CARDS reaches $2.6 million per month in revenue. AVICI user base grows by 35%. DeepSnitch AI presale is trending and surpasses $770,000.

While the crypto market is experiencing days of volatility and uncertainty about the future, investors are searching for the biggest gems that can offer explosive gains.

Some projects may offer 10x or even 100x, but the real challenge is finding the next big 1000x crypto. CARDS and AVICI are promising, but DeepSnitch AI is the crowd’s favorite.

This artificial intelligence project is trending after launching a bonus offer that gives 50% to 100% more tokens to those who invest in the coming days. It has already raised over $770,000, driving the price up 80%, and as an AI project, it has significant upside potential, and could reach even 1000x.

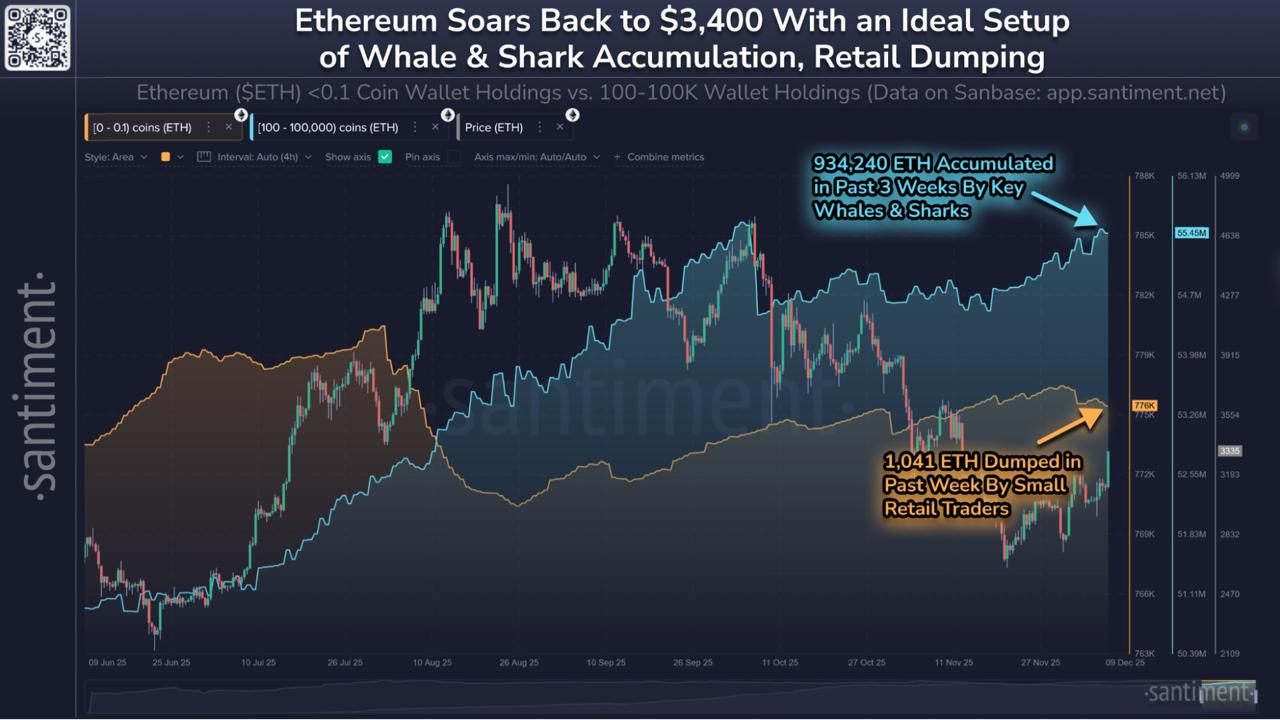

Whales are returning to accumulating Ethereum, while retail investors are dumping

On-chain data from Santiment shows a revealing movement of whales holding between 10,000 and 100,000 ETH accumulated approximately over 900,000 ETH in three weeks (a value close to $3.15 billion), while small investors sold almost 1,000 ETH in the same period.

