Altcoin News

TradingKey – Robinhood (HOOD) announced December 8, 2025, it will launch altcoin futures for SOL, XRP, DOGE, and SUI. This adds to market questions about the elusive "altcoin season," despite recent SEC spot ETF approvals. On December 8, 2025, U.S. online brokerage Robinhood (HOOD) announced plans to launch a series of altcoin futures contracts based on various cryptocurrencies, including Solana (SOL), Ripple (XRP), Dogecoin (DOGE), and SUI.

In mid-to-late November, multiple altcoin spot ETFs, including those for XRP, DOGE, and LINK, successively gained approval from the U.S. Securities and Exchange Commission (SEC). Despite these approvals, the highly anticipated "altcoin season" has not materialized. Altcoins have not experienced the collective massive surge that many expected; instead, only the corresponding cryptocurrencies saw brief, limited gains.

Despite a recent flurry of positive news surrounding altcoins, the long-awaited "altcoin season" remains elusive. This has rekindled talk of altcoin demise, with claims that altcoin liquidity is drying up. Consequently, previously confident users are wavering and raising questions, as anxiety and confusion permeate the market:Why is the "altcoin season" still missing?More extreme voices have emerged, asking:Are altcoins heading towards a collective demise?This article will comprehensively analyze the "altcoin season" phenomenon, explain why it has not yet materialized, and explore the future fate of altcoins.

What are altcoins and altcoins?

According to the earliest definition, Altcoins referred to all cryptocurrencies other than Bitcoin (BTC). This premise implied that all other cryptocurrencies were mere adaptations, created by copying or replicating Bitcoin. While slightly sardonic, this description was largely accurate, as early cryptocurrencies indeed referenced, imitated, or even directly copied Bitcoin in their origins. Notable examples include Litecoin and Zcash (ZEC).

The second definition, which represents the prevailing market view today, states that all cryptocurrencies outside of Bitcoin and Ethereum (ETH) are considered altcoins. Ethereum is excluded primarily because its price movements exhibit a stronger correlation with Bitcoin and its trend is more independent from other altcoins. Furthermore, other factors contribute to its exclusion, including a robust ecosystem, substantial market capitalization, and very high consensus.

The so-called "altcoin season" refers to a period when altcoin prices experience a collective surge, with many assets vying for the top spots on cryptocurrency exchange gainers' lists. This is a highly unique phenomenon within the crypto market. Typically, after Bitcoin's price has significantly risen, established a bull market, and entered a high-level consolidation phase, speculative enthusiasm and liquidity often flood into smaller, more volatile altcoins. This pattern was notably observed during the major bull markets of 2017 and 2021.

Altcoins are exhibiting a "divergence".

Bitcoin reached a new all-time high in March 2024, surpassing its 2021 peak with a $1.4 trillion market capitalization after rebounding from $15,000 in 2023. After about six months of consolidation, Bitcoin resumed its upward trajectory,climbing to a peak of $125,000 by October 2025 and nearing a $2 trillion market cap, setting yet another record.This marked a gain of over 730% since the last bear market. It is therefore undeniable thatBitcoin has been in a bull market for the past two years.

Bitcoin Price Chart, Source: TradingView.

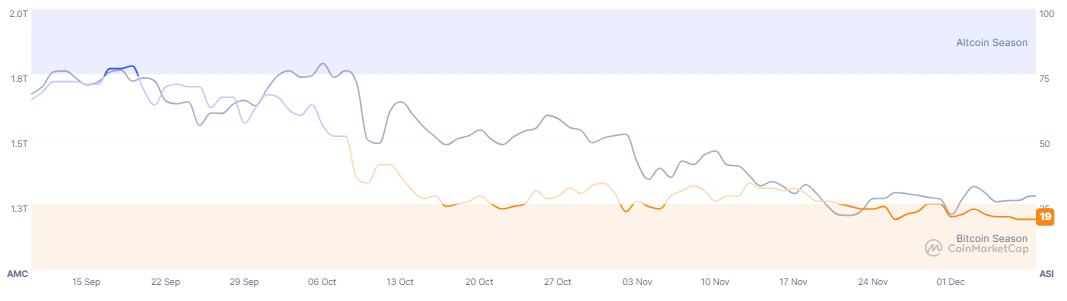

It is now confirmed that Bitcoin remains in a bull market, and its price has been in a correction over the past three months. These two factors typically foreshadow an altcoin surge. However,not only has there been no "altcoin season," but the total market capitalization of altcoins has steadily declined.According to CoinMarketCap data, altcoin market cap over the past three monthshas fallen from $1.8 trillion to $1.4 trillion, a 27% drop.The prices of individual altcoins, such as Cardano (ADA) and Shiba Inu (Shib), have even dropped back to or below their previous bear market lows. This divergence clearly differs from characteristics observed in prior bull markets.

Altcoin Total Market Cap Change, Source: CoinMarketCap.

Why has this round of "knock-off season" been delayed?

