The Ethereum price prediction has faced a firm rejection at the $4,400 level after the market weakened following the Fed rate cut announcement. Analysts believe the market had already priced in the rate cut, and the Fed’s cautious statement triggered the sell-off.

The second-largest crypto, Ethereum, has dropped 3.54% in the past 24 hours, while Bitcoin tumbled to $90,000 support after the Fed meeting. However, ETH is still holding the crucial $3,100 support, which could act as a retest level for the altcoin.

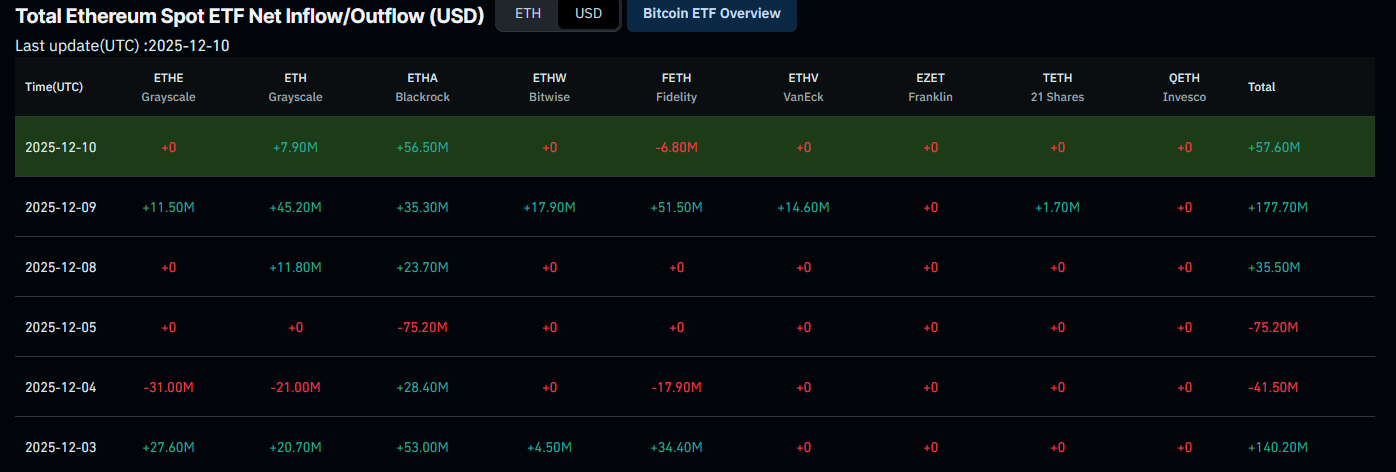

While price makes bearish moves, ETH ETF products are back on track with a streak of inflows over the last three days. In the past three sessions, spot Ethereum ETFs have attracted over $270 million, pulling the month back into the green.

At the same time, one emerging project, Bitcoin Hyper (HYPER), has been attracting attention for its presale performance and revolutionary L-2 technology. Many experts believe this could be the next big winner, with its price moving from around $0.013405 to $1 in exchange for a launch.

As Ethereum price prediction improves, Bitcoin Hyper’s concept and early progress have placed it on the priority watchlist of savvy investors.

Ethereum ETFs Inflows Surge to Highest In Six Weeks

Ethereum ETFs saw a sharp pickup in interest this week. Investors poured $177.6 million into spot ETH ETFs on Tuesday, the strongest single-day inflow in six weeks, and added another $57.6 million on Wednesday. The bounce is encouraging, but sentiment still feels cautious after the mixed outflows seen just a week earlier.

Rachel Lin. CEO and Co-Founder at SynFutures, said, “ETF flows are telling a clear story,” suggesting that investors are “becoming more selective inside crypto.” She further added, “The divergence we’re seeing—with Ethereum pulling meaningful inflows even when Bitcoin slows — suggests a structural rotation rather than a short-term trade. Institutions that entered through Bitcoin are now broadening their exposure.”

At the same time, Ethereum’s exchange supply has dropped to its lowest level ever. More holders are moving their ETH into personal wallets, a move that usually signals long-term conviction rather than plans to sell. With fewer tokens sitting on exchanges, the market faces less immediate selling pressure.

The accumulation strengthens the demand backdrop and adds another layer of support for Ethereum’s outlook.

Ethereum Price Prediction Shows Mixed Signals

Ethereum has experienced a sharp drop in the past 24 hours, with its market cap dropping by $42 billion. In the recent move, altcoin attempted a breakout above the $3,400 resistance; however, the broader market sell-off pulled the price to the support level. The move comes after seeing a rejection near the 50-day EMA on Tuesday.

Technical analysis shows that Ethereum has formed a cup and handle bullish pattern on the daily timeframe. This bullish formation includes a breakout resistance at $3,200, which is now acting as a retest level.

The pattern’s next breakout pivot now sits at $3,450. A breakout to this level could push the price higher towards $3,700 and $4,000. However, analysts note that weekly chart patterns still show signs of bearish dominance. If ETH fails its current support level, it could dip below the $3,000 psychological mark.

Bitcoin Hyper: The Layer-2 Challenger in Presale

While Ethereum maintains its position as a leading large-cap crypto, Bitcoin Hyper is gaining traction as a low-cap, high-potential layer-2 project. The Bitcoin-backed platform reports having raised over $29.3 million in its ongoing presale, with investors accumulating over 638 million tokens.

Bitcoin Hyper reimagines how Bitcoin can scale by splitting responsibilities across two layers. The Bitcoin base layer focuses on settlement, while a new Layer 2, powered by the Solana Virtual Machine (SVM), handles all execution. This setup lets transactions confirm in under a second and supports fast, low-latency smart contracts, all while anchoring everything back to Bitcoin’s security.

By shifting the heavy work to its SVM Layer 2, HYPER clears the hurdles that have held Bitcoin back for years. Slow block times, low transaction capacity, and a limited script system no longer restrict what developers can build. The goal is to preserve Bitcoin’s trust and brand strength while unlocking the performance users expect from modern chains like Solana.

Some of the factors supporting Bitcoin Hyper’s growth:

The Bitcoin market capitalization of $2 trillion provides utility potential

40% APY staking rewards with an explosive price growth opportunity

Audited by Coinsult and Spywolf for security and transparency

Strong investor interest with $29.2 million raised

Undervalued token price of $0.013405

Beyond these milestones, Bitcoin Hyper’s unique infrastructure, which delivers Solana-like speed and scalability to the Bitcoin network, is the biggest highlight. With low gas fees, real-world use cases, and high growth potential, Bitcoin Hyper is closely monitored as one of the best crypto to buy this season.