Bitcoin climbed to a three-week high on Tuesday before slipping back, a move that has traders and analysts watching closely.

According to TradingView data, Bitcoin price topped out at $94,600 late in the session — its highest level since November 25 — then eased to about $92,450 at the time of reporting.

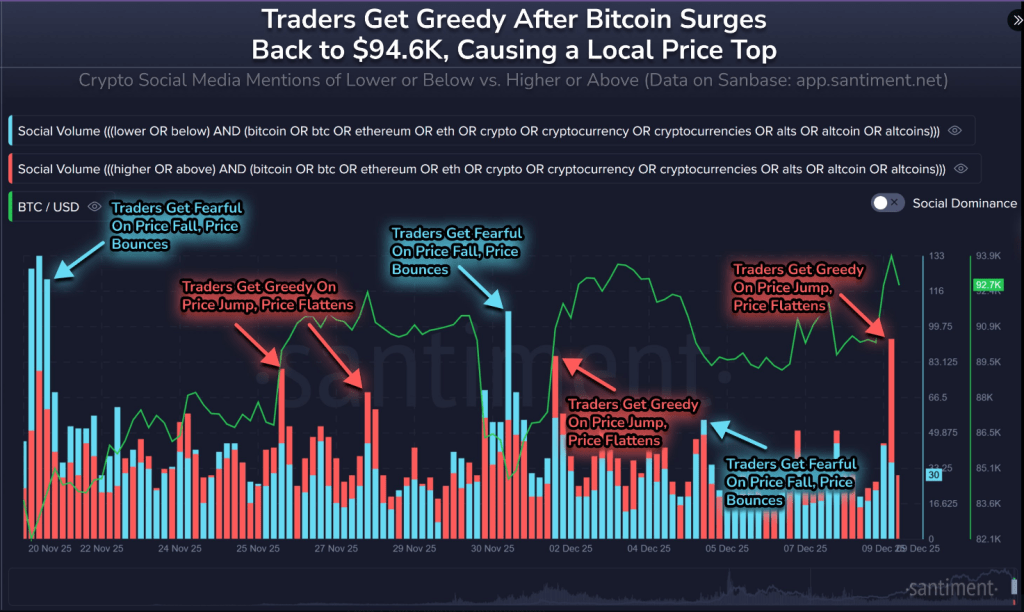

Santiment, a blockchain analytics firm, said social chatter calling for “higher” and “above” exploded during the spike, but market action remained uneven.

Bitcoin: Trader Frenzy And Skepticism

Reports have disclosed that the surge drew heavy retail attention and a flurry of social-media posts urging more buying.

Some market watchers questioned how organic the rise was. A well-known long-term investor using the handle “NoLimit” told his 53,000 X followers that the $94,000 push looked engineered: big buys packed into a few minutes, thin order books, then little follow-through.

That pattern, he argued, is how larger traders can create short-term fear of missing out so they can sell into strength.

Santiment also highlighted a behavioral twist: smaller traders appear to pile in after spikes, often leaving them on the wrong side of moves.

Volatility followed the high, as prices pulled back by a couple thousand dollars within hours. Exchange order depth and timing of large blocks, analysts say, matter a lot when liquidity is shallow.

Fed Decision Could Shift Momentum

The US central bank meeting this week is a key wildcard. Market pricing on CME Group futures showed an 88% chance of a 0.25% rate cut, which many traders think helped fuel the rally. Yet some analysts warned that any sign of hesitation about future cuts could dampen risk appetite.

Beyond US policy, next week’s potential Bank of Japan rate action is being watched because a tighter stance there could lift yields and pull capital back to Japan, tightening global liquidity. That kind of flow can pressure risky assets across markets.

Liquidity, Institutions And The Bigger Picture

Meanwhile, long-term holders pared back supply after a 36% correction from the all-time high, and some addresses now hold levels seen in March.

Jessica Gonzales, an analyst cited in reports, said M2 money supply sits at about $22.3 trillion and stablecoin reserves remain elevated, suggesting there is capital around but not necessarily evenly distributed in markets.

Institutional moves also feature: big firms such as BlackRock and Strategy have expanded crypto exposure, which could add a steadier buyer base — or simply shift where risk sits.

What Traders Should Watch

Short-term traders should track order-book depth, large trade clusters, and how price reacts to any Fed wording about future cuts.

The next 25 days were flagged as especially important by several observers because liquidity swings and regulatory updates could flip the narrative fast. If a true broad-based bid forms, prices could move quickly. If the Fed signals caution, the opposite could happen.

Featured image from Gemini, chart from TradingView