KEY TAKEAWAYS

COAI’s price surged 54.5% in 24 hours, lifting its 30-day gain to over 2,200.

The altcoin broke above a descending channel, with strong CMF and MACD.

Sustained volume could drive COAI toward $18.84 if bulls hold the structure.

While most cryptos in the market were asleep, ChainOpera AI (COAI) remained wide awake.

Over the last 24 hours, COAI, native to the decentralized AI platform, has increased by 54.50%. This comes after the COAI price dropped by 44% earlier.

Following the recent rebound, he token’s 30-day performance now stands at an impressive 2,220% gain.

The big question now is: what’s next for COAI? Let’s take a closer look at the charts and reveal what could be next.

ChatGPT Boosts ChainOpera AI Momentum

According to CCN’s findings, COAI’s recent outperformance can be largely attributed to OpenAI’s release of a ChatGPT browser.

This development strengthened market attention toward projects positioned at the intersection of artificial intelligence and blockchain, with ChainOpera AI emerging as a standout beneficiary.

As founder Salman Avestimehr previously noted, the project’s model emphasizes collaborative development and economic scalability, aligning with the broader narrative of a “ChatGPT for crypto needs.”

At press time, COAI’s price wobbles around $9.50. While this is a massive increase from its value some days ago, it is still down 78.50% from its all-time high.

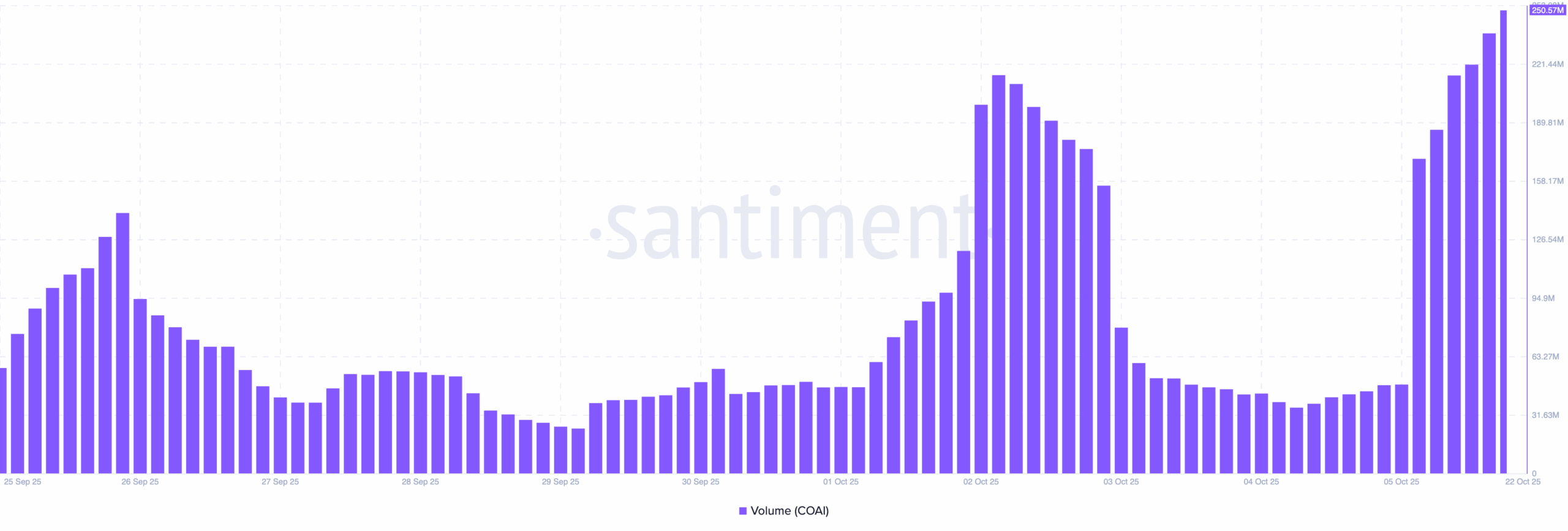

Beyond the catalyst of ChatGPT, a rise in trading volume also fueled COAI’s latest surge.

On October 5, the daily volume had dropped to around $50 million, reflecting reduced market participation.

However, as of today, volume has soared fivefold to nearly $250 million, signaling a strong return of trader interest.

This spike in activity suggests that COAI’s rally is backed by solid market engagement. Sustained volume at these levels could support further upside, with a high chance that COAI’s price will trade higher.

COAI Price Prediction: Higher

From a technical perspective, the 4-hour chart shows that COAI’s price has broken above the upper trendline of its descending channel.

This signals a potential shift from correction to recovery.

Supporting this breakout, the Chaikin Money Flow (CMF) has risen above the zero line, indicating growing buying pressure and capital inflows.

Additionally, the Moving Average Convergence Divergence (MACD) has formed a bullish crossover, with the histogram now posting positive readings — a sign of strengthening momentum.

If this structure holds, COAI could challenge resistance at $11.70 in the short term. A confirmed breakout above this level might open the door for a rally toward $18.84.

Under highly bullish conditions, the cryptocurrency could extend its advance toward $30, continuing its impressive uptrend.

Conversely, if selling pressure resurfaces, momentum could fade. In that scenario, COAI’s price may retrace toward $5.60, invalidating the current bullish setup and signaling a potential consolidation phase.