Bitcoin price prediction is trending again in headlines as investors expect the crypto market to surge amid Fed rate cuts. The FOMC’s decision to reduce interest rates by another 25 basis points is expected to inject liquidity and drive BTC higher.

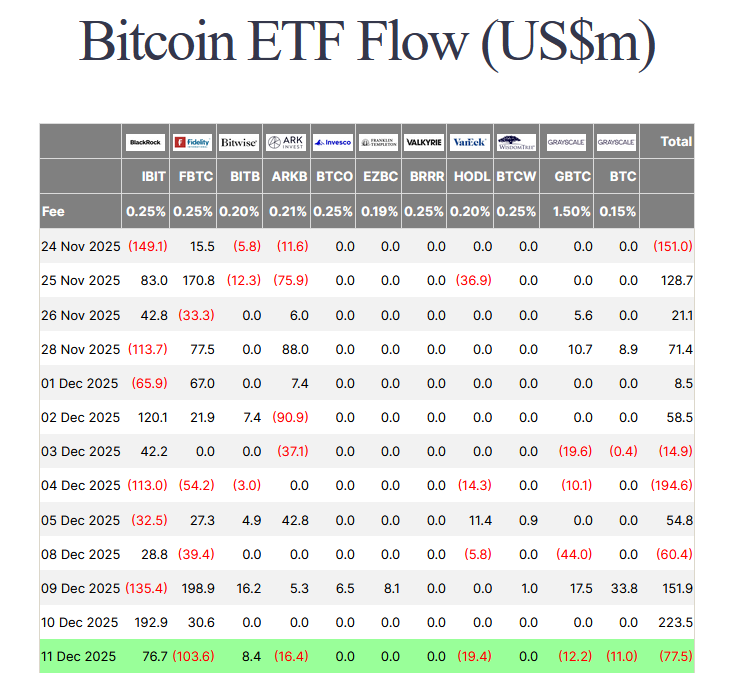

With dovish news, Bitcoin ETF inflows are surging once again as institutional capital returns to the asset. According to Farside data, spot BTC ETFs gained $223.5 million on December 10th, the day of the rate cut announcement.

After a net $87.7 million outflow in the first week of December, Bitcoin ETFs have experienced a total $237.5 million inflow so far this week. As institutions return to accumulate Bitcoin near $90k levels, analysts suggest retail capital will soon follow.

However, at present, retail investors are flocking to Bitcoin Hyper, an emerging project pegged to Bitcoin’s performance. It is the first layer-2 on Bitcoin and, with a micro-sized valuation, offers exponentially more upside to early investors in its presale.

Bitcoin Price Analysis: Recovery Signs After Correction

Bitcoin reached an all-time high of $126k on October 6, strengthening hype for ‘Uptober’. However, by this time, the market had become overpriced, and massive liquidations began to correct the price. The Bitcoin price quickly developed a downtrend, declining over 35% by November 21.

Following the bearish tone in the first half of Q4, BTC began consolidating. Over the past three weeks, it has been moving in a tight rising wedge pattern, slowly recovering from oversold regions.

Bitcoin has gained nearly 10% since the trend change three weeks ago, but continues to face significant resistance around $94k. As price congestion increases and volume dries, it could break with high momentum in either direction.

A breakout from the immediate resistance, with improving broader market sentiment, could help the Bitcoin price reclaim the $100k psychological level. At the same time, a drop below the rising wedge could mean a considerable correction to the 52-week low at $75k.

Standard Chartered Halves Bitcoin Price Prediction for 2025

In July 2025, Standard Chartered gave a $200k Bitcoin price prediction for the end of 2025. The bank forecasted this target based on rising ETF inflows, increased corporate treasuries, and new pro-crypto policies.

However, in its latest update released on Tuesday, the bank has slashed that target in half, bringing the forecast down to $100,000.

Geoff Kendrick, Standard Chartered’s Global Head of Digital Assets Research, explained the shift in sentiment. “We think buying by Bitcoin digital-asset treasury companies is likely over,” Kendrick said. “As a result, we now think future Bitcoin price increases will effectively be driven by one leg only — ETF buying.”

According to him, corporate accumulation of Bitcoin as part of a digital asset treasury strategy no longer significantly affects the price. Instead, institutional capital flows into ETFs are expected to determine BTC’s price movement in the long run.

Bitcoin Hyper Presale Gains Momentum, Nearly $30 Million Raised

Bitcoin offers resilience as the largest and most trusted crypto. Long-term investors prefer the asset for its stability and liquidity, but it does not attract those seeking short-term profits. Retail investors are moving to Bitcoin Hyper as Bitcoin cannot deliver the explosive upside due to its massive market cap.

The early-stage layer-2 infrastructure project is driving demand with cutting-edge smart contract technology. It is revolutionizing crypto by bringing a Solana-like experience and performance to the oldest and most robust blockchain network.

Bitcoin Hyper solves Bitcoin’s transaction bottlenecks, scalability constraints, and lack of programmability by operating as a virtual high-performance Layer 2 on top of the base layer. The project employs the Solana Virtual Machine to enable native execution of smart contracts and decentralized applications on Bitcoin.

Why Bitcoin Hyper stands out:

Closing in on $30 million raised with nearly 650 million tokens sold

Presale participants can stake HYPER for a 39% annual return

Token available at a discounted $0.013415 price in presale

HYPER’s value surges with a new stage every 72 hours

Significant ROI within weeks when HYPER lists on major exchanges

Bitcoin Hyper is an ideal choice for investors who have been holding BTC for a long time and want to gain exposure to projects with modern real-world use cases, such as dApps and gaming. It also offers a much higher upside while still retaining the core principles of Bitcoin.

Expected to list in Q4 2025 or Q1 2026, depending on demand and presale momentum, the HYPER token could be the best investment of 2025 for early presale participants.