The Federal Reserve prepares for its final 2025 interest rate meeting, and the crypto market braces for potential turbulence and opportunities. While many analysts have given their opinions based on the job market and inflation, we asked ChatGPT about the FOMC meeting outcome.

Recent forecasts from tools like FedMarket Watch show an 87.6% chance, while Polymarket shows a 96% chance that the Fed will cut interest rates by 25 basis points. Another rate cut could be a good development, driving investor interest towards risk assets, including cryptocurrencies.

According to CoinMarketCap data, the total crypto market cap rose to $3.17 trillion, up 3.14% in the past 24 hours. The renewed interest reflects traders’ positioning ahead of the Fed’s rate decision.

With the broader market focused on FOMC headlines, one standout name is quickly climbing the ranks of investor attention. Bitcoin Hyper, a layer-2 project, has stunned the crypto community, raising $29.2 million and selling out 638 million tokens during its presale.

In this guide, we will discuss ChatGPT’s stance on the FOMC meeting outcome and why many are asking if Bitcoin Hyper could be the breakout DeFi project for this cycle.

ChatGPT Predicts Dovish Remarks By FOMC Meeting

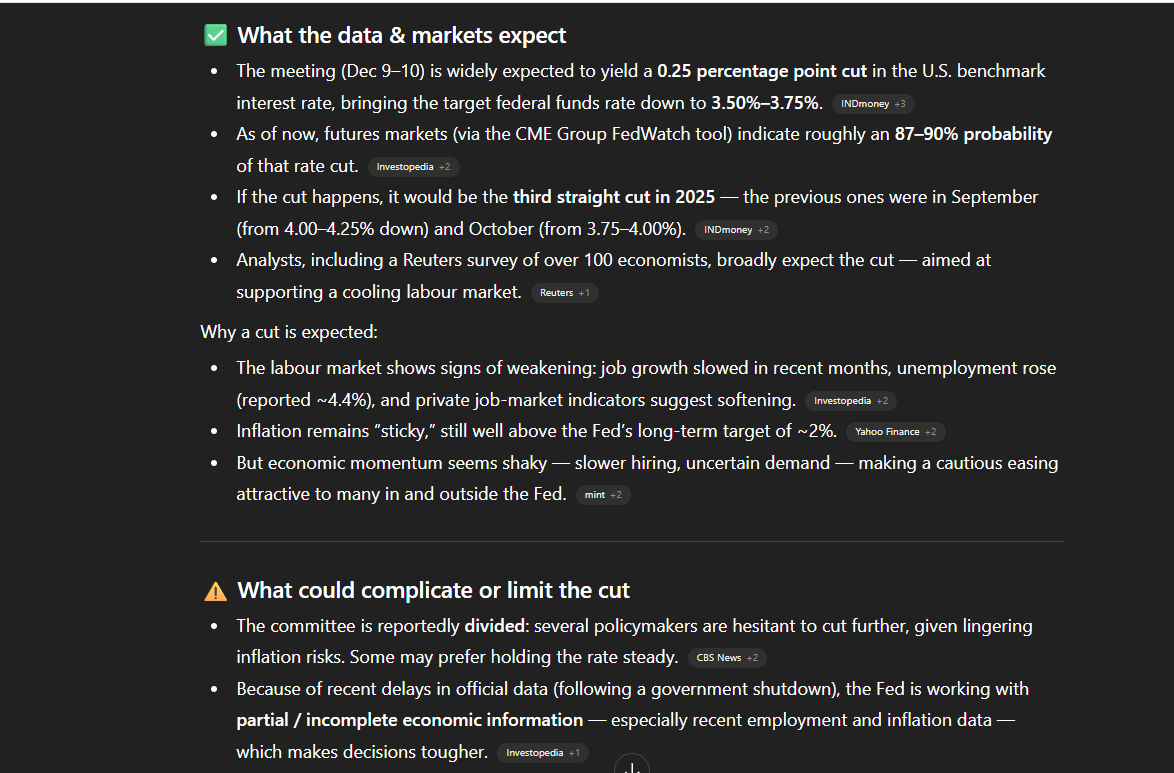

According to ChatGPT’s analysis, the December 10 FOMC meeting is likely to deliver a 25 bps rate cut, bringing the federal funds rate to 3.50%–3.75%. This would mark the third consecutive cut of 2025, following the September and October reductions. Futures markets are already pricing in the move with an 87–90% probability, signalling strong market confidence in a dovish shift.

