Bitcoin is struggling to mount a sustained recovery as two critical sources of market liquidity, stablecoin inflows to exchanges and corporate treasury buying, show signs of exhaustion.

The digital asset fell to the $88,000 range again earlier today after failing to sustain above the modest levels it managed to regain at $90,000. Before then, it had reached an all-time high of over $126,000 in October.

Why is Bitcoin struggling?

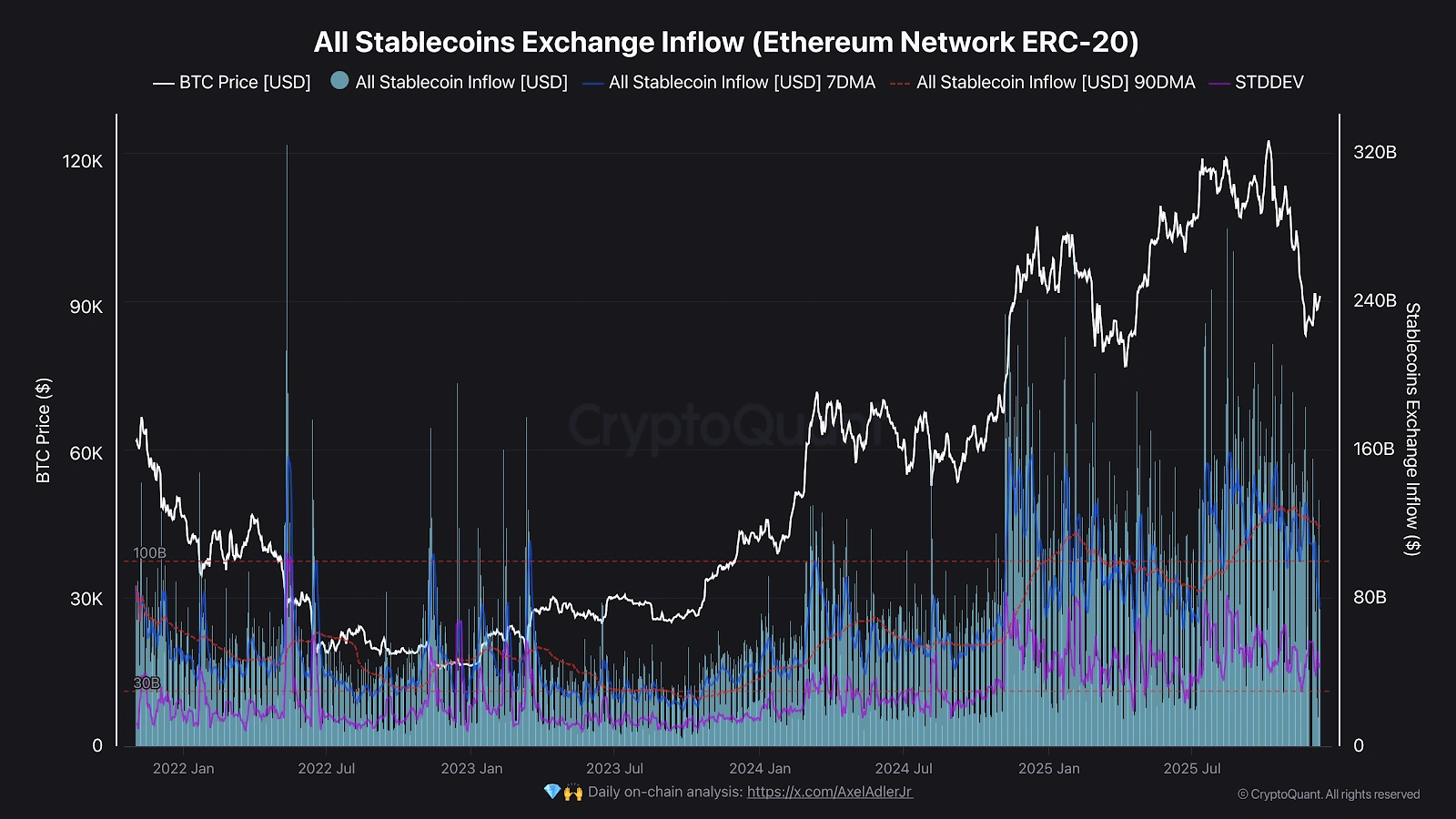

Data from CryptoQuant reveals that inflows of ERC-20 stablecoins into exchanges have dropped from $158 billion in August to around $76 billion currently.

The 90-day average has also declined from $130 billion to $118 billion, showing that fresh capital is not entering the market as it used to a few months earlier.

CryptoQuant analyst, Darkfrost stated, “the trend remains downward, and the slight rebounds we are seeing mainly result from reduced selling pressure rather than renewed buying interest.”

Stablecoins, which serve as the primary on-ramp for institutional and retail liquidity in crypto markets, are widely viewed as a bellwether for buying interest.

