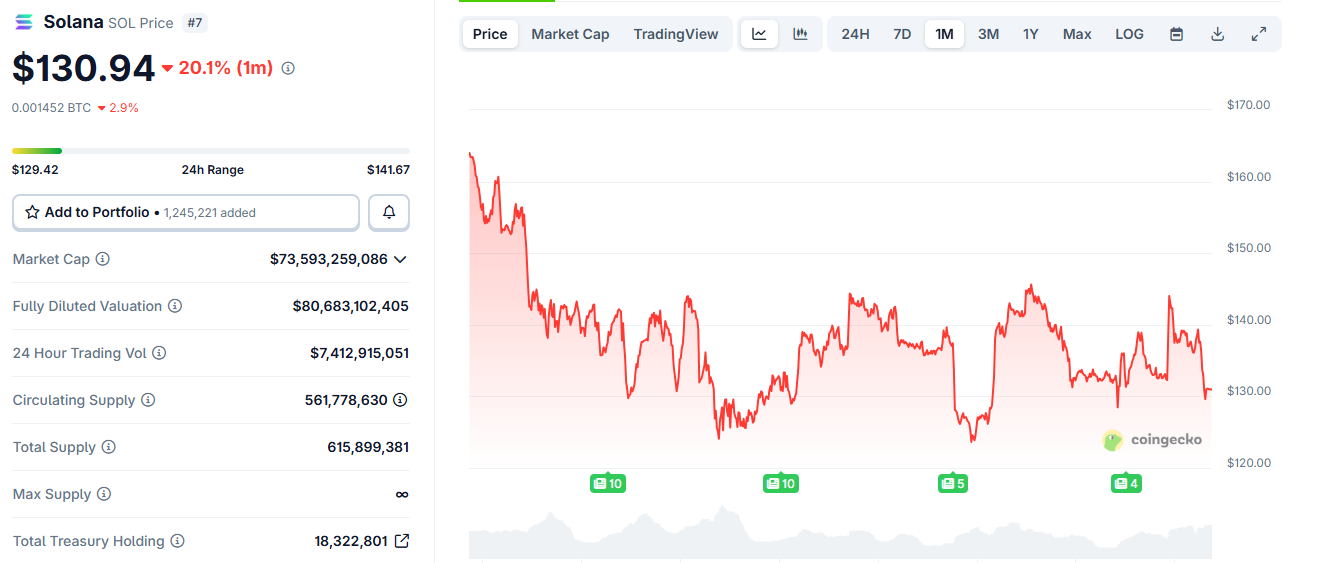

Solana price prediction has become a hot topic once again as SOL trades at $131.02, caught in a tight range between $124 and $145. Despite daily volume climbing over $6.6 billion and DEX usage reaching new highs, the token is struggling to break through key resistance.

Traders are watching for signs of a breakout, but with volatility muted and a broader descending trendline still in play, confidence remains split.

While Solana works through this range-bound phase, many short-term traders are shifting their attention to Bitcoin Hyper, a new presale coin that has already raised over $29.3 million and is just hours away from a price increase.

SOL Holds Between $124 and $145 – But For How Long?

The current Solana range remains well-defined. Analysts point to repeated tests of the $145 resistance, which have all failed, and a growing weakness near $124, where buyer support looks softer than in previous weeks.

Right now, SOL sits right around $131, the midpoint of this range. Traders often avoid new entries in this zone because it offers poor risk-to-reward setups. The chart structure reveals that neither bulls nor bears have seized control.

Until that changes, the most likely outcome is continued range-bound movement – but a breakout on either side could lead to a much stronger trend.

