XRP continues to struggle under a persistent downtrend as bearish cues from the broader crypto market limit recovery attempts.

Despite this weakness, the altcoin still benefits from the support of major wallets, even as some whale cohorts reduce their exposure.

XRP Supply Changes Hands

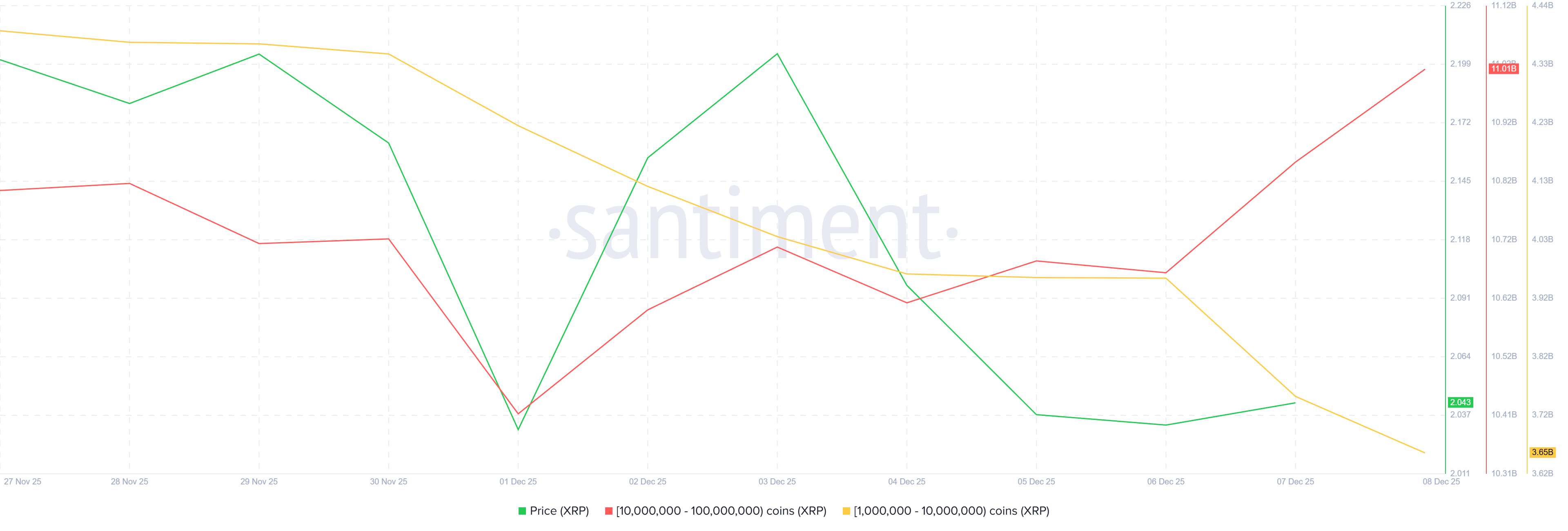

Whale activity shows a notable redistribution of XRP supply between major cohorts. Addresses holding 1 million to 10 million XRP offloaded more than 330 million XRP in the past four days, reflecting skepticism among mid-sized whales. Their selling pressure, however, did not send supply to exchanges or retail holders.

Instead, larger wallets holding 10 million to 100 million XRP absorbed this supply. Their combined holdings climbed by 350 million XRP during the same period, worth more than $729 million. This accumulation signals confidence from deeper-pocketed investors who often act as stabilizing forces when market sentiment weakens.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Whale Holding. Source: Santiment

