Crypto markets rebounded from key support levels, with Bitcoin reclaiming the $93,000 mark and broad market sentiment turning green.

However, with conviction still thin and macro uncertainty lingering, traders are split on whether this move signals stabilization or just a short lived relief rally.

Crypto Markets Bounce From Key Support Levels

The crypto markets saw a coordinated rebound after defending critical support, easing immediate downside pressure. The total crypto market cap saw a 2.18% rise to the $3.15 trillion mark.

Bitcoin saw a wick that fell to as low as $89,200 but prices soon rallied passed the psychological $90,000 region and now retesting the crucial resistance at the $94,000 mark.

From an altcoin perspective, the TOTAL2 chart saw a 2.65% rally and now sits at $1.26 trillion. The OTHERS chart, which is often seen as a barometer for how mid to small caps are performing also saw a ~4% rise.

Bitcoin Reclaims $91K After Holding Critical Support

Bitcoin rebounded from intraday lows of the $89,500 – $90,000 zone before reclaiming $92,000 as of this writing.

The $90-91K area has acted as a key technical support range for three weeks now. A clean support line of this zone helped slow selling pressure after the latest macro-driven volatility spike.

Momentum, however, remains mixed. Trading volumes have yet to show a decisive expansion, suggesting the rebound is being driven more by positioning adjustments than fresh conviction buying.

Altcoins Turn Green as Risk Appetite Improves

Altcoins broadly followed Bitcoin higher as risk appetite in the short term improved. Ethereum continues to outperform Bitcoin, a trend that’s been in place since the start of the month.

Solana was the other standout top 10 altcoin to perform with a 6% rise. Other notable gainers were Hyperliquid with a 4.7% move up, Zcash posting a 8% rise and Sui rallying by 7%.

The rebound extended into higher beta segments, with memecoins recovering in tandem. The memecoin sector as a whole rose by ~7% with coins like Bonk, MemeCore and SPX6900 all rallying ~5%

This synchronized move highlights Bitcoin’s continued role as the primary market driver, with altcoin performance closely tied to BTC’s ability to hold key levels.

What Drove Today’s Bounce?

