Bitcoin (BTC) hovers near a crucial $92K–$94K resistance zone, testing investor patience as traders speculate whether the cryptocurrency can surge toward the coveted $100,000 milestone.

After recent highs around $94,500, BTC has consolidated within this range, reflecting a tug-of-war between bullish momentum and profit-taking. Observing historical patterns, similar compressions in late 2021 and mid-2024 preceded moves of 5%–12% within a week, suggesting that BTC may be preparing for elevated volatility once this range resolves.

Bitcoin Holds Critical Resistance

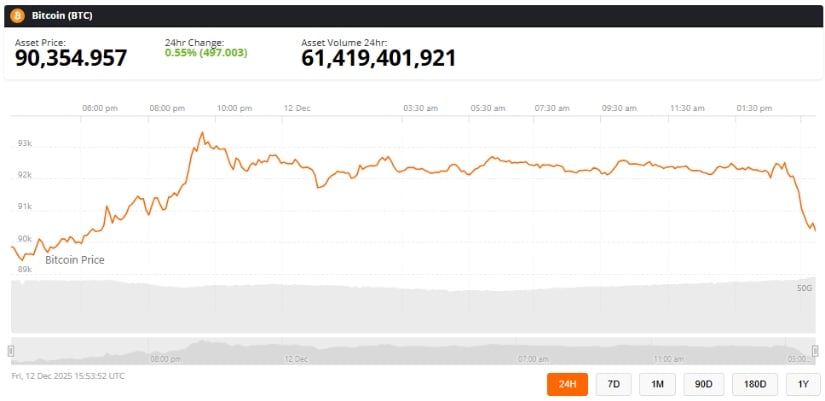

Bitcoin continues to trade within a pivotal range, with the $92,000–$94,000 resistance zone acting as a key battleground between bulls and bears. As of December 12, 2025, BTC’s price hovered around 90,354, representing a 0.55% gain on the day with strong trading volume. This activity indicates active participation from both retail and institutional players.

Bitcoin ($BTC) tests the $92K–$94K resistance zone, eyeing a potential rally to $100K or a drop below $90K. Source: @TedPillows via X

According to Ted (@TedPillows), a cryptocurrency market analyst known for tracking BTC cycles since 2018, “$BTC is back into its $92,000–$94,000 resistance zone. If Bitcoin bulls are able to push Bitcoin above this zone, a rally towards $100,000 could happen. Otherwise, expect another dump below the $90,000 level.” While Ted’s commentary reflects technical observations, historical review suggests that similar compression periods have often resulted in sharp but short-lived directional moves.

Technical Signals Point to Imminent Breakout

Technical indicators show BTC compressing in a narrowing range, a pattern often preceding volatility expansion. Wealthmanager (@Wealthmanager), who has analyzed BTC for over five years and follows both macro and on-chain trends, highlighted, “$BTC is compressing within a tight range, and we should see a breakout within the next 7 days.”

Bitcoin is tightly compressed near $92K–$94K, with a higher-probability breakout toward $99K as capital rotates into high-potential assets. Source: @Wealthmanager via X

They note that the structure currently favors upward movement toward $99,000, citing liquidity clusters above the current price.

Broader macro conditions support this view: the S&P 500 recently hit a new all-time high of 6,901, while silver and gold also reached record levels, indicating capital rotation into high-potential assets. These cross-market dynamics can occasionally amplify BTC momentum as traders seek alternative stores of value.

On‑Chain Metrics Highlight Accumulation

On-chain analysis from Glassnode and CryptoQuant indicates sustained accumulation by long-term Bitcoin holders, even as shorter-term traders occasionally distribute coins near resistance. Metrics such as long-term holder supply and exchange net flows suggest that “strong hands” are positioned for potential breakout scenarios.

Historical context reinforces this interpretation: during November 2025, BTC stalled at similar levels before moving higher in measured steps. Analysts are therefore watching whether Bitcoin can repeat this pattern or if exhaustion leads to a pullback.

Support Levels and Alternative Outcomes

Despite bullish signs, risk remains. CryptoSanders9563, a technical strategist with experience monitoring BTC intraday patterns, observes that the $93,500–$94,500 resistance band has consistently repelled upward moves on the 4-hour chart. Support near $89,000–$89,100 is critical, with deeper support zones at $84,584 and $80,550 if that level breaks.

BTC consolidates above a rising trendline, facing $93K–$94K resistance, with key support at $89K; a breakout could target $96K–$100K, while a breakdown risks $84K–$81K. Source: CryptoSanders9563 on tradingView

“Local horizontal support is now around 89,000–89,100, and if the trendline fails, deeper support is at 84,584 and 80,550,” CryptoSanders9563 noted.

Scenario analysis suggests:

Bullish scenario: A 4-hour candle close above $94,500 could open the path toward $96,000–$100,000, reflecting strong buying interest.

Bearish scenario: A breakdown below $89,000 may lead to retesting of lower demand zones, highlighting the risks of false breakouts.

What This Means for Traders and Investors

Tight compression near prior highs historically signals both elevated breakout probability and increased false-break risk. Readers should understand that such conditions often lead to sharp directional moves once liquidity clusters are tested.

Key takeaways include:

Watch the $92K–$94K range as the pivot for short-term sentiment.

Support at $89K is vital for sustaining bullish setups.

Any decisive break above resistance could accelerate momentum, but it remains probabilistic, not guaranteed

This perspective provides readers with context for interpreting volatility and understanding the market mechanics behind BTC’s behavior.

Final Thoughts

Bitcoin’s performance around the $92K–$94K resistance zone remains a critical indicator for short-term market sentiment and positioning. With price compression intensifying, sustained accumulation by long-term holders, and generally constructive macro conditions, the next few days could set the tone for BTC heading into 2026.

Bitcoin was trading at around 90,354, up 0.55% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

While some analysts highlight the potential for a surge toward six figures, it is important to recognize the inherent volatility of cryptocurrency markets. This analysis represents a snapshot of current conditions and should be viewed as scenario-based guidance rather than a guaranteed outcome. Traders and investors should consider both upside potential and downside risk when interpreting Bitcoin’s next moves.