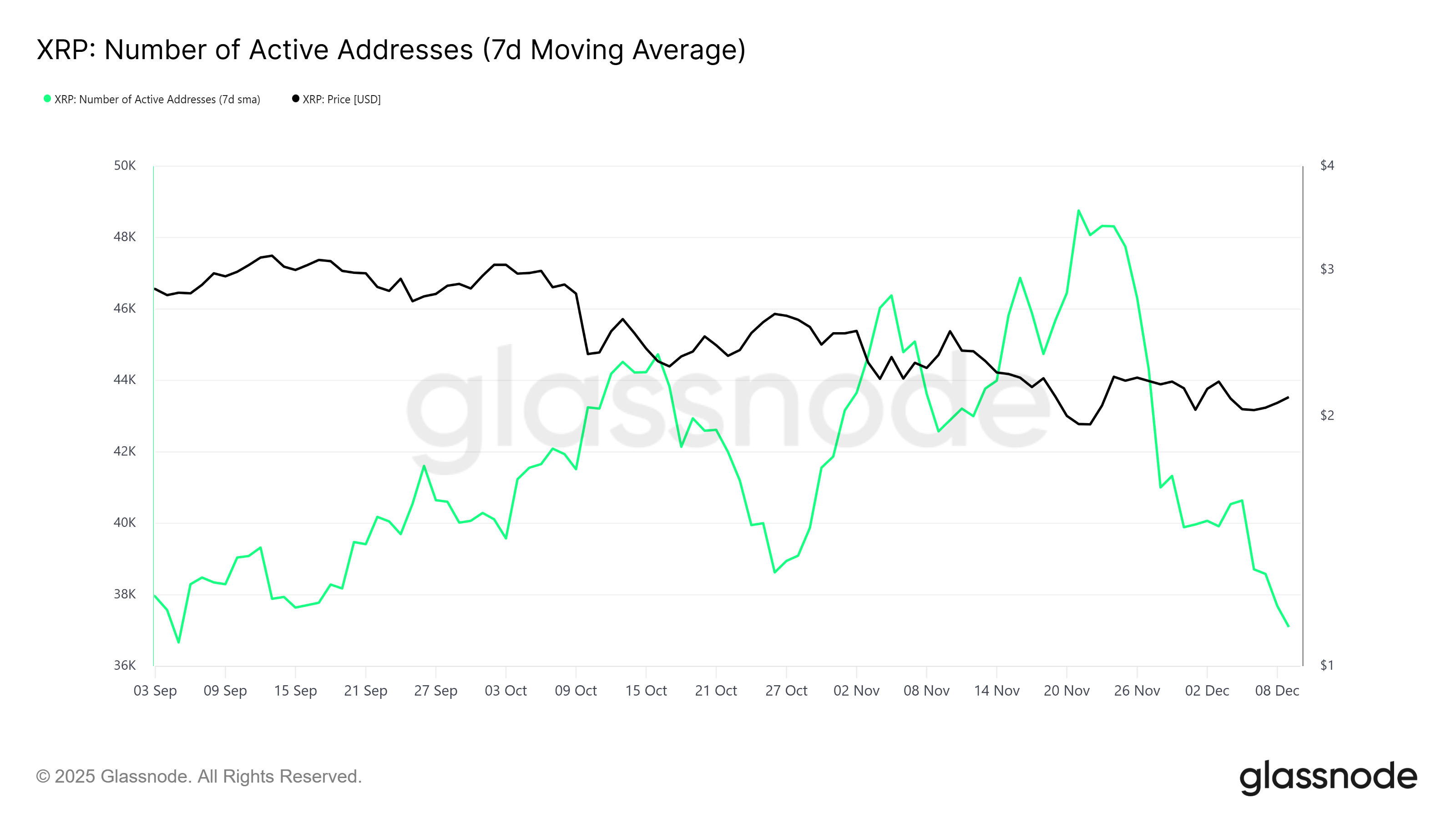

XRP’s macro picture remains challenged by declining network activity. Active addresses have fallen to a three-month low of 37,088, showing that many investors are not transacting or engaging with the network. Such a drop typically signals fading interest or uncertainty about near-term price direction.

Reduced participation also impacts liquidity, making it harder for XRP to stage a strong recovery even when large holders are accumulating. With fewer users initiating transactions, demand remains muted, slowing down the pace at which XRP can escape its downtrend.

XRP Active Addresses. Source: Glassnode

XRP Price Could Remain Rangebound

XRP is trading at $2.08 at the time of writing, extending a nearly month-long downtrend. For several days, the altcoin has oscillated within the narrow range between $2.20 and $2.02. This highlights the ongoing struggle to generate momentum.

The mixed signals from whales and weak network activity suggest that XRP may continue consolidating within this band. If broader market conditions improve, a break above $2.20 could allow XRP to target $2.36. This would mark its first meaningful recovery attempt in weeks.

XRP Price Analysis. Source: TradingView

If bullish sentiment fails to develop, XRP faces the risk of another downturn. Losing the $2.02 support level would send the price below $2.00. This would invalidate the bullish thesis, exposing the altcoin to deeper losses.