The Solana meme coin ecosystem is attractive, but it is also filled with risks. Many investors plan to trade in the short term. Yet rapid price swings forced them to become “diamond hands” unwillingly.

Can they recover their losses? The following reasons show why this is difficult.

Why Solana Meme Coin Investors Face Slim Chances of Breaking Even

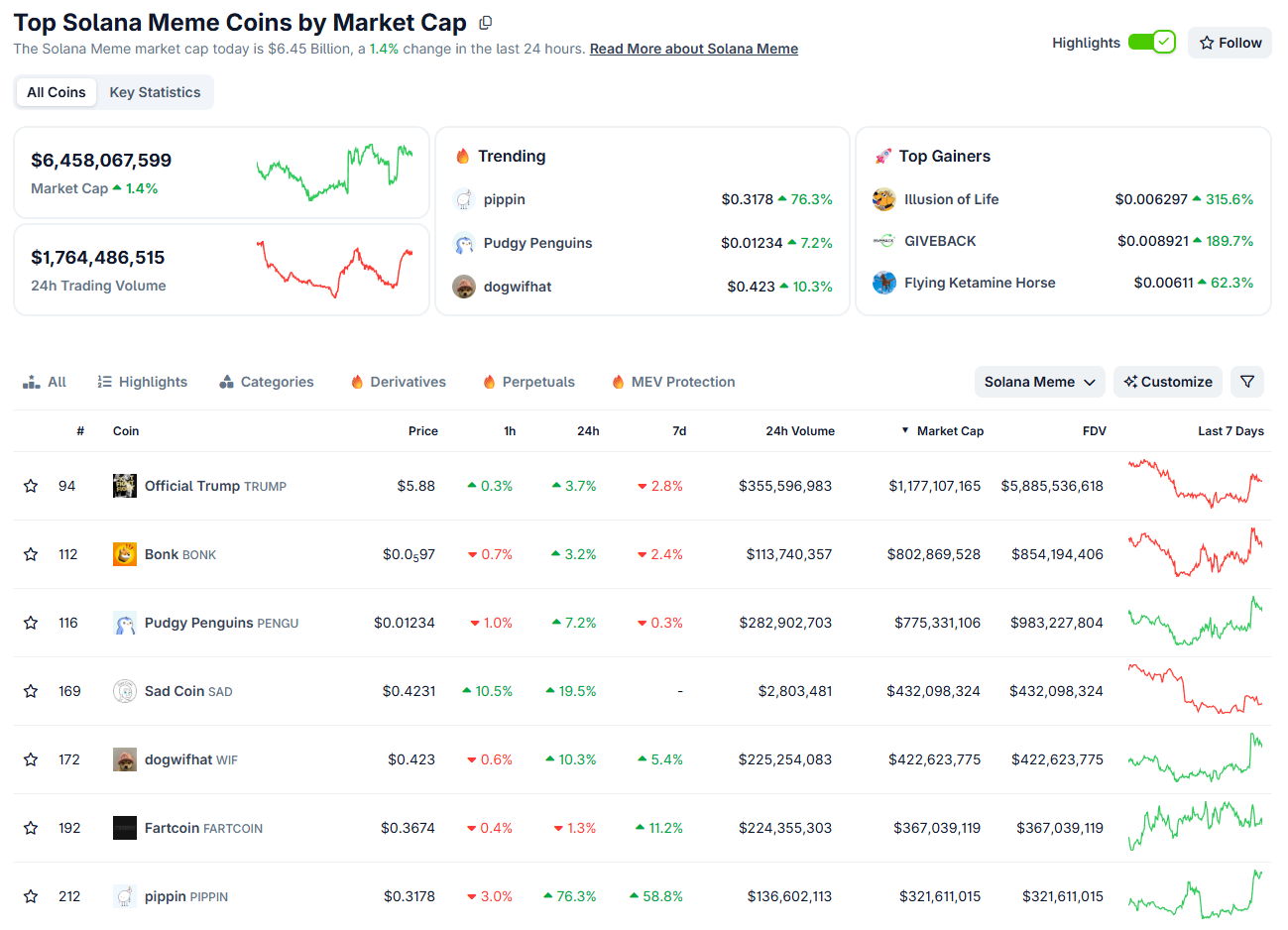

CoinGecko reports that the total market capitalization of Solana meme coins is approximately $6.45 billion, with a daily trading volume of over $1.7 billion.

However, the seven leading meme coins — TRUMP, BONK, PENGU, WIF, FARTCOIN, and PIPPIN — account for about 70% of the total market cap. Their combined daily volume covers 75% of the sector’s liquidity.

Top Solana Meme Coins by Market Cap. Source: CoinGecko

This liquidity concentration keeps most remaining meme tokens stuck with low trading volume. Their ability to recover becomes limited.

A report from Stalkchain shows that major ecosystem tokens such as PUMP, MELANIA, PENGU, SOL, and TRUMP all have unlock schedules in December. These dilution events cause large-cap tokens to bleed and drag down the entire sector.

The situation worsens as scams spread. Thesis.io analyzed 109 newly issued Solana tokens last week. 68.8% quickly became scams, and only 18.3% showed “potential.” Even within the potential group, 39.1% of individuals fell victim to scams within seven days.

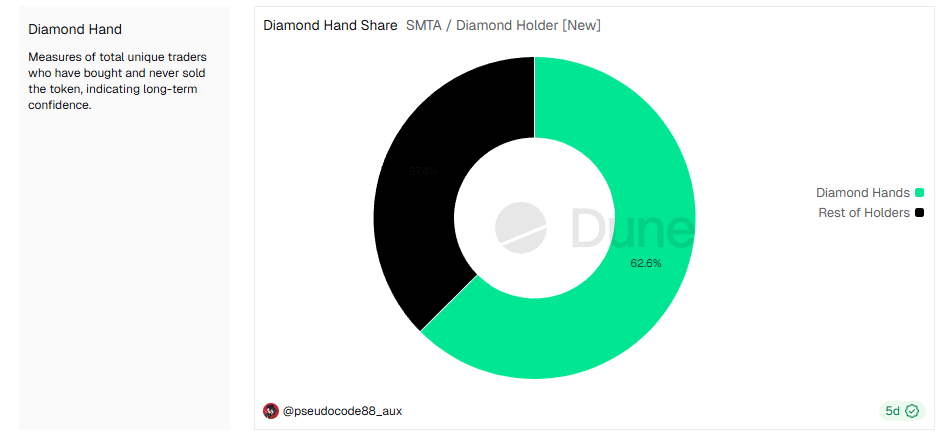

Dune data shows that more than 62% of Solana meme coin holders qualify as “diamond hands,” meaning they bought tokens and have never sold any.

Solana Meme Token Holders. Source: Dune

Whether they became holders by accident or by long-term conviction, their chances of breaking even shrink for the reasons above.

Is There Any Hope?

A small positive signal exists. The meme coin market has shown early signs of recovery, although the momentum remains weak.

The most optimistic scenario would be fresh capital flowing into the entire ecosystem. This could lift both large meme coins and smaller low-cap tokens.

If no new capital enters, capital may shift from large-cap to small-cap stocks. This rotation could give underwater holders a chance to exit.

“PUMP, TRUMP, BONK, WIF, PENGU, FARTCOIN and USELESS hold most of the memecoin liquidity on Solana. So when money moves out of them, it has to go somewhere, and that’s when small caps and new tokens start pumping,” Stalkchain predicts.

However, searching for opportunities in meme coins remains a high-risk bet. Proper portfolio allocation is necessary so that the entire portfolio does not become overly dependent on these tokens.