XRP is currently navigating a pivotal price range near $2.04, with market participants closely observing whether it can hold above $1.96 support or challenge the $2.17 resistance level.

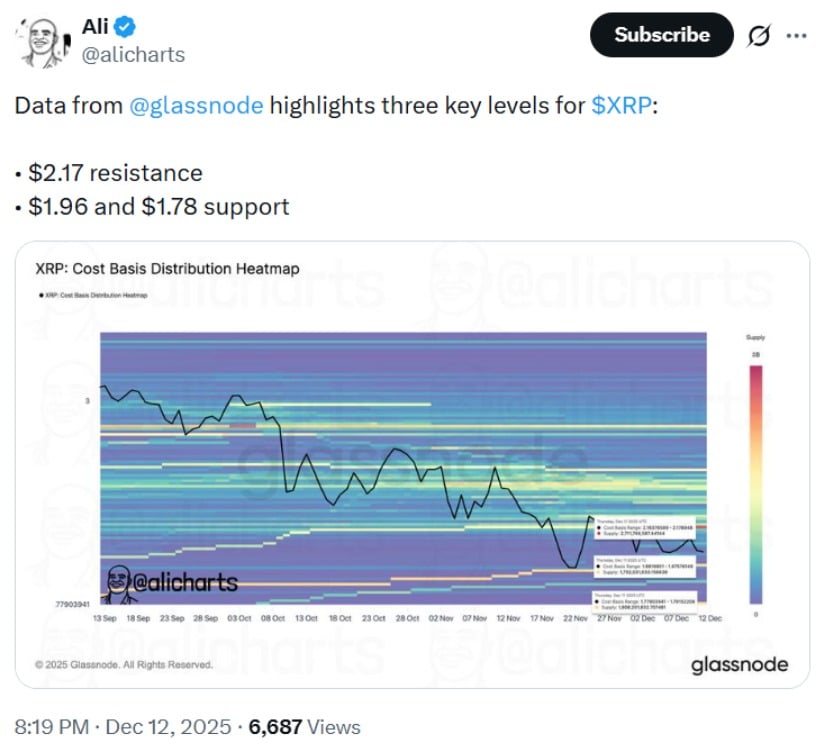

The cryptocurrency market is paying close attention to Ripple’s XRP as short-term volatility rises amid concentrated supply zones. Glassnode’s on-chain metrics, including the URPD (UTXO Realized Price Distribution), highlight clusters where holders’ cost bases are densest. This provides insight into potential market reactions, making XRP’s current position relevant for both retail and institutional traders.

Key Resistance and Support Levels

Blockchain analytics firm Glassnode identifies three critical price levels for XRP. The $2.17 mark represents a significant resistance area where a large volume of XRP was accumulated. Conversely, $1.96 and $1.78 serve as support zones with high holder concentration.

XRP hovers between key support at $1.96–$1.78 and resistance at $2.17, highlighting critical levels for traders. Source: @alicharts via X

Ali, an on-chain analyst who regularly studies holder distributions and supply clustering, notes, “Breaking $2.17 could relieve short-term profit pressure. Conversely, a drop below $1.96 might trigger increased selling from holders who purchased at higher prices.”

These levels are meaningful because they reflect the underlying distribution of XRP holdings. Traders often watch such zones closely, as moves above resistance or below support can lead to heightened volatility.

Historical Parallels and Scenario Analysis

Technical analyst ChartNerd, known for comparing historical crypto cycles, draws a parallel to XRP’s 2016–2017 cycle. After rejecting an accumulation supply block in Q4 2016, XRP experienced a 69% ABC-structured flash crash before eventually surging more than 110,000%.

XRP could experience a sharp pullback to the low $1 range if a historical ABC flash crash pattern repeats, potentially setting the stage for a long-term rally toward $27 by 2026. Source: @ChartNerdTA via X

ChartNerd notes, “If a similar setup occurs this year, a sharp correction could push XRP toward the low $1 range before stabilizing. This scenario is not a prediction but a historical analogy highlighting potential market behavior under concentrated supply conditions.”

It’s important to contextualize this comparison. XRP’s market today is more mature, with higher liquidity and evolving regulatory oversight, including ongoing Ripple SEC developments. This limits direct parallels with past cycles, meaning historical patterns serve as illustrative rather than predictive tools.

Market Consolidation and Technical Signals

TradingView analyst SwallowAcademy, who focuses on technical analysis of crypto price structures, observes that XRP is currently compressed between established support levels and exponential moving averages (EMAs).

XRP is consolidating between key support and EMAs, creating price pressure that could lead to a stronger move once a breakout occurs, with buyers needing a clear push above EMAs to regain momentum. Source: SwallowAcademy via X

“Price compression between EMAs and support zones often precedes larger moves, as reduced liquidity amplifies volatility,” the analyst explains.

Buyers have maintained the $1.96 support, but regaining momentum may require a clear market structure break (MSB) above the EMAs. A successful breakout could push XRP toward the $2.17 resistance, whereas failure to hold support may increase near-term volatility. Historical patterns indicate that consolidation in such zones typically precedes directional decisions.

XRP Market Outlook

XRP’s current price action is attracting attention from both retail and institutional investors. On-chain data, technical signals, and volume trends suggest that short-term volatility could increase as the cryptocurrency tests its critical levels.

Analysts emphasize that observing multiple indicators together provides a more comprehensive market view. Consolidation near EMAs, coupled with dense holder clusters, often indicates reduced liquidity, which can amplify price swings. Traders should note that while historical analogs provide context, present-market differences, such as regulatory developments and liquidity depth, affect potential outcomes.

Final Thoughts

XRP remains at a key junction, balancing between critical support at $1.96 and resistance near $2.17. While historical analogs highlight potential flash-crash scenarios, current consolidation and multi-month support suggest the market retains stability.

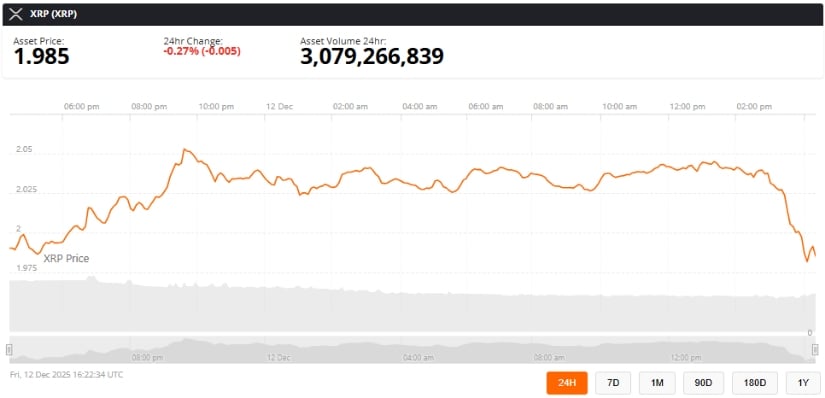

XRP was trading at around 1.98, down 0.27% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Investors and traders are encouraged to monitor on-chain metrics, trading volume, and technical indicators to better understand market dynamics. Combining these insights allows for a more nuanced perspective on XRP’s short- and medium-term outlook while accounting for inherent uncertainties in the cryptocurrency market.