A fresh debate about which cryptocurrency to consider for investment has reappeared as investors follow those showing resilience in 2025. Ripple (XRP) has started gaining traction based on a continued drop in reserves among major trading platforms, while Mutuum Finance (MUTM) keeps getting momentum with its presale.

Both of these tokens attract a different category of investors. However, this contrast has broadened the debate about which cryptocurrency to invest in now. The shrinking supply of XRP and explosive growth of Mutuum Finance (MUTM) represent a contrasting strategy for any investor trying to identify a cryptocurrency for investment before a shift occurs in market trends.

Ripple’s Supply Reduction Supports Price Interest

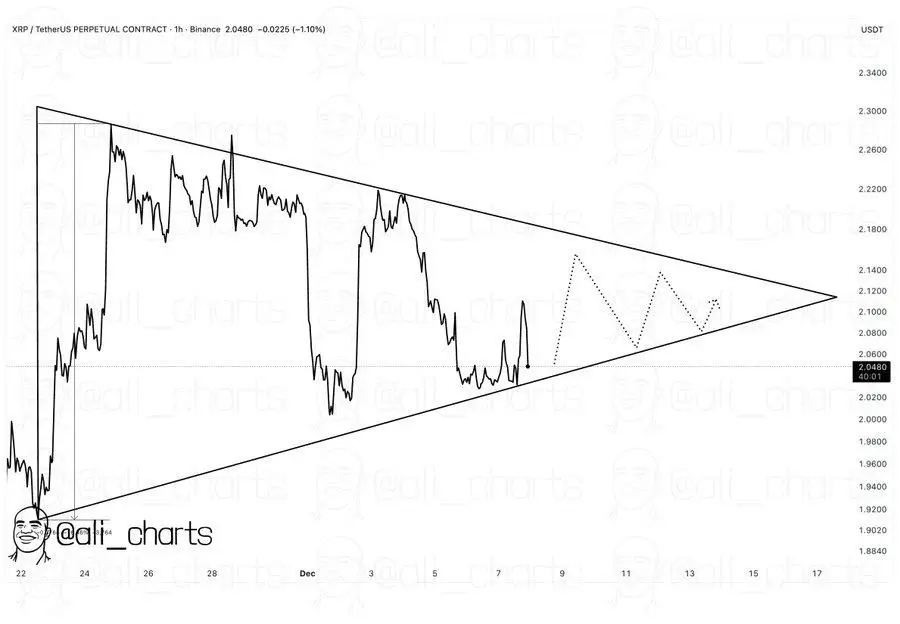

Ripple has also shown constant strength around the $2.18 level as its supply within the market continues to reduce. This reduction in available supply continues to build a more stable zone of support for the cryptocurrency and has caught the attention of traders among current crypto news.

Binance has shown one of the most dramatic reductions in exchange supply, cutting down its supply to around 2.7 billion from figures above 3 billion. Long-term holders have begun transferring XRP to offline wallets, cutting down the supply available for sale.

ETF inflows exceeding $640 million have fueled this sentiment even further, pulling more XRP out of trading circulation. Institutional investors looking for assets with stable liquidity levels have contributed to more demand in the market, and with each inflow, the supply continues to decline. Traders are currently focusing on the $2.17-$2.20 region, viewing this as a strong level for possible stops before any potential rise towards the $2.60-$2.85 region.

MUTM’s Presale Quick Progress

Mutuum Finance (MUTM) continues to move along in presale with increasing momentum. The current position of Phase 6 stands at 98% completion. The current price stands constant at $0.035. This marks a 250% increase over the price of $0.01 observed in Phase 1. A total of $19,250,000 has been raised. This is alongside a total number of 18,400 holders. The current presale phase of 6 looks to be selling out rapidly. This serves as an impetus for those considering which cryptocurrency to buy today prior to a price reset. Following completion of the current allotment, phase 7 shall price at $0.04 with a nearly 20% increase.

The launch price for this asset has been recorded as $0.06. This gives those who are currently invested a potential increase of 360%. Investors considering where to put their money in crypto are keeping a keen eye on this shrinking opportunity. The presence of a 24-hour leaderboard has also contributed to this heightened activity. This gives a prize of $500 for the best participant who completes any transaction in a cycle with a reset time of 00:00 UTC.

Dual Lending Structure of MUTM

Mutuum Finance (MUTM) has been working on a dual lending mechanism that will be capable of catering to varying user requirements in its impending protocol. Its Peer-to-Contract system architecture will enable liquidity for prominent assets while enabling lenders to earn yield without manual intervention when borrowers interact with the protocol.

Additionally, the Peer-to-Peer Market will facilitate loans for assets that have customized terms. This will help facilitate liquidity and give users a chance to choose a form of borrowing that best suits their risk preference. Halborn Security is conducting a thorough audit of smart contracts. The code will be formally reviewed before being launched.

Mutuum Finance (MUTM) is also working towards the development of a stablecoin that is fully collateralized and capable of being used as a unit of account. This will bring stability to borrowers and liquidity to lenders. This stablecoin will be integrated with both layers of lending in a manner that will reduce exposure to volatility.

The update for the V1 protocol will come with several elements such as liquidity pool, mtToken, debt token, and liquidator bot. This update will be rolled out with the Sepolia testnet in Q4 of 2025.

Why a MUTM investment exceeds XRP investment.

A decreasing supply of XRP may be a good thing for a long-term interest, but when looking for something with easy early access and increasing uses, Mutuum Finance (MUTM) appears to be ahead of others when considering which cryptocurrency investment will be best before the new year. Investors looking for a long-term investment should look at MUTM before Phase 6 sells out.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance