KEY TAKEAWAYS

Moonbeam’s GLMR sank to an all-time low of $0.07929 on March 11, 2025.

The token has been on a downturn since it emerged in early 2022.

Our Moonbeam price prediction says GLMR could drop to $0.0112 this year.

Interested in buying or selling MOONBEAM GLMR? Read our review of the best exchanges to buy and sell MOONBEAM GLMR.

The Moonbeam smart contract platform’s GLMR token has been falling since it was released in January 2022. On March 11, 2025, the crypto reached its nadir when it traded at an all-time low of $0.07929. It has made some of a recovery since then, and on March 18, 2025, Moonbeam was worth about $0.0877.

Let’s look at our Moonbeam price predictions, made on March 18, 2025. We will also examine the Moonbeam price history and talk a little about what Moonbeam is and what it does.

Moonbeam Price Prediction

Using the wave count method, let’s examine CCN’s GLMR price predictions for March 18, 2025. We will add and remove 20% from the final targets to create the minimum and maximum GLMR price predictions.

| Minimum GLMR price prediction | Average GLMR price prediction | Maximum GLMR price prediction | |

|---|---|---|---|

| 2025 | $0.0112 | $0.014 | $0.0168 |

| 2026 | $0.00846 | $0.0106 | $0.01269 |

| 2030 | $0.00006 | $0.00008 | $0.0001 |

The most likely wave count shows that GLMR completed a five-wave downward movement since launch. After bouncing in July 2023, GLMR started another five-wave downward movement.

If it has the same length and duration as the previous one, GLMR will bottom at $0.00511 in July 2026.

During this decline, the GLMR price is predicted to reach a low of $0.014 at the end of 2025.

Then, we will use the rate of decrease since launch to make a GLMR price prediction for the end of 2026 and 2030.

The GLMR price has fallen by 98% since launch, and projecting this rate of decrease forward leads to targets of $0.0106 and $0.00008 for the end of 2026 and 2030, respectively.

Moonbeam Price Prediction for 2025

The wave count method gives a GLMR price prediction range between $0.012 and $0.0168 for the end of 2025.

Moonbeam Price Prediction for 2026

The daily rate of decrease gives a GLMR price prediction range between $0.00846 and $0.01269 for the end of 2026.

Moonbeam Price Prediction for 2030

The daily rate of decrease gives a GLMR price prediction range between $0.00006 and $0.0001 for the end of 2030.

Moonbeam Price Analysis

The weekly time frame GLMR analysis shows that the price has fallen significantly since March 2024. GLMR created a lower high in December before resuming its downward movement.

At the start of 2025, GLMR broke down from the $0.16 horizontal support area, falling to a new all-time low of $0.078.

If the decrease continues, the next closest support will be $0.0053, created by the 1.27 external Fibonacci retracement of the previous increase.

The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) are both bearish, suggesting the decline will continue.

Short-Term GLMR Price Prediction

The GLMR price prediction for the next 24 hours is bearish. GLMR will likely continue falling to new lows until it reaches at least $0.0053.

Looking for a safe place to buy and sell MOONBEAM GLMR? See the leading platforms for buying and selling MOONBEAM GLMR