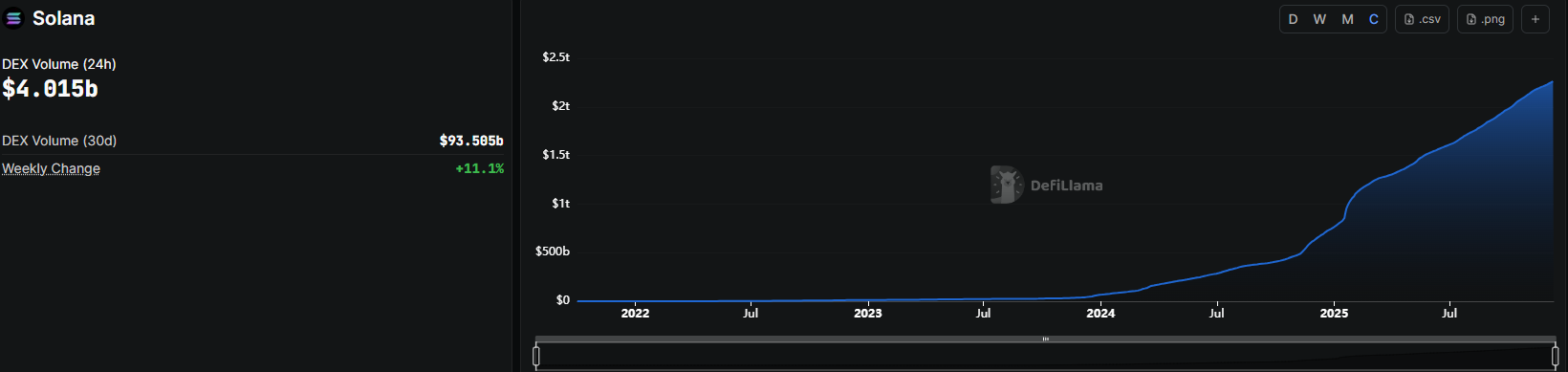

DEX Volume Surges While SOL Price Stalls

Even with price stalling, Solana’s network activity is telling a different story. New data from DeFiLlama shows DEX trading volume on Solana jumped 27% last week, pushing the total to over $24.2 billion, its highest point in a month.

That makes 16 straight weeks where Solana led all chains in weekly DEX volume – a sign of growing adoption even during market hesitation.

One of the biggest drivers is HumidiFi, a dark-pool style DEX gaining strong traction among large DeFi traders.

Meanwhile, stablecoin transfers rose 14% and active wallet addresses climbed 12%, proving that fundamentals are still strengthening beneath the surface.

This creates a notable disconnect: while SOL’s price consolidates, usage and liquidity continue to expand. For long-term holders, that could be a bullish divergence. But for short-term price action, the chart remains locked in a waiting game.

Short-Term Targets and Long-Term Outlook

Looking at updated projections, the short-term Solana price prediction shows moderate upside.

The forecast calls for a climb toward $131.88 by December 16, reflecting a modest 0.64% gain from the current price. This comes after a weekly drop of -8.56%, suggesting the market is still digesting recent volatility.

For the rest of December, the average price is projected at $134.87, with a possible move toward $140.01 if resistance breaks. That would mark a 6.85% recovery from current levels.

In the long-term view, analysts still expect SOL to trend higher over the coming years. But the key to unlocking this momentum will be breaking decisively above $145 and holding that level. Without that, the token may remain trapped in this compression zone into early 2026.

Traders Watch for the Next Trigger – or Move to Presales

Momentum is building – both in activity and in price structure – but the Solana price prediction will remain uncertain until the market shows conviction.

A breakout above $145 could send buyers rushing in and flip sentiment bullish, especially if volume confirms. But failure to reclaim that level soon could open the door for a sharp drop below $124 and potentially back toward deeper support.

Until the breakout happens, many traders are staying cautious. Some are turning to faster-moving opportunities like presales, where the momentum is clearer and the upside more immediate.

One of the top rotating alternatives right now is Bitcoin Hyper, a new token that’s raised over $29.3 million and is just under 9 hours away from a price jump. At $0.013405 per token, it’s gaining traction fast – and could become a key narrative in the weeks ahead if SOL continues to stall.