Cardano price is up 8.6% in the past 24 hours as excitement builds around Midnight, its new privacy-focused subchain. In the lunar cycle, a midnight phase usually marks a reset — a moment before a new beginning. But for ADA, this reset may signal the beginning of a new drop instead.

The price still sits inside a bearish pattern, momentum remains weak, and several on-chain signals point toward a possible continuation of the same downtrend that has dominated for months. Could this be the beginning of a 39% ADA price dip?

Bear Flag Structure And Hidden Bearish Divergence Still Favor The Downtrend

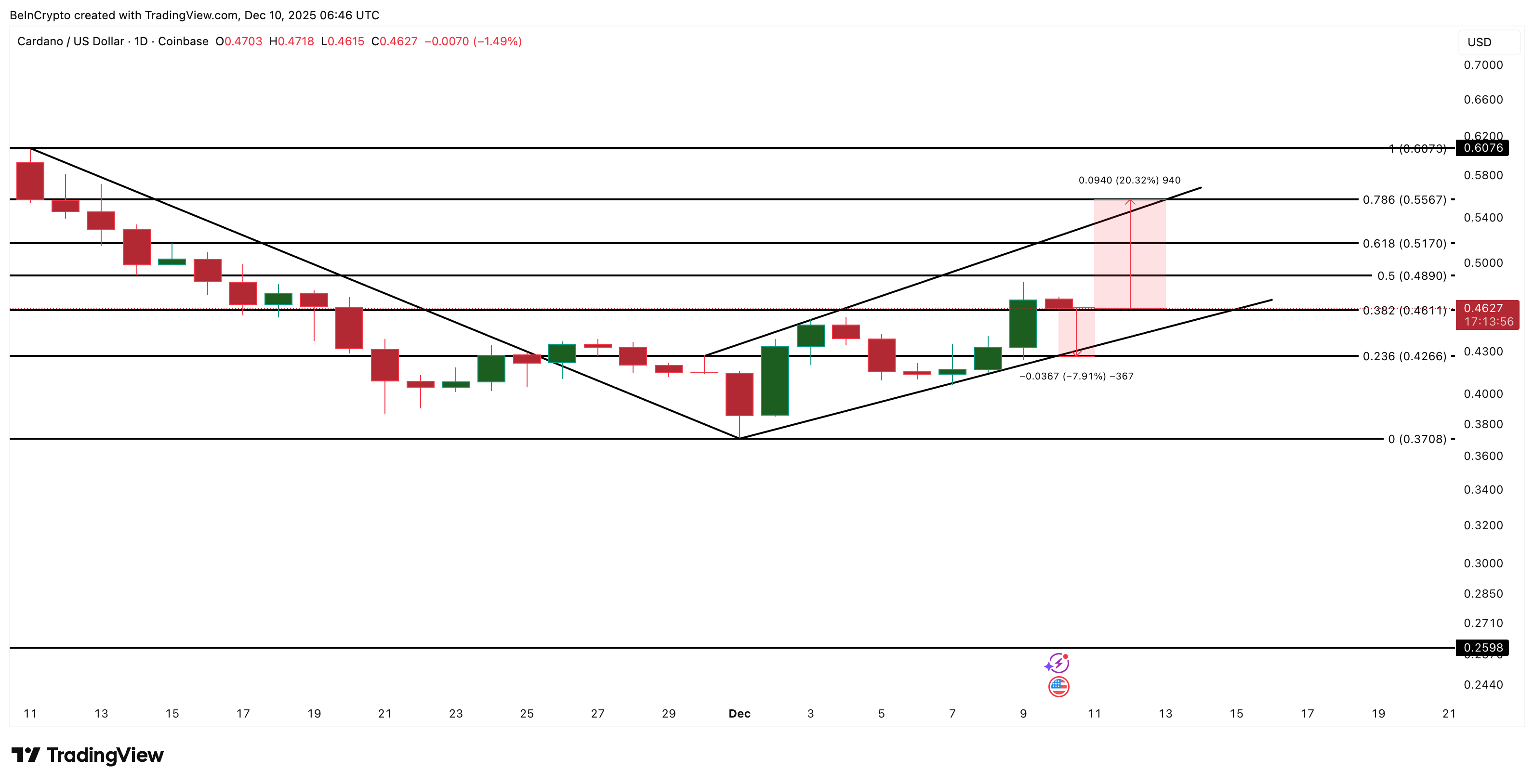

Cardano is still trading inside a bear flag on the daily chart. A bear flag forms when a sharp fall is followed by a smaller, upward-sloping channel. That channel often acts as a pause before the same downtrend continues.

Between November 10 and December 9, ADA’s price made a lower high, while the RSI made a higher high. RSI, or Relative Strength Index, is a momentum indicator that shows whether buying or selling pressure is stronger. When RSI climbs, but the price fails to follow, it often signals that the bounce is weak and sellers still control the trend.

Because ADA is already down about 54% over the past year, this hidden bearish divergence supports the idea that the downtrend is not finished.

Cardano Price Leans Bearish: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The bear flag’s pole projects a possible 39% drop if the lower trendline breaks. That move would place ADA near $0.25, a deeper bearish target.

This sets the stage for the rest of the story: Midnight may mark a new phase for the network, but the chart still treats this bounce as part of a larger downtrend.

Whales Exit As Spent Coins Jump — Traders Are Selling Into The Bounce?