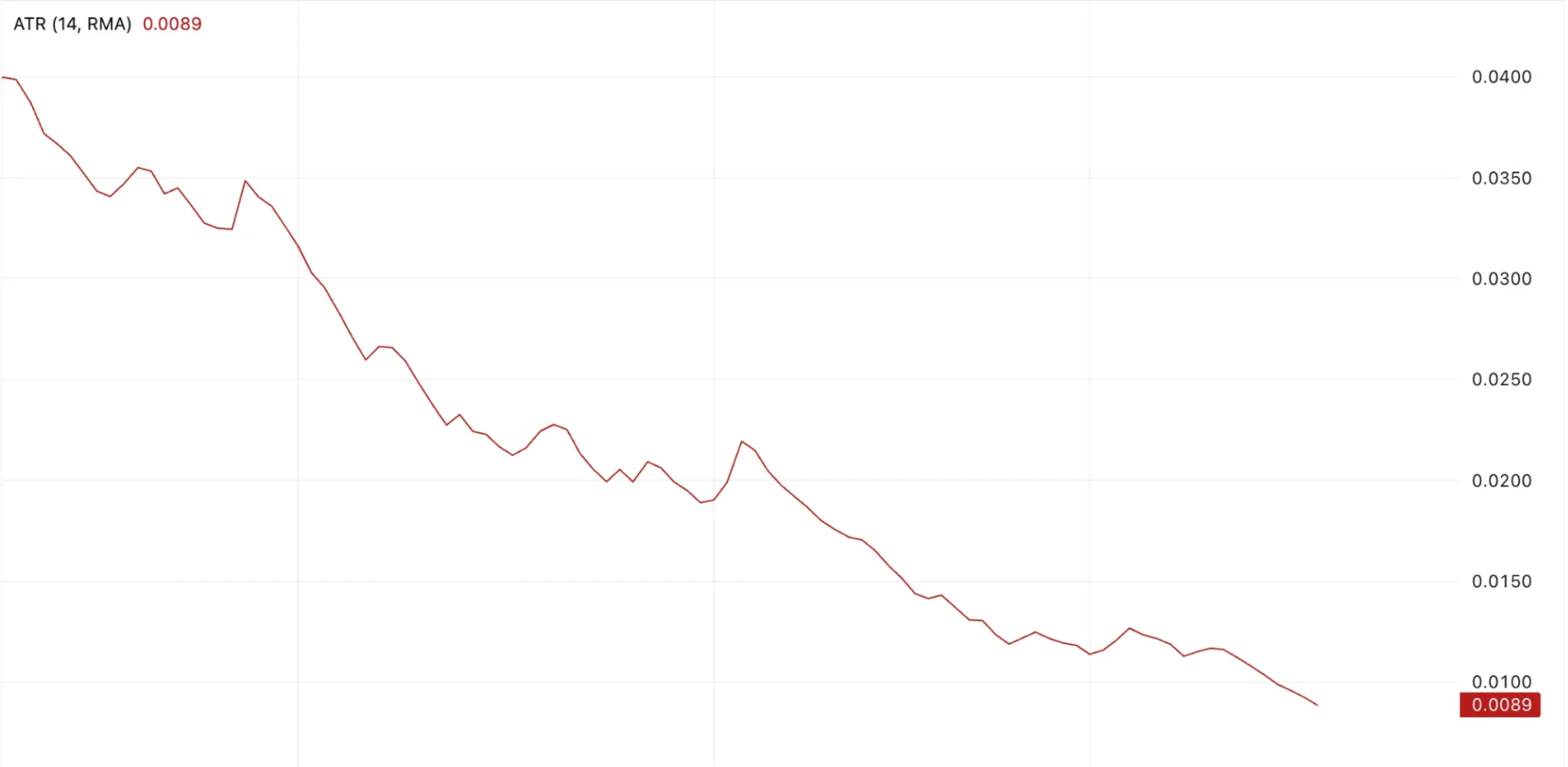

Moonbeam Average True Range (ATR): GLMR Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility. Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels.

On March 18, 2025, Moonbeam’s ATR was 0.0089, suggesting relatively high volatility.