Altcoins are being discarded primarily due to a restrictive macro environment, Bitcoin's capital drain, and a lack of new compelling narratives.

Unfavorable Macro Environment

With the Bank of Japan hiking rates and the Federal Reserve maintaining high interest rate expectations, markets are increasingly pricing in rate hikes by major global central banks. This signifies a tightening of global liquidity, significantly elevating the opportunity cost of capital and increasing risk aversion, thereby substantially limiting the scale and momentum of speculative hot money.

Bitcoin's "Vampire Effect"

The approval of spot Bitcoin ETFs in the U.S. has created an unprecedented capital siphon. When substantial traditional institutional funds—such as pension and sovereign wealth funds—enter the crypto market, their demands for compliance, security, and scalability lead them to almost exclusively favor Bitcoin ETFs. Consequently, the anticipated "spillover effect" to altcoins has been significantly diminished, making this "vampire effect" more pronounced than ever.

Altcoins Lack New Narratives

In 2021, altcoin narratives, including DeFi, NFTs, and GameFi, were abundant, continuously driving successive price rallies. In recent years, however, beyond a slight buzz around meme coins, Artificial Intelligence (AI) has been more talk than action. Essentially, there are no new substantive drivers, leading to a sharp decline in the power of narratives. Furthermore, investors are growing weary, even disgusted, with projects perceived as "old wine in new bottles."

Will the knock-off season ever happen again?

Bitcoin’s market capitalization has largely remained above 50% and shown an upward trend since January 2025, according to CoinMarketCap data. Conversely, altcoin market share has stayed below 30% with little change. With the altcoin index at just 18, well below the critical threshold of 75, the market remains Bitcoin-dominated, and altcoins face marginalization. This raises the question: Will an altcoin season re-emerge to reverse this trend?

Bitcoin, Ethereum, and other Altcoins' Market Share, Source: CoinMarketCap.

Ki Young Ju, founder and CEO of CryptoQuant, holds a negative view on this prospect, warning in a December 1 post that "altcoin liquidity is drying up." Similarly, crypto analyst Cobie believes altcoin trading is becoming increasingly difficult and threatening, signaling an irreversible trend.

However, market opinions always diverge, with some believing an altcoin season will still materialize. Paul Howard, a senior executive at trading firm Wincent, and Yat Siu, founder of Animoca Brands, both contend that altcoins will benefit from Bitcoin's volatility and could even outperform it. On December 5, Paul Howard noted, "Barring significant macroeconomic news, Bitcoin is expected to continue fluctuating between $85,000 and $95,000 for the remainder of the month, potentially leading to some outperformance for altcoins."

Whether an altcoin season reappears hinges on three aforementioned conditions: the macroeconomic environment, Bitcoin's "vampiric" effect, and altcoin narratives. The macroeconomic environment stands as the most crucial factor. Should high interest rates restrict the inflow of hot money, altcoin liquidity would be further constrained, potentially preventing any alt season during this bull market. Conversely, if global central banks, particularly the Federal Reserve, continue to pursue low-interest rate policies, this would stimulate the flow of hot money into risk assets, thereby alleviating concerns about altcoin liquidity.

Which altcoins are most worth paying attention to?

In today's challenging market, investors should pivot from short-term gains to altcoins capable of enduring rigorous structural stress tests. This approach offers greater security and stability, positioning these resilient tokens for future outperformance if market conditions improve.

Category | Token | Core Investment Thesis |

Base Public Chains (Layer-1) | Solana (SOL) | Boasting significant advantages in transaction speed and cost, Solana has attracted numerous high-frequency applications, including meme coins. Its ecosystem shows extremely high activity, supported by a strong community and substantial capital appeal. It is widely referred to as an 'Ethereum killer.' |

Decentralized Finance (DeFi) | Uniswap (UNI) | As the absolute dominant force among DEXs, Uniswap commands the vast majority of spot trading volume. It serves as DeFi's foundational infrastructure and liquidity cornerstone. |

Artificial Intelligence (AI) | Render Network (RENDER) | Render Network connects GPU compute power demanders with providers, aligning perfectly with the AI surge.It has a clear business model and generates tangible revenue. |

Real World Assets (RWA) | Ondo Finance (ONDO) | Ondo Finance tokenizes low-risk, interest-bearing traditional financial assets such as U.S. Treasuries and money market funds, offering 'yield-generating foundational assets.' This positions it at the core frontier where Wall Street intersects with the crypto world.Furthermore, its founding team hails from top financial institutions like Goldman Sachs and Bridgewater Associates, and it has established partnerships with industry giants such as BlackRock. |

in conclusion

The anticipated "altcoin season" has yet to materialize, constrained by a lack of fresh market capital and Bitcoin's continued dominance in absorbing available funds. This does not mean all altcoins will perish; however, a segment of these tokens will gradually exit the market. Therefore, caution is advised when selecting altcoins, with a priority placed on leading cryptocurrencies within promising sectors such as AI, RWA, and Layer-1.