Bitcoin’s growth history shows notable patterns that analysts often use to project future trends. Recently, Jurrien Timmer, Director of Global Macro at Fidelity, released a fresh analysis based on Bitcoin’s developmental wave model.

Experts remain optimistic about next year, yet they still present their outlook with caution.

How Strong Is Bitcoin’s Sixth Growth Wave?

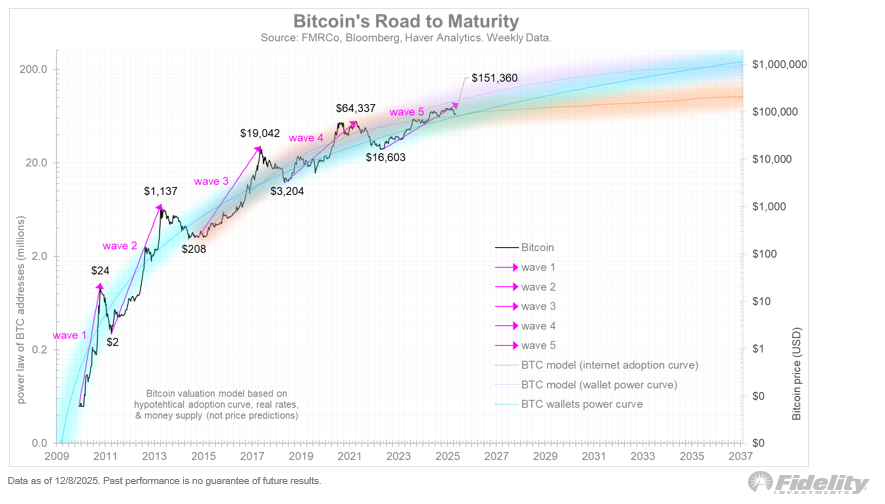

In a recent report, Jurrien Timmer highlighted that Bitcoin’s wave-development model shows each new growth cycle expands with a smaller magnitude but lasts longer.

Using historical data since 2010, Timmer suggested that Bitcoin is currently in its fifth wave. The cycle began at the 2022 bottom of $16,603 and may reach a projected peak of around $151,360.

“It’s hard to tell in real time whether a new winter is upon us. But the evolving wave structure of Bitcoin’s maturing network curve shows that the most recent bull market (from around $16,000 in 2022) looks pretty mature,” Jurrien Timmer said.

5 Waves of Bitcoin Growth. Source: Fidelity

In the short term, he remains optimistic about Bitcoin’s year-end performance. Investor sentiment has improved thanks to the Federal Reserve’s monetary easing.

In the long term, he hinted at a sixth growth wave. The model utilizes linear projections derived from data collected over the previous five waves.

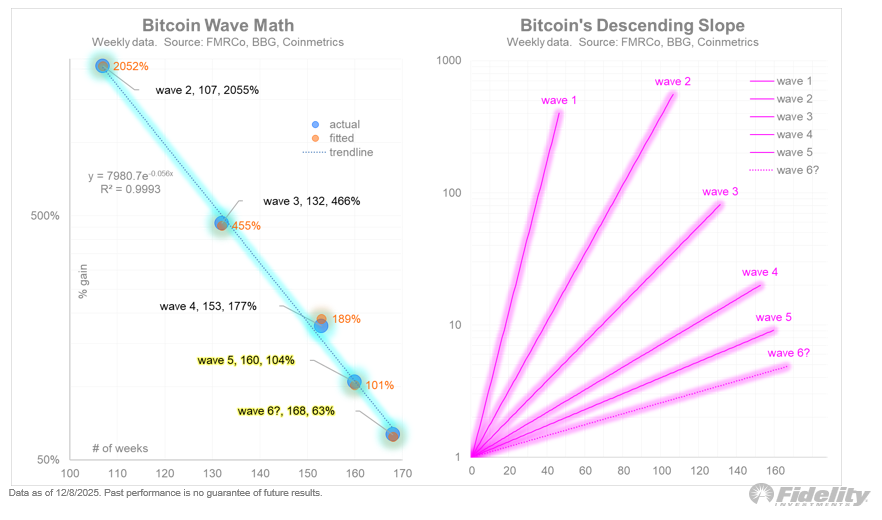

According to this model, Bitcoin’s Descending Slope chart (in pink) indicates:

Bitcoin’s Descending Slope. Source: Fidelity

Wave 4: BTC grew 20 times over 153 weeks from its bottom to its top.

Wave 5 (ongoing): BTC may grow 9 times over 160 weeks.

Wave 6 (upcoming): BTC may grow approximately 5 times over 168 weeks.

However, the model does not determine the exact bottom that will start Wave 6. Timmer suggested a potential support level at the current cycle’s floor around $80,554.

These projections indicate a relatively positive start for 2026, as Bitcoin has not yet completed its fifth wave.

Jimmy Xue, COO and Co-founder of Axis, shared a similar outlook with BeInCrypto. He expects the effect of the Fed’s rate cuts to show up soon.

“We are leaning towards a period of stabilization and chop rather than a V-shape rebound immediately. The market needs time to absorb the recent volatility. However, the medium-term setup remains bullish for Q1 2026 as the rate cuts eventually cycle into global liquidity and institutional allocations reset in January,” Jimmy Xue told BeInCrypto.

However, some observations point to a more pessimistic scenario. The year 2026 is a midterm election year. Historical performance shows that Bitcoin tends to perform poorly in such years, with drawdowns ranging from 60% to 75%.

These contrasting analyses signal an adventurous 2026 for investors. Institutional investors, in particular, have continued to accumulate BTC over the past two years since Bitcoin ETFs received approval.