Speculation around an altcoin season soon has intensified following the Federal Reserve’s policy shift in December 2025. The Fed resumed Treasury bill purchases and paused quantitative tightening, a reversal aimed at stabilizing liquidity conditions.

The move has been interpreted by market participants as a signal that risk assets, including cryptocurrencies, could benefit from a more accommodative environment heading into 2026.

Among presales gaining early traction is Bitcoin Hyper ($HYPER), which has raised over $29.3 million and is nearing its next price increase.

Fed Reverses Course: Liquidity Back On

The Federal Reserve reintroduced $40 billion in Treasury bill purchases as part of its repurchase operations (RMPs) in late 2025, citing concerns over market funding stress.

Quantitative tightening was paused in October, halting the reduction of the Fed’s balance sheet. Officials stated the pivot was intended to ensure the stability of the federal funds rate and preserve broader financial conditions.

The reintroduction of liquidity tools marks a return to “ample” reserve conditions, a stance not seen since the early pandemic response.

Mortgage-backed security redemptions were also slowed to ease runoff pressures. These measures are designed to prevent market dislocations while giving the Fed more flexibility on rates heading into a potentially volatile election year.

2026 Is Starting to Look Like 2020

Altcoin performance has historically responded strongly to liquidity cycles. During the 2020–2021 easing phase, Ethereum and Solana gained significantly, outperforming Bitcoin in relative terms.

Analysts note similarities between that period and the current shift, citing policy easing alongside improving risk sentiment.

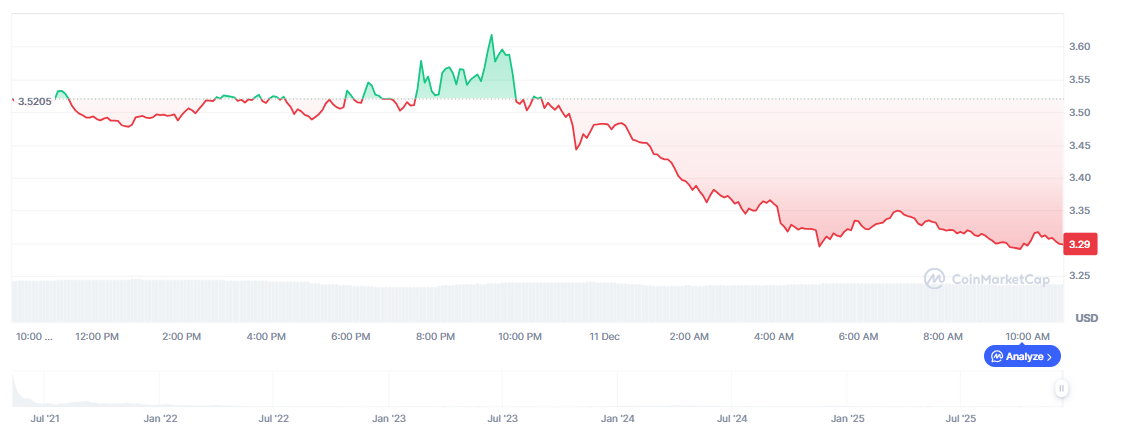

Following the Fed’s restrictive stance in October 2025, Internet Computer (ICP) fell sharply, dropping 6.2% to multi-year lows. However, once easing measures were announced, ICP rebounded over 60% in three days, underlining altcoins’ sensitivity to macroeconomic policy.

Why Altcoins React Sharply to Fed Moves

While Bitcoin tends to behave like a risk-moderated macro asset, altcoins respond more aggressively to monetary shifts due to their lower liquidity and higher volatility.

As of this week, Bitcoin trades at $90,339, down 2.44%, with a $1.8 trillion market cap and $70.43B in 24-hour volume. Ethereum, trading at $3,202, has seen a larger drop of 3.59%, despite higher relative volume at $35.19B.

Market participants note that capital rotation into altcoins often follows a period of Bitcoin stabilization. Current metrics suggest that while Bitcoin dominance remains strong, relative strength in altcoin volume may signal early-stage sector rotation.

Macro-Driven Altcoin Season Soon? 3 Factors Support It

Several developments suggest that a macro-driven altcoin season may emerge in 2026:

Liquidity Expansion: The reintroduction of RMPs and QT pause expand the monetary base, reduce funding costs, and historically benefit high-beta assets. Market analysts are projecting a federal funds rate near 3.4% by the end of 2026, offering a favorable backdrop for risk exposure.

Regulatory Clarity: Clearer frameworks in the U.S. and EU are enabling institutional entry into crypto markets. This aligns with the Fed’s stated goal of maintaining financial stability while allowing for asset market growth in regulated channels.

Market Correlation: Altcoins are showing increasing alignment with broader equity markets. In late 2025, ICP posted a 0.63 correlation with the S&P 500, while gold prices moved inversely. This data indicates that altcoins are evolving into macro-correlated assets, rather than speculative outliers.

$HYPER Presale Surges: Retail Is Already Moving

Retail engagement is rising in select presale markets. Bitcoin Hyper ($HYPER) has raised $29.32 million of a $29.66M target, pricing at $0.013405.

The project’s near-term milestone is a price increase, triggered once the remaining ~$340K threshold is surpassed. With the timer counting down, the window for early entry is narrowing.

Market observers cite $HYPER’s momentum as indicative of retail sentiment shifting toward lower-cap assets with perceived upside. As the altcoin season soon narrative gains traction, such early-stage tokens could see outsized inflows relative to large-cap assets.