What is ChainOpera AI (COAI)? How it Works and its Price

ChainOpera AI (COAI) is a decentralized full-stack AI platform that integrates user applications, developer platforms, and GPU/model infrastructure into a single blockchain protocol.

The main goal of ChainOpera is to build "crypto AGI", a collective artificial intelligence that evolves as more agents, data, and computation are added to the network. In the ever-growing crypto world, ChainOpera brings innovation that can change the way we interact with decentralized AI technology.

With various beneficial features, many people are interested in purchasing and investing in COAI. So, what makes COAI interesting? Let's discuss it further.

Also Read: 7 Proven Crypto Trading Tips for Beginners, Complete with Tips and Tricks

ChainOpera AI (COAI) Ecosystem Components

AI Super App Terminal

This is a gateway for over 2 million users to interact with both AI agents and humans in a decentralized platform.

Developer Agent Platform

This platform is used by over 100,000 developers to design, launch, and monetize their AI agents.

Model & GPU Marketplace

This decentralized marketplace is used for routing AI training and inference tasks.

AI-Native Blockchain Protocol

This protocol uses a Proof of Intelligence mechanism to validate contributions from models, data, and resources on the network.

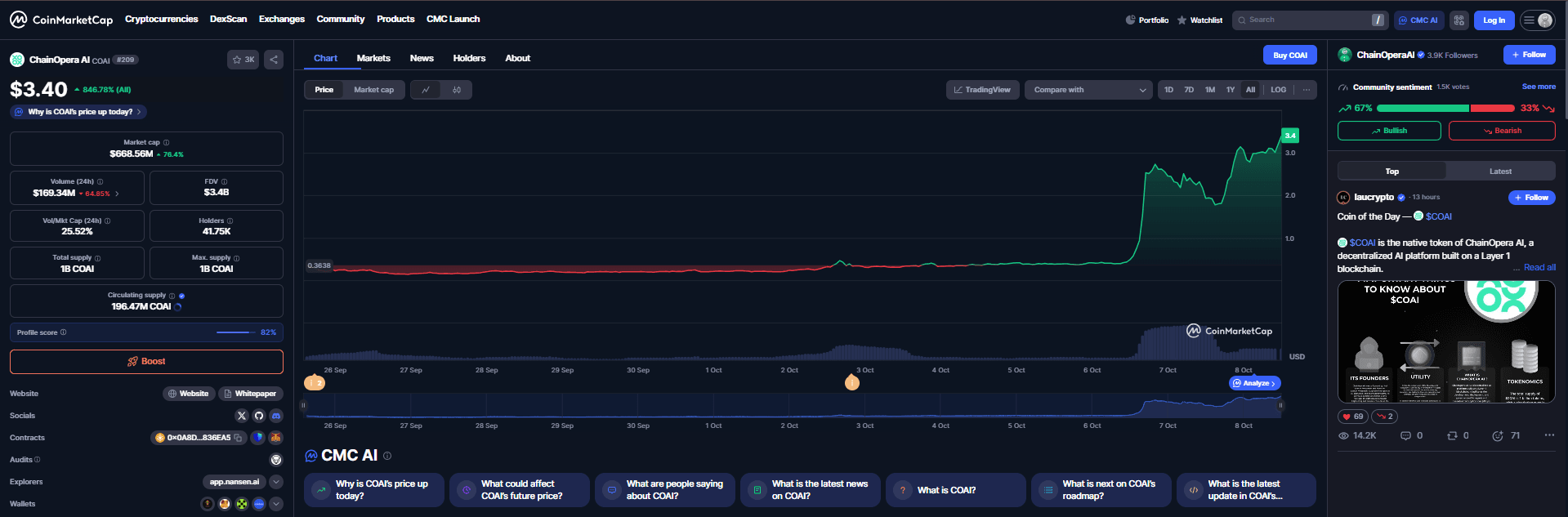

COAI Price and Key Statistics

To help you understand the market position of COAI, here are some key statistics:

Current COAI Price: $3.40

Market Capitalization: $662.55 million

24-Hour Volume: $169.33 million

Fully Diluted Valuation: $3.37 billion

Total Supply: 1 billion COAI

Circulating Supply: 196.47 million COAI

Number of Holders: 41,750 addresses

How to Buy COAI

Through Centralized Exchanges (CEX)

Register and Complete KYC: Create an account on an exchange like Bittime and complete the identity verification process.

Deposit Stablecoin: Transfer stablecoins like USDT or USDC to your account.

Spot Trading: Find the COAI/USDT or COAI/BUSD pair and perform a market or limit order.

Through Decentralized Exchanges (DEX)

Prepare Web3 Wallet: Use MetaMask or Trust Wallet, then load it with ETH or BNB.

Connect to DEX: Access PancakeSwap (BSC) or Uniswap (Ethereum).

Import COAI Contract: Use the official contract address 0x0A8D...836EA5 to ensure token authenticity.

Swap and Confirm: Select COAI, set the amount, and confirm the transaction.

Through P2P Platform

Buy COAI directly from other users on a P2P platform like Bittime with local methods such as bank transfers or e-wallets.

Also Read: Latest 2024 Crypto Playing Guide for Beginners, General Hora

COAI Storage and Security

Exchange Wallet

Exchanges like Bittime automatically protect your account with 2FA and cold storage.

Personal Wallets

Hot Wallet: Withdraw COAI to MetaMask or TrustWallet for daily access.

Cold Wallet: For long-term storage, use wallets like Ledger or Trezor.

Tips and Strategies for Buying COAI

Dollar-Cost Averaging (DCA): Make periodic investments to smooth out COAI price volatility.

Entry Based on Trend: Buy COAI when the price breaks through key resistance with strong momentum.

Laddering Purchases: Place orders at different price levels to diversify risk.

Conclusion

ChainOpera AI (COAI) is an interesting crypto project with a lot of potential, especially for those looking to invest in decentralized AI and blockchain. With various ways to buy COAI and innovative features within it, COAI provides opportunities for investors to profit.

Start trading COAI on the platforms mentioned above and keep your COAI safe. To begin trading, visit Bittime Exchange or read the latest crypto news on Bittime Blog.