Crypto markets faced a fresh wave of anxiety on Thursday as Bitcoin slipped back below $90,000. The broader risk sentiment deteriorated, hitting meme coins and other categories especially hard. The cumulative crypto market cap dipped by almost 3% over the last 24 hours to stand at $3.07 trillion. The Fear and Greed index is flashing “Fear” among the investors with no plans of getting better anytime soon.

The meme coin mania that defined much of 2025 is finally showing signs of exhaustion. Pump.fun turned out to be the launchpad responsible for flooding the market with tens of millions of joke tokens.

As of now, the activity on the platform has dropped back to levels seen shortly after its debut. On the other side, OFFICIAL TRUMP, which rode headlines into an $8.8 billion valuation, is down by 92% from its all-time high.

Meme coin frenzy fades as volume drops 27%

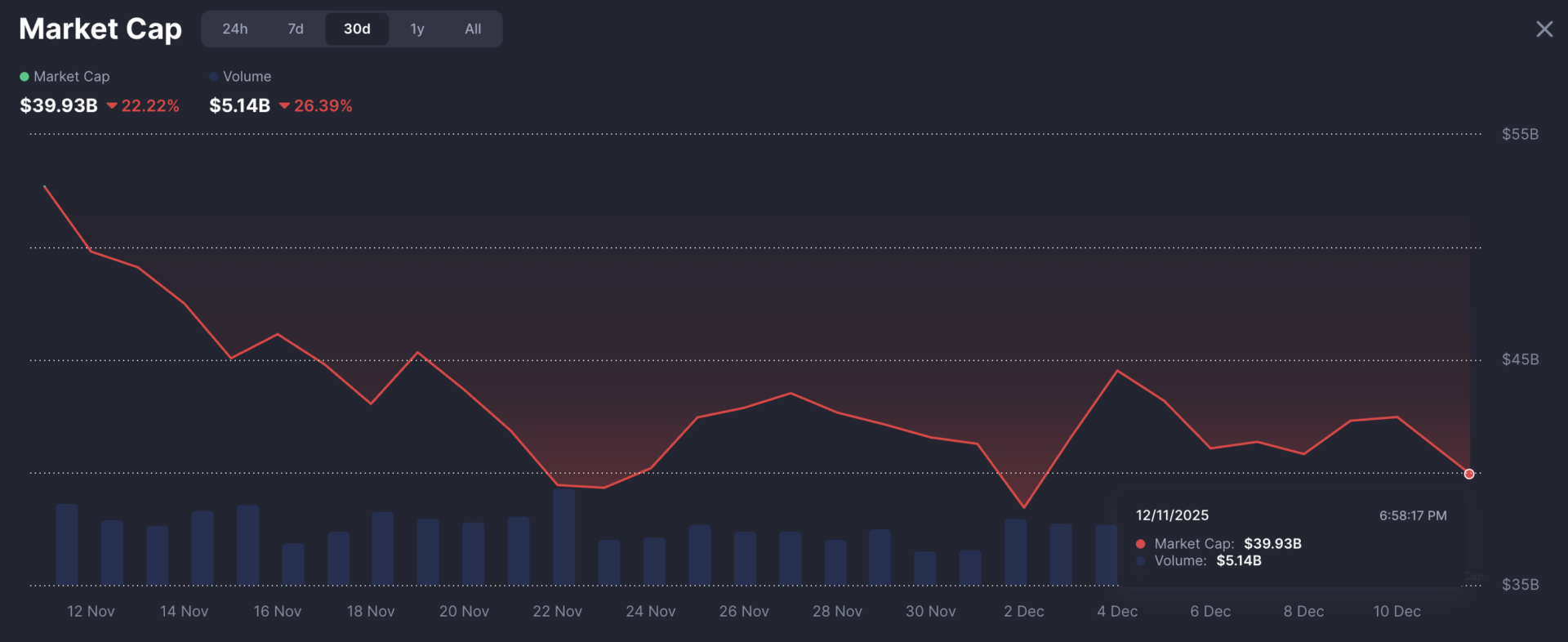

The cumulative meme crypto market cap took a massive hit amid the heavy sell-offs. It slumped by a huge 22% over the last 30 days to hover around $40 billion. Its trading volume is down by 27% to hit $5.15 billion in the same period.

In the political-meme niche, promoters are scrambling to keep tokens alive. The OFFICIAL TRUMP coin is being repurposed into a “Billionaires Club” mobile game. Its market cap has shrunk below $1.2 billion. TRUMP is trading at an average price of $5.64 at the press time.

Even Dogecoin marked its 12th anniversary with subdued price action. Analysts continue to debate whether its long consolidation phase is nearing a breakout or will it collapse heading into year 13.

The grandfather of the entire meme economy is down by 57% on a year-to-date (YTD) basis. DOGE is trading at an average price of $0.138 at press time. Once much hyped meme coin, Shiba Inu, is also running down by 61% on YTD. SHIB is trading 90% below its ATH.

It looks clear that the memecoin wildfire that raged across 2025 has finally run out of fuel. The crowd seems to be moving on.

Has meme coin mania finally burned out?

Experts have highlighted that the world simply doesn’t have the attention span for 25 million memecoins. Maybe a dozen can hold the spotlight for a weekend, and maybe a handful might survive for a year. But for everyone else, the trade works until it doesn’t, and ultimately, even most of the “winners” leave their holders underwater.

There was never a real investment case behind these tokens, and people didn’t buy them because of fundamentals, says Mikko Ohtamaa. He suggests that people bought them because they thought someone else, somewhere, would buy higher.

Calling it “investing” always stretched the definition beyond recognition. He added that no one bought LIBRA (Milei) or TRUMP tokens because of policy analysis.

Eventually, the market players have figured it out. Traders lost money, came back for another swing, and lost again. One year was all it took for the cycle to burn out. These episodes don’t die because of regulators’ crackdown down; they die because the supply of new hopefuls dries up.

However, this doesn’t mean the end of internet culture, as there will still be memes worth celebrating.

According to a16z crypto’s 2025 State of Crypto report, more than 13 million memecoins have been issued this year. The firm argues that it is a symptom of the US’s lack of formal digital-asset market rules. The report positions the Digital Asset Market Clarity Act as essential for restoring order. This will protect consumers and give legitimate projects a regulatory runway.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.