Pi Coin price had a steady run in November when most large tokens struggled. But the tone changed this week. The token is down almost 10% over the past seven days and more than 4% in the last 24 hours. The move under a key level confirmed a clear pattern break on the daily chart, which many traders might link with “doomsday” risk because it can push the price toward a new all-time low if selling continues.

The main question now is whether the chart can recover this time.

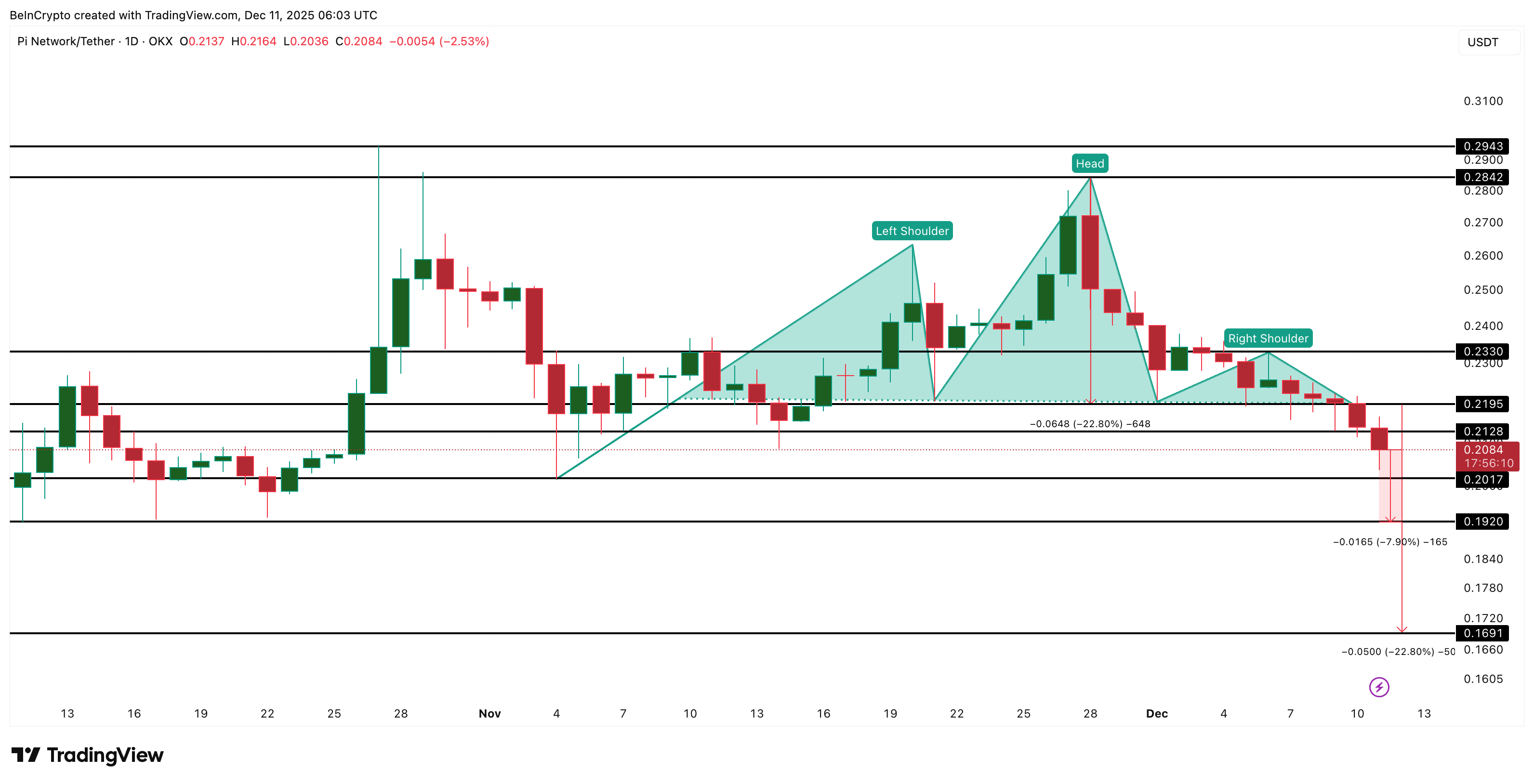

Pattern Breakdown Opens the Path to a New Low

Pi Coin dropped below the neckline near $0.219, completing a standard head and shoulders pattern, signifying a possible bearish reversal.

The usual downside projection comes from the gap between the neckline and the head. That projection suggests a possible fall of about 22.8%, placing Pi Coin near $0.169.

PI Price Risk: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This matters because Pi Coin’s current all-time low is near $0.172 per CoinGecko, so a move toward $0.169 would create a new low. But two metrics can still help PI avert the risk.

Sellers Are Strong, but Buyers Still Show Signs of Life

There are still hints of support from larger buyers. One sign comes from the money flow. The Chaikin Money Flow (CMF), which tracks how much big money is entering or leaving, shows a small divergence. Between December 9 and December 11, the price made a lower low, but the CMF trended higher. This usually signals that some buyers are absorbing the dips.

CMF has also broken above its short-term downtrend, but it has not yet moved over the zero line. The zero line is where money flow shifts from net selling to net buying. Pi Coin needs that shift to confirm strength.

Money Flow Might Be Returning: TradingView

Momentum shows a similar picture. The Relative Strength Index (RSI), which measures buying pressure and selling pressure, formed a divergence of its own. Between November 4 and December 10, the PI price made a higher low, but the RSI made a lower low — hidden bullish divergence. This can mean that the selling pressure is starting to weaken.

Hidden Bullishness Surfaces: TradingView

These early signals do not reverse the breakdown, but they show that sellers do not have full control.

Key Pi Coin Price Levels Decide The Fate

The Pi Coin price trades near $0.208 at press time. The most important line is $0.192. A break below it would open the path toward $0.169—the pattern target — and lock in a fresh low for the chart.

For a recovery, Pi Coin must first reclaim $0.233. This level sits above the right shoulder and would show early improvement. A full trend reversal only happens if the price moves above $0.284, which is the zone above the head of the pattern.

Pi Coin Price Analysis: TradingView

Right now, Pi Coin sits between pressure and early support signs. The breakdown points to a new low, but the divergences show that buyers are still active. The next move depends on whether the price holds the $0.192 support or gives in to the downtrend.