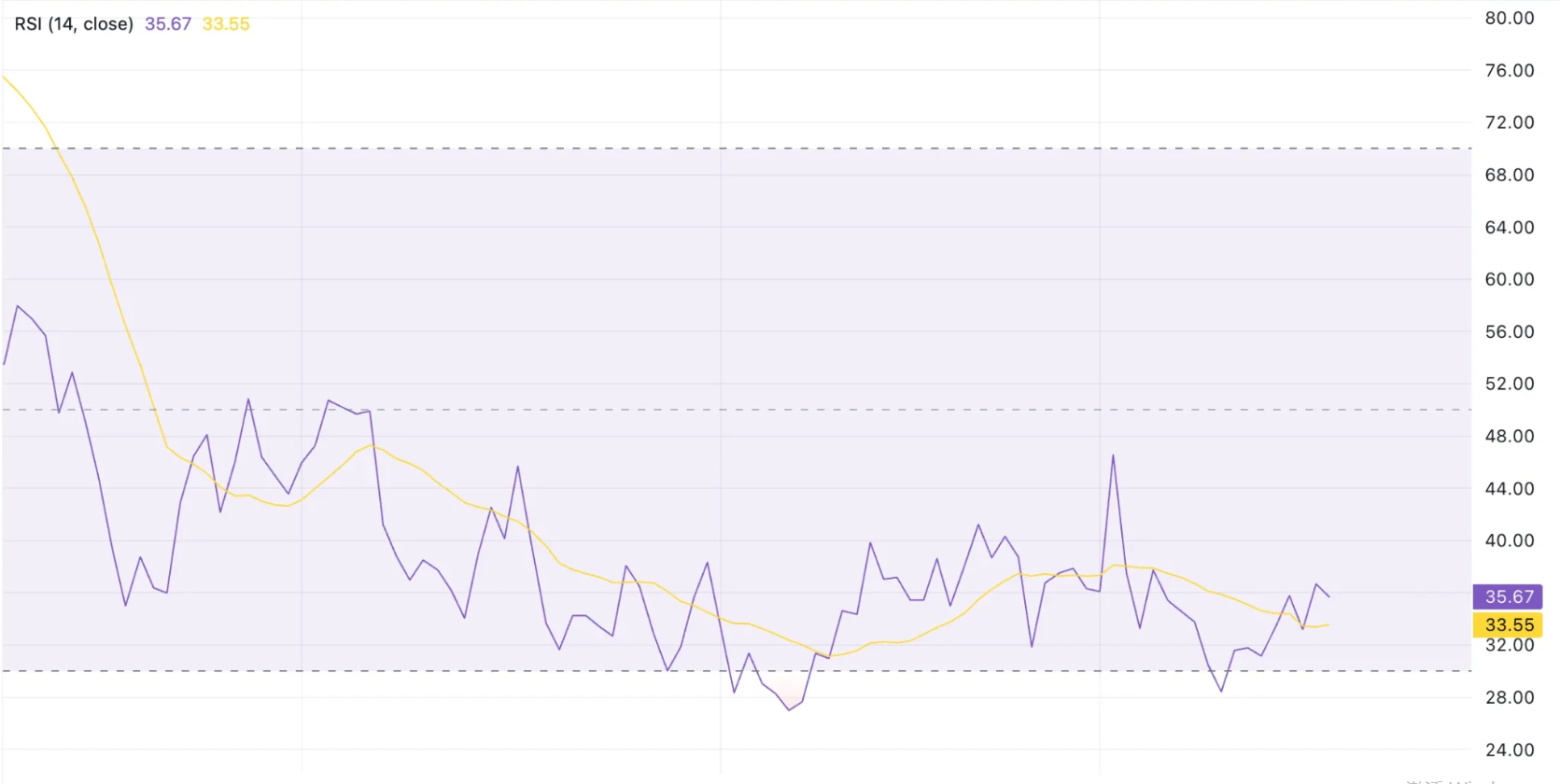

Moonbeam Relative Strength Index (RSI): Is GLMR Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold. Movements above 70 and below 30 show over and undervaluation, respectively.

Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On March 18, 2025, the Moonbeam RSI was 35, indicating bearish conditions.