The AI model highlighted that recent economic indicators support such a move. The labour market has cooled noticeably, with unemployment climbing to around 4.4% and job growth slowing month after month. Inflation, however, remains above the Fed’s ideal 2% target, adding tension to an otherwise clear case for easing.

Several policymakers remain cautious, worried that inflation could flare again if the Fed loosens too quickly. The central bank is also operating with incomplete economic data due to delays in government statistics. This could push the Fed toward a more conservative tone even if it delivers the expected cut.

The model anticipates a “hawkish dovish” stance: a cut paired with strong messaging that future rate reductions will depend on fresh data. In essence, ChatGPT expects the Fed to support the economy without signalling an aggressive easing cycle for 2026.

Bitcoin Hyper Stands Out Amid Market Uncertainty

As ChatGPT predicts the FOMC meeting outcome, Bitcoin Hyper is quickly becoming the next big altcoin in the crypto market. Priced at just $0.013405 per token, HYPER presale has already raised over $29.2 million.

The project stands out in the crowded presale market by addressing the $2 trillion utility gap on the Bitcoin blockchain.

While Solana and Ethereum flourish with innovative contract capabilities, Bitcoin has lagged due to its slow speed and high transaction costs. BTC’s $2 trillion market capitalization remains underutilized despite its 60% market dominance. Bitcoin Hyper is precisely addressing this.

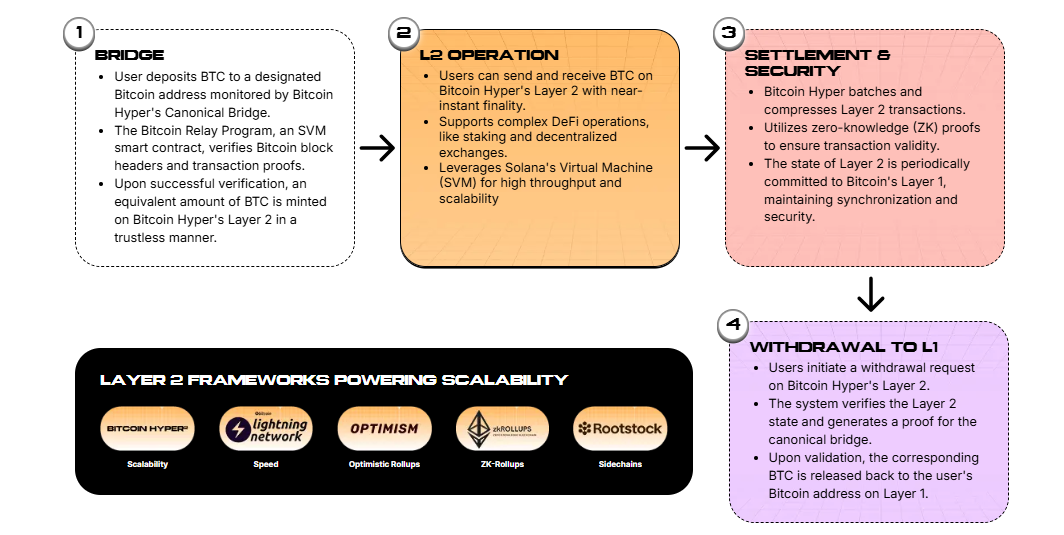

The new chain aims to deliver Solana-like speed with the Solana Virtual Machine while still relying on Bitcoin’s strong security. Many see it as a turning point for building scalable systems on top of Bitcoin. At the center of this setup is a bridge that moves BTC into the Layer-2 environment. Once the BTC is there, users can transact with it almost instantly. This process not only makes Bitcoin more usable but also opens the door for more advanced, high-speed apps to grow around it.

ChatGPT Predicts HYPER’s $2 Trillion TAM and Passive Income Model Could Drive Massive Demand

According to ChatGPT, the project’s biggest highlight is its $2 trillion total addressable market. This capital, if utilized in meme coin trading, tokenization, and NFT minting and other dApps, could create a massive market in itself.

Another standout point is its 40% annual staking rewards. Early adopters can stake their HYPER tokens and earn a 40% APY, one of the highest in the industry. This mix of growth potential and passive income makes it one of the most attractive cryptos to buy now.

The Bitcoin Hyper project has already been audited by Coinsult and Spywolf for high security and transparency. With security built on Bitcoin’s base layer and a growing user base, Bitcoin Hyper is proving it could stand alongside giants in the upcoming bull market.