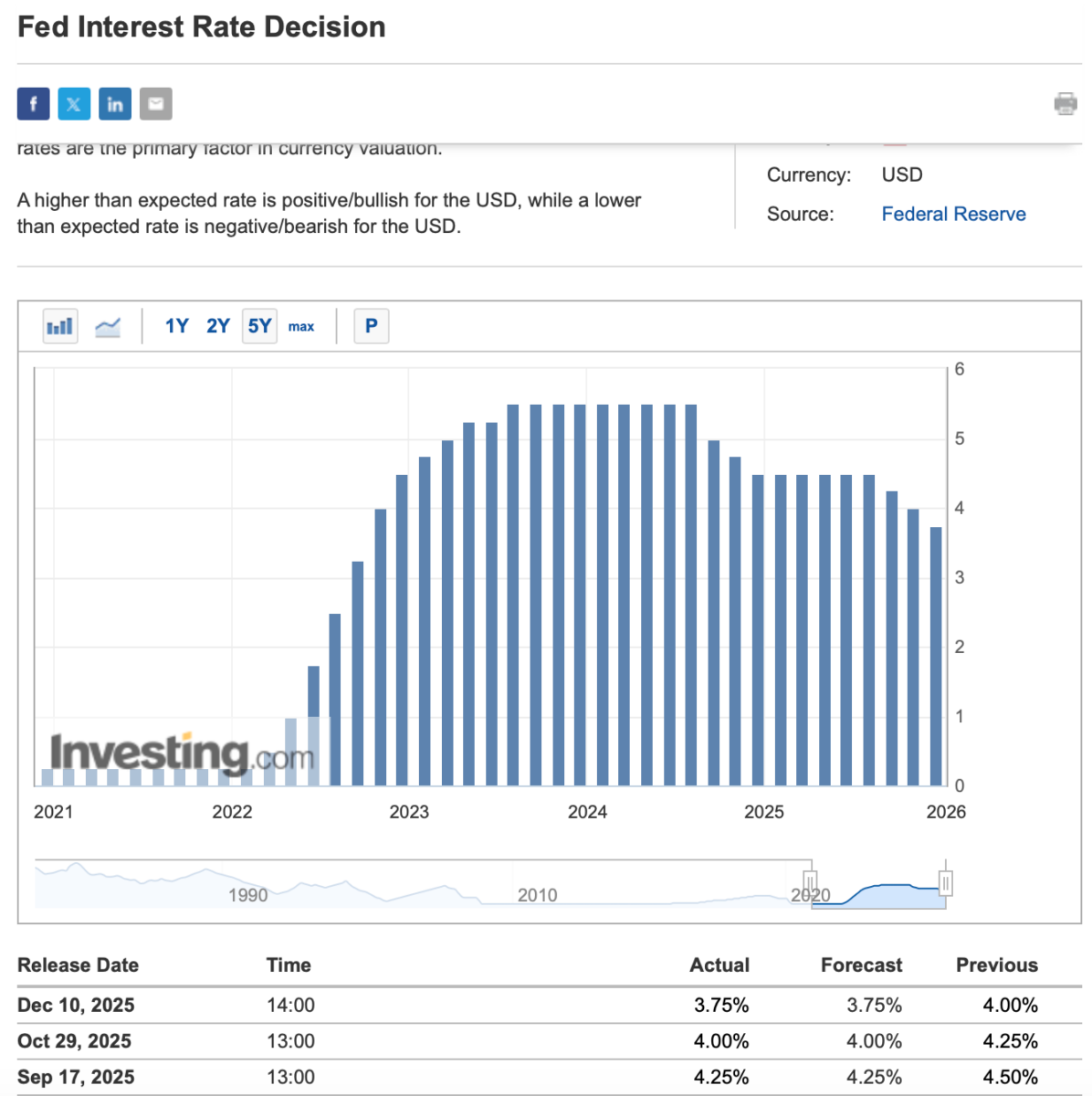

One factor supporting the rebound was renewed optimism around U.S. Federal Reserve Policy. After the Fed announced another round of interest rate cuts, expectations that rates may stabilize rather than tighten further helped improve short term sentiment across risk assets.

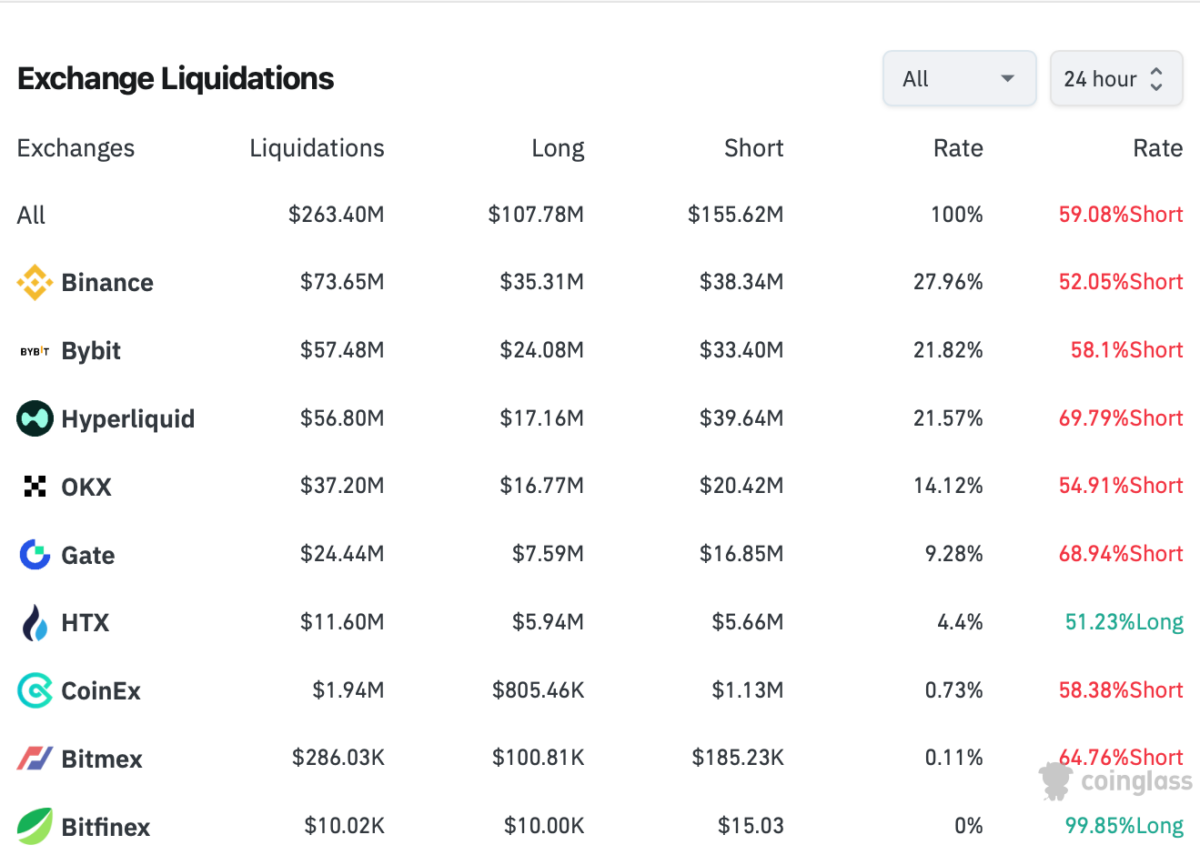

Position dynamics also played a role. Short liquidations and a reduction in leveraged exposure helped relieve immediate selling pressure, allowing prices to climb higher.