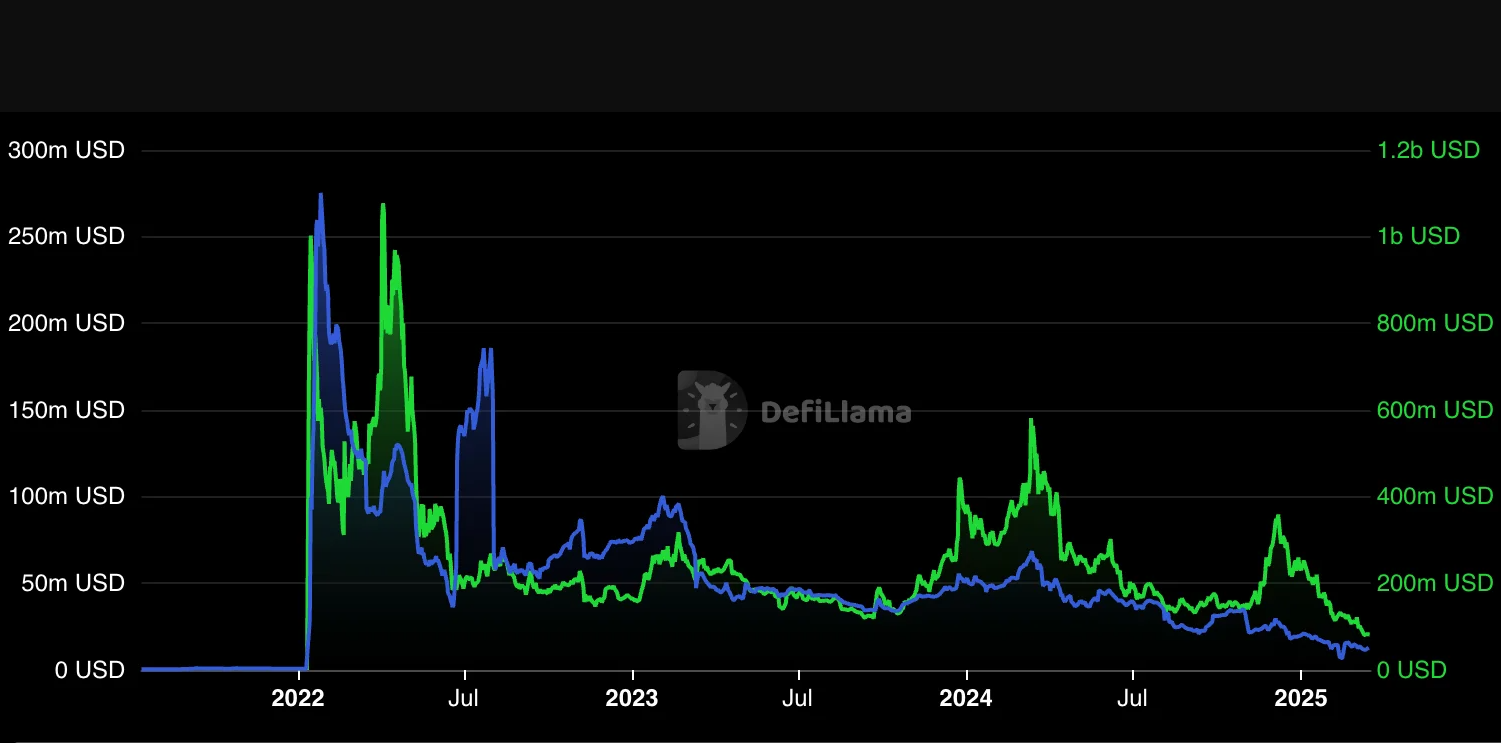

Moonbeam Market Cap to TVL Ratio

The Total Value Locked (TVL) to market cap ratio (TVL ratio) measures the valuation of a decentralized finance (DeFi) project by comparing its market capitalization to the total value of assets locked in its smart contracts.

This ratio shows the project’s utilization and links the platform’s health to locked asset value.

A ratio above 1.0 indicates overvaluation because the market cap exceeds the value of assets used in the platform. A ratio below 1.0 indicates undervaluation because the market cap is lower than the value of locked assets.

On March 18, 2025, the Moonbeam TVL ratio was 6.57, suggesting overvaluation.

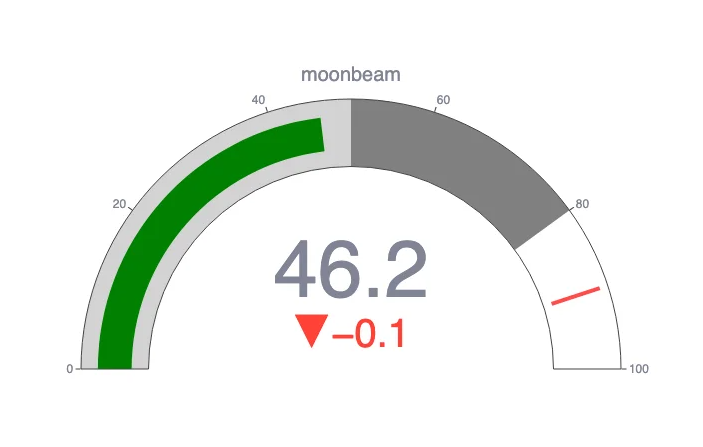

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes. The same principle applies to rapid declines: a sudden drop will spike the score downward, but as volatility decreases, the score will slowly adjust back up.

