A proposed exchange-traded fund is built to chase Bitcoin’s price action while the U.S. market is shut on Wall Street.

The product is named the Nicholas Bitcoin and Treasuries AfterDark ETF, according to a filing dated December 9 was sent to the Securities and Exchange Commission.

The fund opens Bitcoin-linked trades “after the U.S. financial markets close” and exits those positions “shortly after the next day’s open.”

Trading is locked into the overnight window, and of course the fund will not hold Bitcoin directly. At least 80% of assets would be used on Bitcoin futures, exchange-traded products, other Bitcoin ETFs, and options tied to those ETFs and ETPs. The rest can sit in Treasuries.

The filing said that the goal is to use price action that forms when the equity market is offline. Exposure stays inside listed products only. No spot tokens, no on-chain custody, and all positions reset each morning after the open.

After-hours trading drives ETF flows

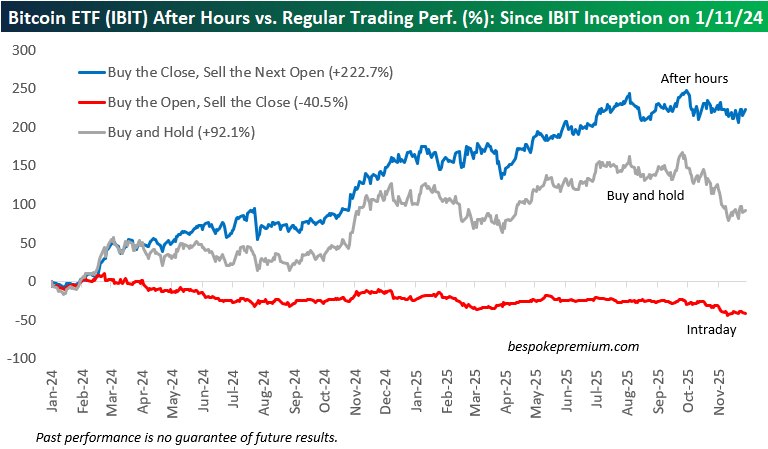

Bespoke Investment Group tracked a test using the iShares Bitcoin Trust ETF (IBIT), and reported that “buying at the U.S. market close and selling at the next open since January 2024 produced a 222% gain.”

The same test flipped to daytime only showed “a 40.5% loss from buying at the open and selling at the close.” That gap is the return spread the AfterDark ETF is built to target.

Bitcoin last traded at $92,320, down nearly 1% on the day, down about 12% over the past month, and little changed since the start of the year. ETF filings across crypto keep expanding. Products tied to Aptos, Sui, Bonk, and Dogecoin are now in the pipeline.

The pace picked up after President Donald Trump pushed for softer rules at the SEC and the Commodity Futures Trading Commission. After that push, Donald pressed both agencies on token issuers and digital asset exchanges.

Since approvals began in January 2024 under the prior administration, more than 30 Bitcoin ETFs have started trading in the U.S., based on figures from ETF.com. U.S. spot ETFs are now seeing fresh inflows as prices move in a choppy climb after weeks of pullbacks.

On Tuesday, SoSoValue reported that “spot Ethereum ETFs pulled in $177.64 million,” the highest level in six weeks. That beat the “$151.74 million” that went into spot Bitcoin ETFs on the same day.

Solana ETFs added $16.54 million. XRP ETFs took $8.73 million. Dogecoin and Chainlink funds recorded flat flows. Across all products so far, $21.40 billion in Ethereum has been absorbed by ETFs, equal to about 5% of its $400 billion market value.

If you're reading this, you’re already ahead. Stay there with our newsletter.