Finally, dip buying activity emerged around well defined technical support zones. Rather than aggressive accumulation, the flow appears defensive, aimed at protecting key levels rather than starting a new trend.

Relief Rally or Bull Trap? Analysts Remain Split

From a bullish perspective, a successful retest of support suggest sellers may be losing momentum. Volatility has begun to contract and if Bitcoin can build above current levels, traders see room for a move back above the $94k-$95k region.

The opposing view remains cautious, Follow through has been limited and broader macro uncertainty continues to cap upside. Without a clear expansion in volume and participation, the rebound risks forming a lower high within a broader corrective structure.

Onchain data adds another perspective. BTC short term holders, coins held for one to three months remain deep in loss. This group has entered one of 2025’s largest pain zones.

In the short term, that overhang keeps pressure on price, as weak hands could potentially sell into each rally. Over time, however, such deep loss pockets tend to appear closer to the later stages of a correction.

Key Levels Traders Are Watching

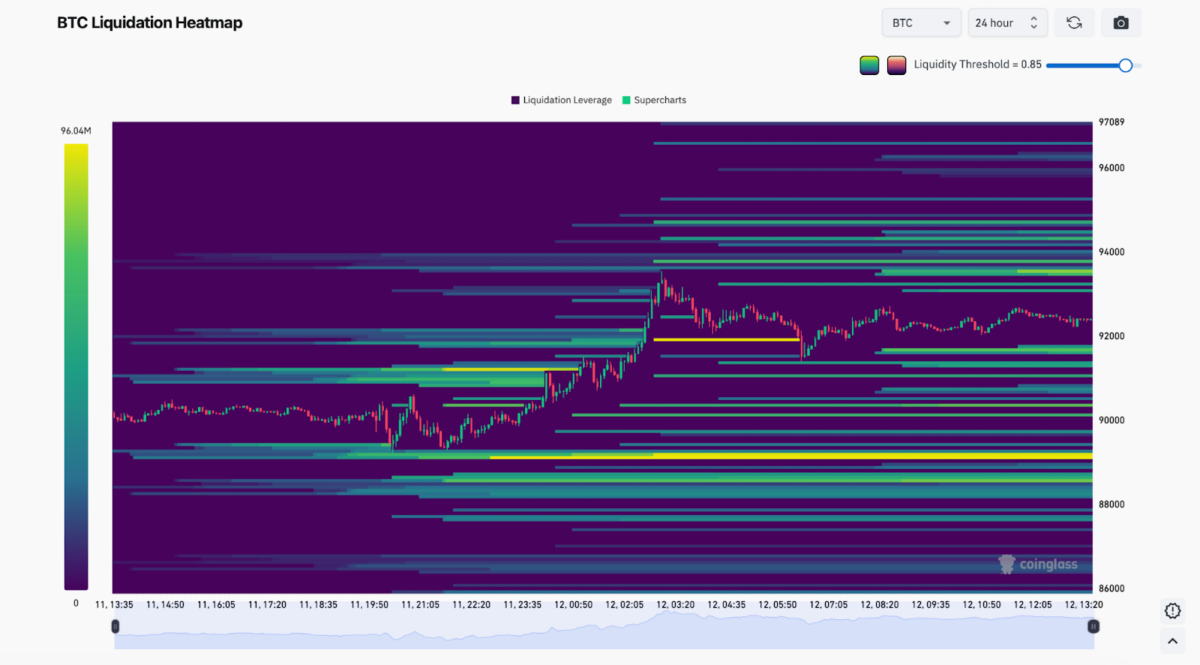

On the upside, resistance sits in the $94K range, where prior breakdowns and supply clusters remain active. A failure to reclaim this zone could reinforce the relief rally narrative. Derivatives positioning supports this view, with liquidation data showing a concentration of shot leverage just above price. A push through resistance trigger stop-driven upside, leading to a quick expansion rather than a slow grind up

On the downside, $90K remains the first key support, with 88K acting as the next critical level. A loss of these supports would likely reintroduce downside volatility and test market confidence. A clean loss of $90K would increase the probability of price being drawn toward this deeper liquidity pocket, potentially accelerating downside pressure.

In short, price is currently positioned between nearby upside liquidity and heavier downside liquidity, making reactions around these levels crucial for determining the next directional move.

Market Outlook

As of this writing, crypto markets show signs of stability but lack clear confirmation.

Traders are watching volume, price follow-through and upcoming macro signals. Caution remains, even as prices recover from recent lows.