This combination of large wallet inflows and outflows only from small investors reinforces a scenario of high-conviction accumulation, while influencing the asset’s price. After weeks of correction, ETH rose 8% in December, trading around $3,095 at the curren.

The big players are positioning themselves, as the data and charts indicate Ethereum should continue rising in the coming weeks, possibly soon returning to above $4,000.

DeepSnitch AI: The presale with 1000x potential

A report published by Bank of America showed that artificial intelligence will be the sector receiving the most investment in 2026. Simultaneously, Gartner reports are in agreement, projecting that the AI sector should grow 25x by 2030. With this perspective, investing in projects like DeepSnitch AI could be the best investment right now.

First, it’s an artificial intelligence project, with AI agents, and a platform to help traders access key market news, on-chain data, new token launches, and more. The platform processes all data and sends it in real time, giving users access to advanced information and thus enabling them to make better investment decisions.

DeepSnitch AI is in presale, giving investors the opportunity to buy tokens at a low price (just $0.02735). And now it’s even more attractive because a bonus offer has been launched. If investing over $2,000, use the code DSNTVIP50 to receive 50% more tokens; and over $5,000, use the code DSNTVIP100 to receive 100% more tokens.

So, doing a simple calculation, without the bonus offer, if you invest $5,000 now, you get 182,815 tokens, and if DSNT hits $1, that’s worth $182,815 (like 36x return). But with the bonus offer, if you invest $5,000 now, you get 365,630 tokens, and if DSNT hits $1, that’s worth $365,630 (an approximate 73x return).

The AI crypto sector is projected to expand roughly 25x by 2030. If DSNT captures even a small but meaningful slice of this growth, early presale buyers, especially those securing bonus allocations, could see returns that far outpace the broader market, so 1000x remains firmly on the table.

AVICI: Web3 bank with high-upside crypto potential

Revolut and Trust Wallet have partnered to enable instant purchase of Bitcoin and other cryptocurrencies via Revolut Pay. This is a significant update, as Revolut currently has a market capitalization of $75 billion and is one of the leading Web2 banks.

It is in this context that AVICI comes, a DeFi app with an on-chain Visa card that instantly converts crypto to fiat currency, with full self-custody. It already works with Apple Pay/Google Pay in over 40 countries, and for this reason, it has been nicknamed the “Web3 crypto version of Revolut,” with the difference that it is 100% decentralized and 100% on-chain.

AVICI is growing its user base by 35% per month. Currently has a market cap of $47 million, but considering that Revolut’s valuation is $75 billion, this gives this neobank enough upside to potentially be the next big 1000x crypto.

CARDS: Mix of RWA, NFTs, nostalgia, and the future

Collectible Pokémon cards currently generate $2.2 billion in annual sales, with an estimated brand value of $20 billion. For many years solely with physical products, fans have always had problems with fake cards. But now, with a partnership with Collector Crypt (CARDS) offers fans the certainty of buying original cards, registered on the blockchain.

It is the leading trading card game platform, operating 100% on-chain on Solana, and allows fans to buy, sell, or trade Pokémon NFT cards. The big difference is that every NFT card is a 1:1 digital token with a real physical card, so users can exchange the NFT card for the real version, burn the NFT, and receive the physical card at home.

CARDS currently has a market cap of only $8 million, making it an ultra-low-cap gem, and generating approximately $2.6 million per month in revenue. Considering that the market value of Pokémon cards is currently $20 billion, CARDS could reach an $8 billion market cap in the long term, thus becoming the next big 1000x crypto.

Conclusion

Predicting what the next big 1000x crypto will be is a difficult task. CARDS, being connected to the Pokémon universe, and AVICI, being a Revolut version in the crypto market, are promising projects. But CARDS depends on the NFT market coming back to life, while AVICI depends on regulatory approvals and bureaucracy.

DeepSnitch AI is the best choice, because it depends only on itself, having already launched its network and three of five AI agents, showing that the product is real and the technology promising. Furthermore, being still in presale offers greater upside, and combined with the bonus offer, becomes a potential 1000x.