American Bitcoin Corp., Eric Trump’s digital asset mining firm, has purchased an additional 416 Bitcoin for $38 million at an average price of $91,346 per BTC. The corporation now holds 4,783 BTC in its treasury.

American Bitcoin Corp. (ABTC), a U.S.-based bitcoin mining and treasury management company backed by Eric Trump, executed a strategic purchase of 416 Bitcoins for $38 million on December 10. The purchase brings each acquired BTC to an average buying price of $91,346.

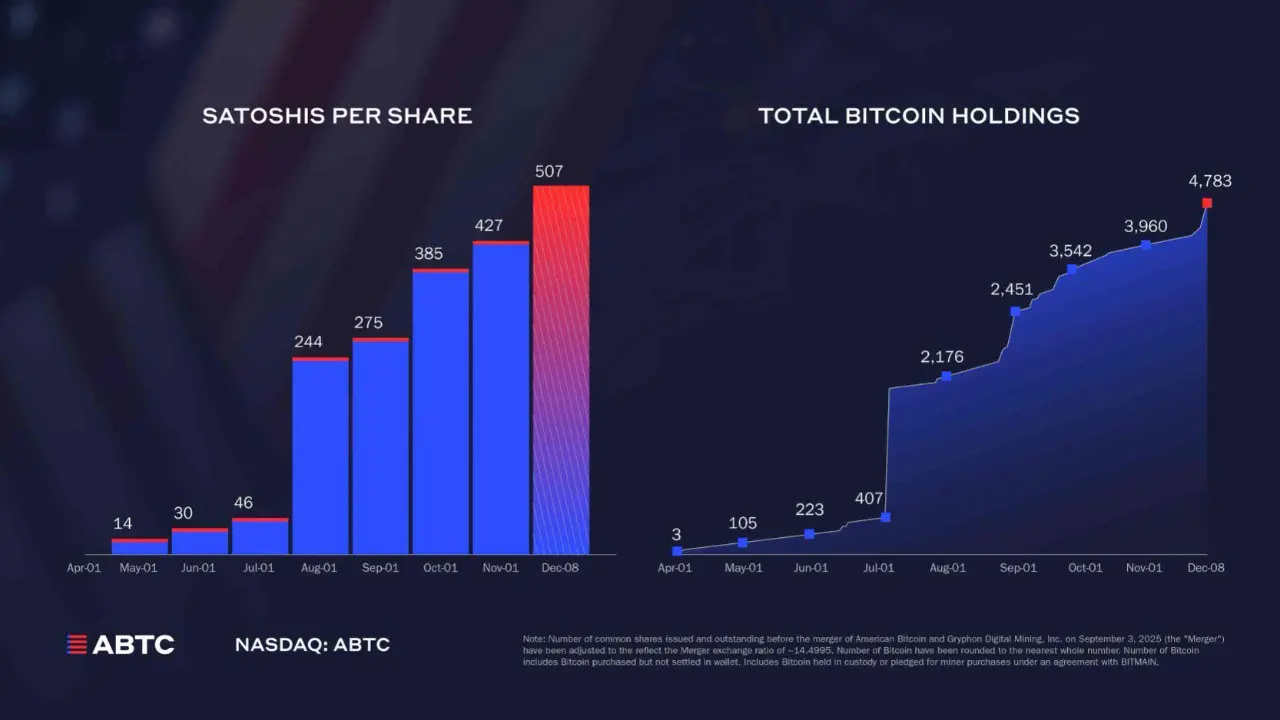

American Bitcoin Corp. now holds 4,783 BTC

According to data from Bitcoin Treasuries, the Nasdaq-listed corporation now holds 4,783 BTC worth $440.16 million at current BTC prices. The BTC holdings represent those held in custody or pledged for miner purchases under an agreement with BITMAIN, according to the company. The data also shows that American Bitcoin Corp now ranks 22nd among the largest Bitcoin holding corporations, surpassing Gamestop and HIVE Digital Technologies.

American Bitcoin Corp. also updated investors on its Satoshis Per Share (“SPS”) metric, which tracks the amount of Bitcoin attributable to each outstanding share of common stock. The firm’s SPS grew by more than 17% in just over a month.

Eric Trump, Co-founder and Chief Strategy Officer of American Bitcoin, commented on the purchase, saying that the company has built one of the largest and fastest-growing Bitcoin accumulators since listing on the Nasdaq Stock Exchange about three months ago. He also said that the company will continue to advance its Bitcoin reserve strategy to ensure long-term value creation for investors.

ABTC shares rose by 1.5% on Tuesday, likely due to the recent purchase of BTC. However, the stock’s performance has not been promising. According to data from Google Finance, the company’s share price has declined by 19.42% over the last five days and by more than 50% in the last month.

On November 14, the firm published its third-quarter 2025 financial results, which revealed that ABTC added more than 3,000 Bitcoin through mining activities and at-market-price purchases. The firm recorded revenue of $64 million for the three months ending September 30, indicating a significant improvement from $11.6 million recorded in the same period the previous year. The three-month net income totaled $3.5 million, compared to a net loss of $0.6 million in the prior-year period.

Institutional interests in Bitcoin surge as BTC prices stabilize

American Bitcoin Corp’s recent purchase signifies renewed institutional interest in Bitcoin. Michael Saylor’s Strategy (formerly known as Microstrategy) leads with the largest corporate Bitcoin balance in its books.

The tech company recently bought $1 billion worth of Bitcoin, marking its largest Bitcoin purchase in months. Strategy now holds 660,624 BTC valued at $60.63 billion. According to Bitcoin Treasuries, the firm’s average cost per BTC is $74,702, resulting in an unrealized profit of 23.11% at the time of this publication.

Strive, a U.S.-based asset management firm, also recently announced a $500 million at-the-market offering program for its Variable Rate Series A Perpetual Preferred Stock (SATA). The firm announced that it intends to use the proceeds to purchase Bitcoin and Bitcoin-related products, among other operational expenses.

Data from ETF tracking Website SosoValue shows that US BTC spot ETFs registered inflows worth $151.74 million. Fidelity’s FBTC and Grayscale’s BTC led the pack with inflows worth $198.85 million and $33.79 million, respectively.

BlackRock’s IBIT was the only ETF that registered negative flows worth $135.44 million despite being the largest exchange-traded fund with over $60 billion in net assets under management.

Bitcoin is currently trading at $92,121. According to data from CoinMarketCap, the crypto asset has remained relatively unchanged over the last week, with a 0.83% drop in the last seven days and a 1.12% rise in the last 24 hours.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.