The on-chain signals line up with the bearish chart.

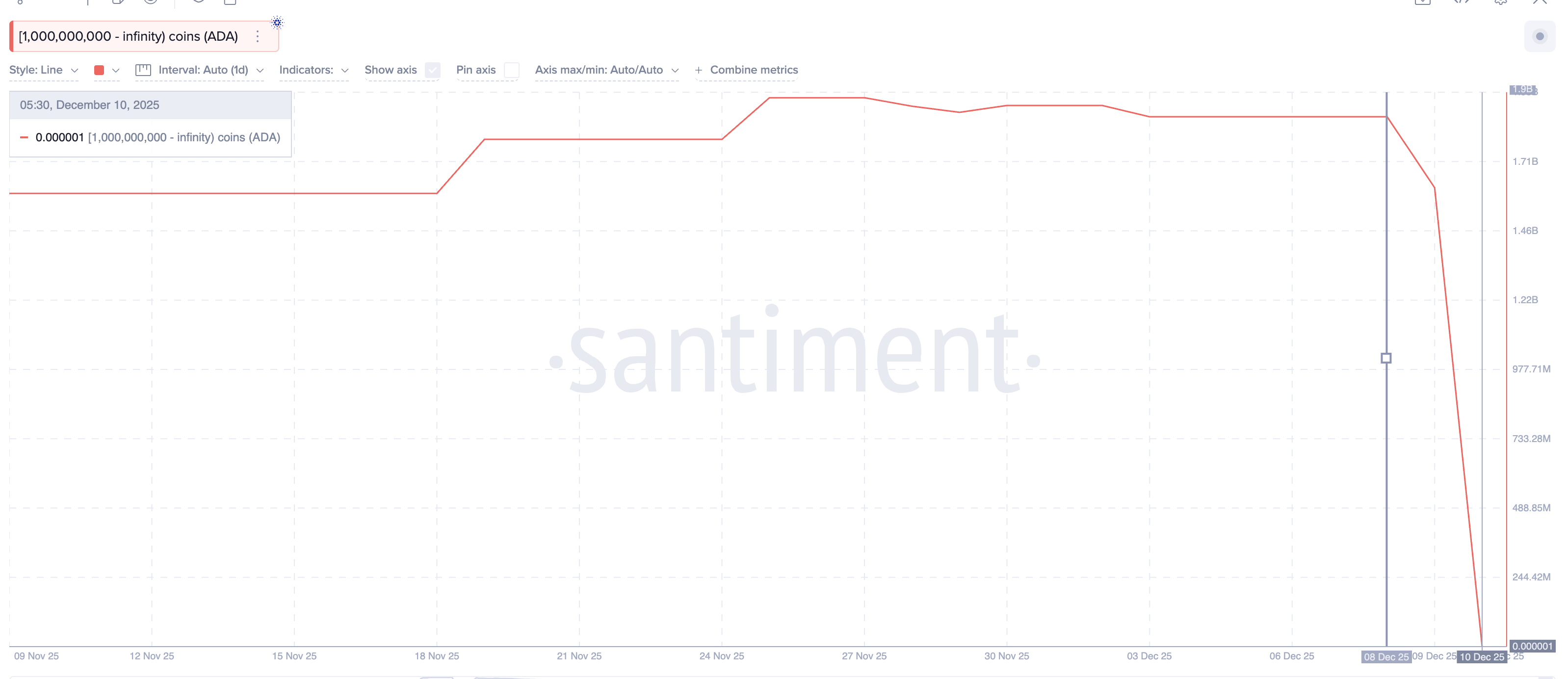

The largest Cardano whales, wallets holding more than 1 billion ADA, have sharply reduced their exposure since December 8. Their combined balance fell from about 1.86 billion ADA to almost zero in just a couple of days. Whales do not empty positions like this unless they expect better entry points lower or want to use strength to exit.

Whales Emptying Stash: Santiment

A second on-chain metric confirms this behavior. The Spent Coins Age Band tracks how many ADA tokens move each day, across both young and old wallets. On December 6, around 95.26 million ADA moved on-chain. By December 10, that number had climbed to 130.46 million ADA, an increase of roughly 37% in four days.

Spent Coins Rising: Santiment

This jump shows that more holders, including older ones, are possibly sending coins to the market. When whale balances collapse and spent coins jump at the same time, it usually means traders are using the bounce to sell, not to accumulate.

So the first section showed that the structure is bearish. This section shows that behavior is also bearish. Now the price levels simply translate this combined pressure into specific zones that traders must watch.

Cardano Price Levels Show A Wider Downside Path

With both the chart and on-chain signals leaning negative, the next moves depend on a few clear levels.

If the ADA price falls below $0.42, the lower trendline of the bear flag breaks. From there, the price can slide toward $0.37. If $0.37 fails to hold, the full flag projection toward $0.25 becomes more likely, the 39% downside suggested by the pattern.

For bulls, the path is narrower but still possible. Cardano must first reclaim $0.55. A daily close above this level would break the upper boundary of the bear flag and weaken the bearish setup. Holding above $0.60 would then show that this Midnight Phase is shifting from a reset into a more constructive recovery.

Cardano Price Analysis: TradingView

Right now, only a small 7–8% drop is needed to trigger the bearish breakdown, while almost a 20% rise is needed to invalidate it. With whales exiting and spent coins rising, the weight of evidence still leans toward the downside.