Ethereum is trading above the $3,200 level as bulls attempt to push the price back toward higher resistance zones, but market sentiment remains fragile. Fear and uncertainty continue to dominate as several analysts warn that the broader trend may still point toward a potential bear market. Yet, beneath the volatile price action, key on-chain data is revealing a development that could shape Ethereum’s next major phase.

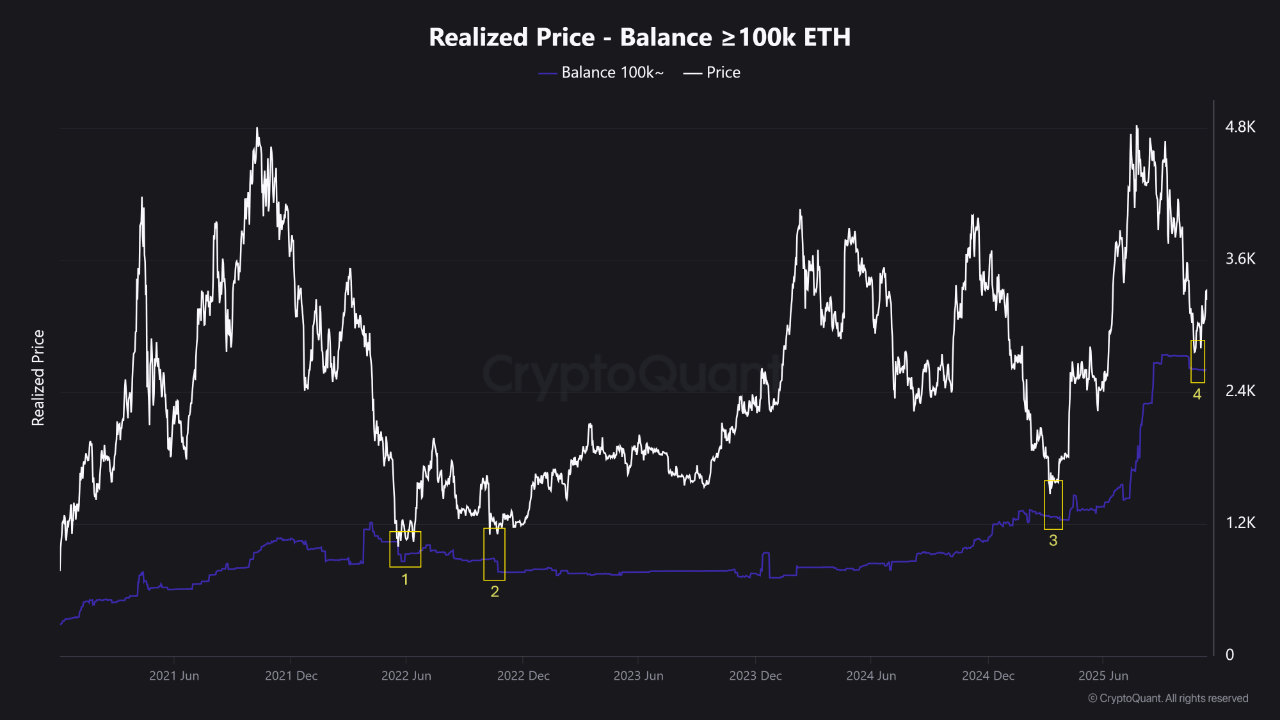

According to a new report from CryptoQuant, a historic signal tied to the realized price of whales holding more than 100,000 ETH has emerged once again. This metric, which tracks the average cost basis of the largest holders, has only been tested a handful of times over the past five years.

Each instance occurred during decisive turning points in Ethereum’s macro trend. Whenever ETH approached or traded near this realized price, it signaled either the exhaustion of a deep downtrend or the beginning of a strong recovery phase.

Today, Ethereum is once again hovering near this critical threshold. With analysts divided and sentiment weakening, the whale realized price has become one of the most important indicators to monitor. Whether ETH bounces or breaks here may determine the direction of the next major trend cycle.

Whale Realized Price as a Cycle-Defining Threshold

The CryptoQuant report highlights the significance of Ethereum’s proximity to the realized price of whales holding at least 100,000 ETH. According to the analysis, ETH has traded very close to this level only four times in the last five years.

Two of those instances occurred during the capitulation phase of the 2022 bear market, when selling pressure peaked, and long-term confidence was severely tested. The other two have happened this year, underscoring how unusual and cycle-defining the current environment has become.

What makes this metric particularly important is its historical reliability. In the past five years, Ethereum has never traded below the realized price of these mega-whales. This level has consistently acted as a structural floor, signaling areas where the largest and most sophisticated holders refuse to sell at a loss. Their behavior often marks moments of deep undervaluation or macro exhaustion within the market.

Today, that realized price sits near the $2,500 range, placing Ethereum within striking distance of a level that has repeatedly separated long-term accumulation zones from full-scale trend reversals. If ETH holds above this threshold, it would reinforce the idea that large holders still see long-term value—despite fear dominating broader market sentiment.

Ethereum Attempts Recovery but Faces Major Overhead Barriers

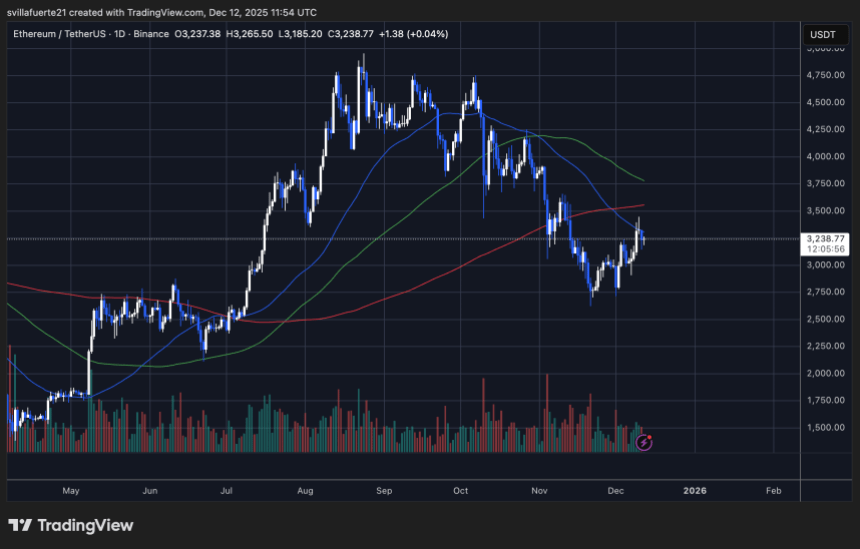

Ethereum’s daily chart shows a market attempting recovery, yet still constrained by significant structural resistance. After rebounding from the sub-$2,900 zone, ETH has reclaimed the $3,200 level and is currently trading near $3,238. While this bounce reflects short-term strength, the broader trend remains fragile.

The price is encountering the 50-day moving average, which has acted as dynamic resistance throughout the decline from September’s peak. ETH briefly pierced above it but failed to secure a strong close, signaling hesitation from buyers.

The 100-day and 200-day moving averages remain well above the current price, reinforcing that Ethereum is still operating beneath major trend markers. These moving averages are likely to form an overhead cluster of resistance between $3,400 and $3,600—an area where sellers previously overwhelmed bullish attempts.

Structurally, ETH is forming a potential higher low, but it has not yet produced a higher high—an essential condition for confirming a trend reversal. A clean breakout above $3,350 would strengthen bullish momentum. Conversely, losing $3,150 risks reopening a path toward $3,000 and potentially retesting deeper support levels.

Featured image from ChatGPT, chart from TradingView.com