On March 18, 2025, Moonbeam scored 46.2 on the CCN Index, suggesting moderate momentum.

Moonbeam Price Performance Comparisons

Moonbeam is essentially a smart contract platform, so let’s compare how GLMR has performed over the last year with other cryptos in the same category with similar market caps.

| Current price | One year ago | Price change | |

|---|---|---|---|

| GLMR | $0.0877 | $0.6051 | -85.5% |

| WAXP | $0.02425 | $0.08473 | -71.3% |

| XVG | $0.00493 | $0.006176 | -20% |

| DYM | $0.3285 | $6.17 | -94.6% |

Best Days and Months to Buy Moonbeam

We looked at the Moonbeam price history and found the best times to buy GLMR.

| Day of the Week | Saturday |

| Week | 52 |

| Month | November |

| Quarter | Fourth |

GLMR Price History

Now, let’s examine some key dates in the Moonbeam price history. While we should never take past performance as an indicator of future results, knowing what the token has achieved can provide us with some very useful context if we want to make or interpret a Moonbeam price prediction.

| Time period | GLMR price |

|---|---|

| Last week (March 11, 2025) | $0.07929 |

| Last month (Feb. 18, 2025) | $0.1356 |

| Three months ago (Dec. 18, 2024) | $0.2849 |

| One year ago (March 18, 2024) | $0.6051 |

| Launch price (Jan. 11, 2022) | $29.84 |

| All-time high (Jan. 11, 2022) | $29.84 |

| All-time low (March 11, 2025) | $0.07929 |

Moonbeam Market Cap

The market capitalization, or market cap, is the sum of the total number of GLMR in circulation multiplied by its price.

On March 18, 2025, Moonbeam’s market cap was $83.82 million, making it the 369th-largest crypto by that metric.

Moonbeam Supply and Distribution

| Supply and Distribution | Figures |

|---|---|

| Total supply | 1,164,259,355 |

| Circulating supply (as of March 18, 2025) | 956,016,788 (82.11% of total supply) |

From the Moonbeam Whitepaper

In its technical documentation, or whitepaper, Moonbeam says it combines the best of both worlds: Ethereum’s familiar and easy-to-use tooling and Polkadot’s scalable, interoperable architecture.

Moonbeam (GLMR) Explained

Moonbeam is a platform dedicated to bringing the tools that help people develop decentralized applications (DApps) on the Ethereum (ETH) blockchain onto the Polkadot (DOT) blockchain.

Derek Yoo, a crypto entrepreneur and founder of the PureStake blockchain infrastructure platform, set up Moonbeam in 2021.

The GLMR token supports the Moonbeam network.

How Moonbeam Works

Moonbeam helps developers create and build programs compatible with Ethereum. This means they can use features like the Ethereum Virtual Machine—a program that acts like a massive decentralized computer and helps run the blockchain—and smart contracts. These computer programs automatically execute once certain conditions are met.

The Moonbeam token supports the system. It helps to power smart contracts, helps decentralized apps (DApps) perform, and keeps the system secure. It pays for transaction fees on the network and pays people who run the system’s computers or nodes. Holders can on proposals relating to the governance of the network. People can also buy, sell, and trade it on exchanges.

Is Moonbeam a Good Investment?

It is hard to say right now. The token is not too far from an all-time low, and while it is up over the last week, it is still a long way from where it was when it first came out. Although there is a belief that one should buy during the dip, we don’t know for sure whether Moonbeam’s dip has bottomed out, where it could recover to, or how long that recovery could take.

As ever with crypto, you will need to make sure you do your own research before deciding whether or not to invest in GLMR.

Will Moonbeam go up or down?

No one can really tell right now. While the Moonbeam crypto price predictions are largely pessimistic, price predictions have a well-earned reputation for being wrong. Keep in mind that prices can and do go down and up.

Should I invest in Moonbeam?

Before you decide whether or not to invest in Moonbeam, you will have to do your own research on GLMR and other coins and tokens such as Chainlink (LINK). Either way, you must also ensure you never invest more money than you can afford to lose.