back under $90K would raise doubts about this rebound.

Altcoin behavior also matters. Broad strength usually supports healthier trends. Narrow rallies often fade.

For now, the market sits between real hope and real fear. Bitcoin’s push above $93K brought excitement back, but the next few days will decide if it lasts, especially once the Fed speaks.