Hyperliquid steadies its intraday recovery above $28.00 as the crypto market awaits the Fed decision.

Hyperliquid DeFi staking balance extends decline to $1.63 billion from $2.42 billion on October 30.

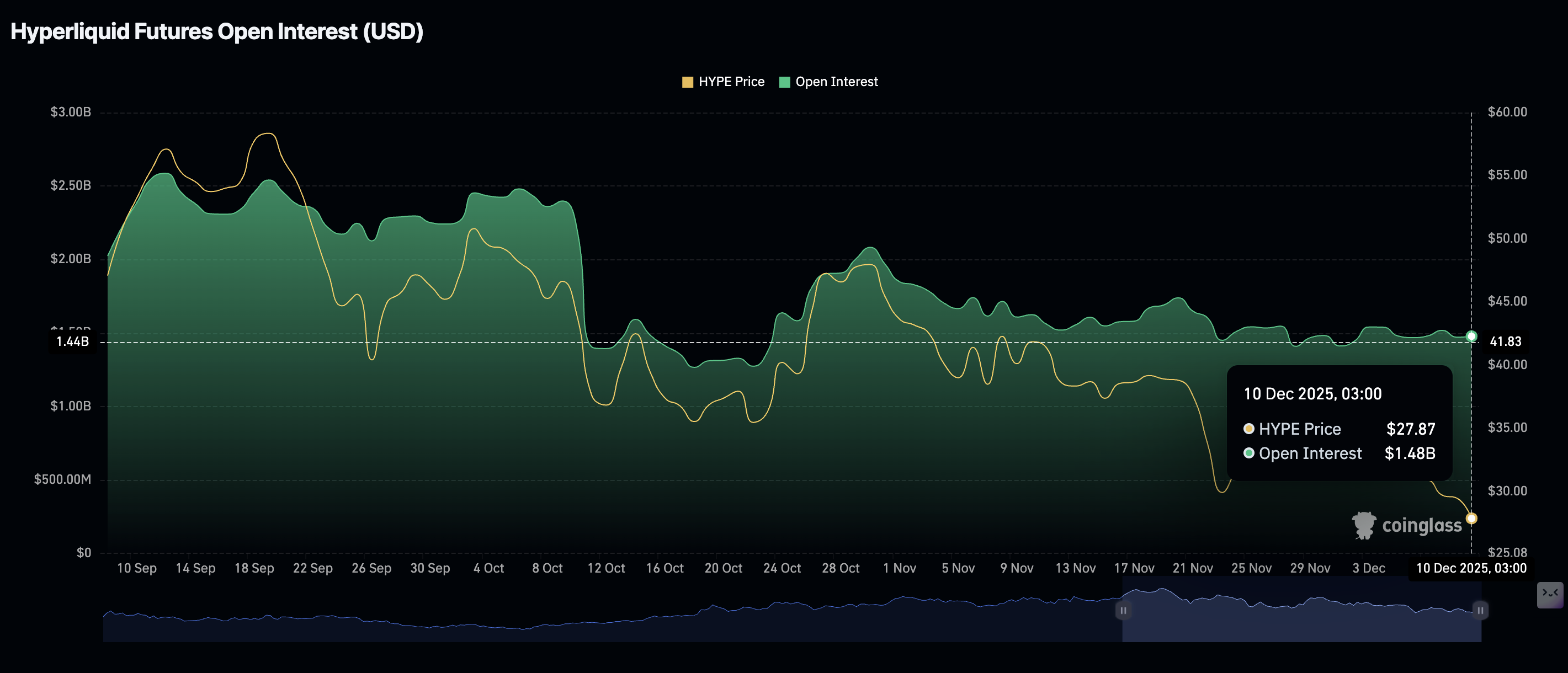

HYPE faces a significantly subdued derivatives market with futures Open Interest averaging $1.48 billion.

Hyperliquid (HYPE) is trading above $28.00 at the time of writing on Wednesday, after rebounding from support at $27.50. The broader cryptocurrency market is characterised by widespread intraday losses ahead of the Federal Reserve (Fed) monetary policy decision.

Markets expect the central bank to cut interest rates by 25 basis points to a range of 3.50%-3.75%. However, the weight of the matter lies with the post-meeting statement and Fed Chair Jerome Powell’s news conference. Here, investors will watch for clues about the central bank’s monetary policy direction, especially in the first quarter of 2026.

Hyperliquid may extend its recovery alongside other cryptocurrencies if the Fed follows through with the rate hike. A break above $30.00 may pave the way for the next recovery phase toward $40.00.

Hyperliquid rises as staking balance dips

Hyperliquid’s Decentralized Finance (DeFi) Total Value Locked (TVL), which is the notional value of all coins held in smart contracts across all protocols on the Layer-1 blockchain, has extended its decline to $1.63 billion from $2.42 billion on October 30.

If investors continue to pull their funds from staking contracts on the Hyperliquid chain, extending the 32.6% decline, selling pressure will likely increase as available supply in the open market expands. Falling TVL suggests that investors are losing confidence in the token and ecosystem, prompting them to reduce their risk exposure.

Meanwhile, demand for Hyperliquid derivatives has stabilized, with futures Open Interest (OI) standing at $1.48 billion on Wednesday. OI, which represents the notional value of outstanding futures contracts, is significantly below its record high of $2.59 billion reached in September, suggesting that low retail interest in HYPE could continue to suppress a recovery.

Technical outlook: Is Hyperliquid poised for a steady rebound?

Hyperliquid is showing subtle signs of recovery, trading above $28.00 at the time of writing on Wednesday. The Layer-1 blockchain token holds above its short-term support at $27.50, underpinning a potential bullish outlook.

The Relative Strength Index (RSI) has risen to 37 on the daily chart, pointing to easing bearish momentum. An extension of the RSI above the 50 midline would back a steady bullish outlook for HYPE and increase the chances of a sustainable breakout above $30.00.

Looking forward, Hyperliquid sits below the 50-day Exponential Moving Average (EMA) at $36.23, the 200-day EMA at $36.41, and the 100-day EMA at $38.67, all of which are sloping downward, reinforcing the bearish thesis. Buyers need to push the price above these moving averages to confirm a native bullish bias and tackle the descending trendline resistance for an accelerated move above $40.00.