Corporate money slows for Bitcoin

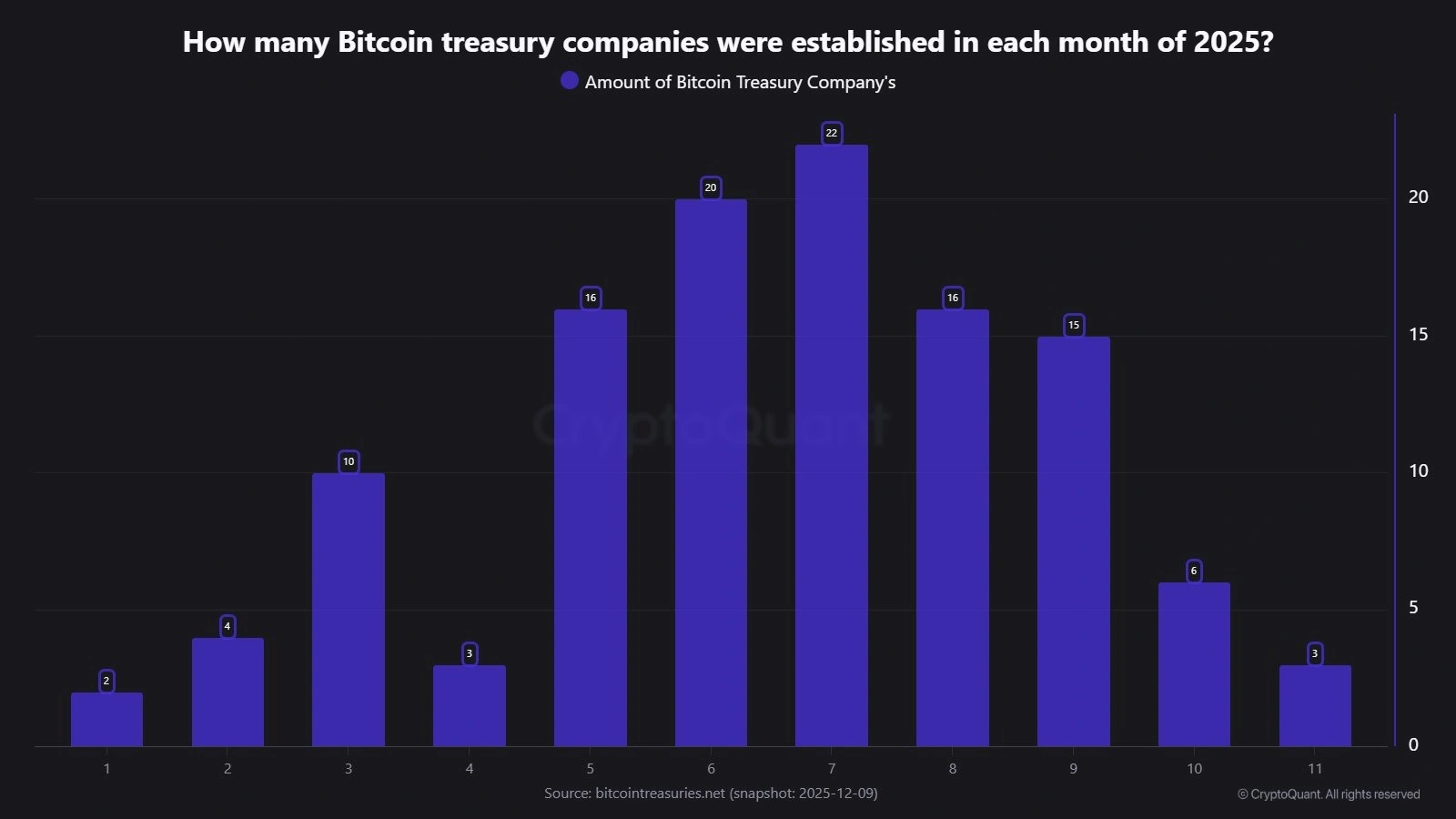

The corporate treasury accumulation trend that defined much of 2025 has slowed down drastically.

While 117 new companies added Bitcoin to their balance sheets this year, only nine firms joined the ranks in the fourth quarter to date, down from 53 in the third quarter and 39 in the second.

The majority of these treasury holders maintain relatively modest positions, with 147 companies holding fewer than 500 Bitcoins.

Strategy continues to dominate the space, having acquired more BTC recently. Saylor made a splash buy of 10,624 Bitcoins for $962.7 million between December 1 and 7, bringing its total holdings to 660,624 Bitcoins.

The treasury company has added $21.48 billion worth of BTC this year and is just $500 million short of matching its $21.97 billion total throughout all of 2024.

However, recent market weakness prompted Strategy to establish a $1.44 billion cash reserve to cover dividend obligations, a defensive move that highlights growing caution in the sector.

Bitmine comes second among the treasury companies that have been acquiring BTC, although its numbers are dwarfed by Strategy’s recent buys.

In November, it acquired $892 million worth of BTC, and so far this month, it has spent $296 million on BTC according to CryptoQuant.

Other major corporate holders have notably pulled back. Japan’s Metaplanet, which held 30,823 Bitcoins as of September, has not added to its position in over two months.

Evernorth has fallen off the map in the last six weeks after splurging $950 million on BTC this year.

Market structure under pressure

Adding to the uncertainty, Strategy faces a potential challenge from MSCI’s proposal to exclude digital asset treasury companies from its indexes, a move that could force institutional investors to unwind positions and reduce the stock’s appeal as a Bitcoin proxy.

Despite the near-term headwinds, some analysts remain constructive on Bitcoin’s prospects. CryptoQuant posted that “BTC could climb toward $99K, the lower band of the Trader Realized Price, a key resistance. Above that, the next hurdles sit at $102K and $112K.”

According to Darkfrost and other market observers, more liquidity must return to the market for Bitcoin to restart another bullish trend.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.