Bitcoin price looks stuck at first glance. Over the past 24 hours, the price has been nearly flat, down just 0.2%. Even on a weekly basis, Bitcoin has barely moved, up roughly 0.7%. The market feels quiet, and many traders are calling this range-bound action.

But under the surface, several signals suggest Bitcoin (BTC) is not as weak as it looks. Momentum is shifting slowly, sellers are losing conviction, and large holders continue to position quietly. Together, these factors explain why bullish Bitcoin price predictions made by experts like Tom Lee have not disappeared, even without a breakout yet.

Momentum And Volume Signals Are Quietly Improving

On the daily chart, the Bitcoin price continues to respect the $90,100 level. This zone has acted as a firm base during recent volatility, preventing deeper pullbacks even as the price failed to trend higher.

One of the clearest early signals comes from On-Balance Volume (OBV). OBV tracks whether volume is flowing into or out of an asset, helping identify hidden buying or selling pressure.

Between December 9 and December 11, the Bitcoin price made a lower high, while OBV made a higher high. This divergence shows that even as prices struggled, buyers were more active beneath the surface.

Bitcoin Flashes Divergence: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That signal strengthened between December 10 and December 12. During this period, the Bitcoin price made a lower low, while OBV formed a higher low. This tells the same story from another angle. Sellers pushed the price lower, but with weaker volume support.

These two OBV divergences work together, not against each other. Combined, they show selling pressure is fading, not accelerating. This does not confirm a breakout, but it often appears before one.

Holders And Whales Are Positioning Despite the Flat Price

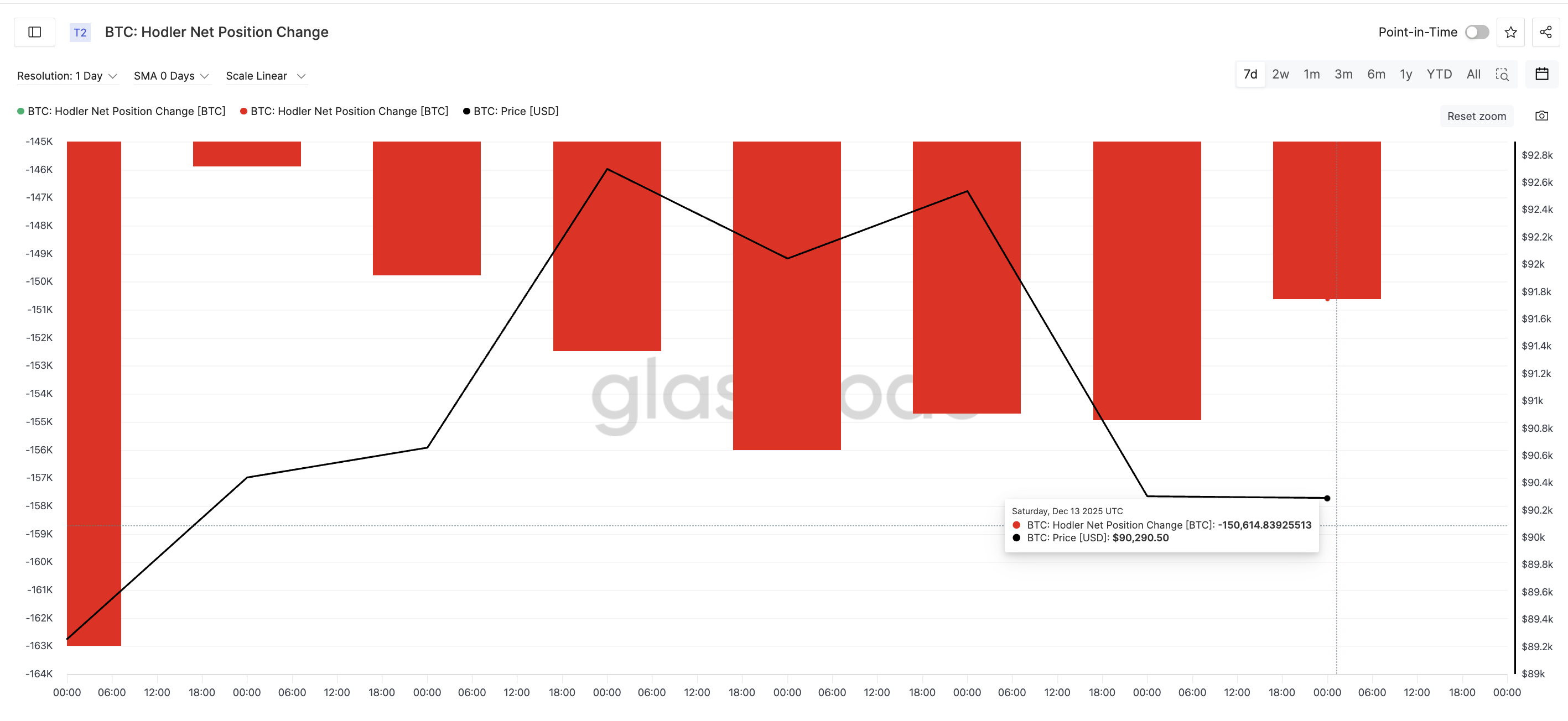

Momentum signals alone are not enough. On-chain data adds confirmation. Holder Net Position Change tracks whether long-term holders are adding or reducing Bitcoin positions. Negative values mean selling. Fewer negative values mean selling pressure is easing.

On December 10, long-term holders were distributing roughly 155,999 BTC. By December 13, that number dropped to around 150,614 BTC. That is a reduction of about 3.4% in selling pressure.

HODLers Selling Fewer Coins: Glassnode

The change is not dramatic, but it is meaningful. Bitcoin is not seeing panic selling despite trading in a range. Instead, holders are selling less as the price stabilizes. This behavior typically appears during consolidation phases, not during breakdowns.

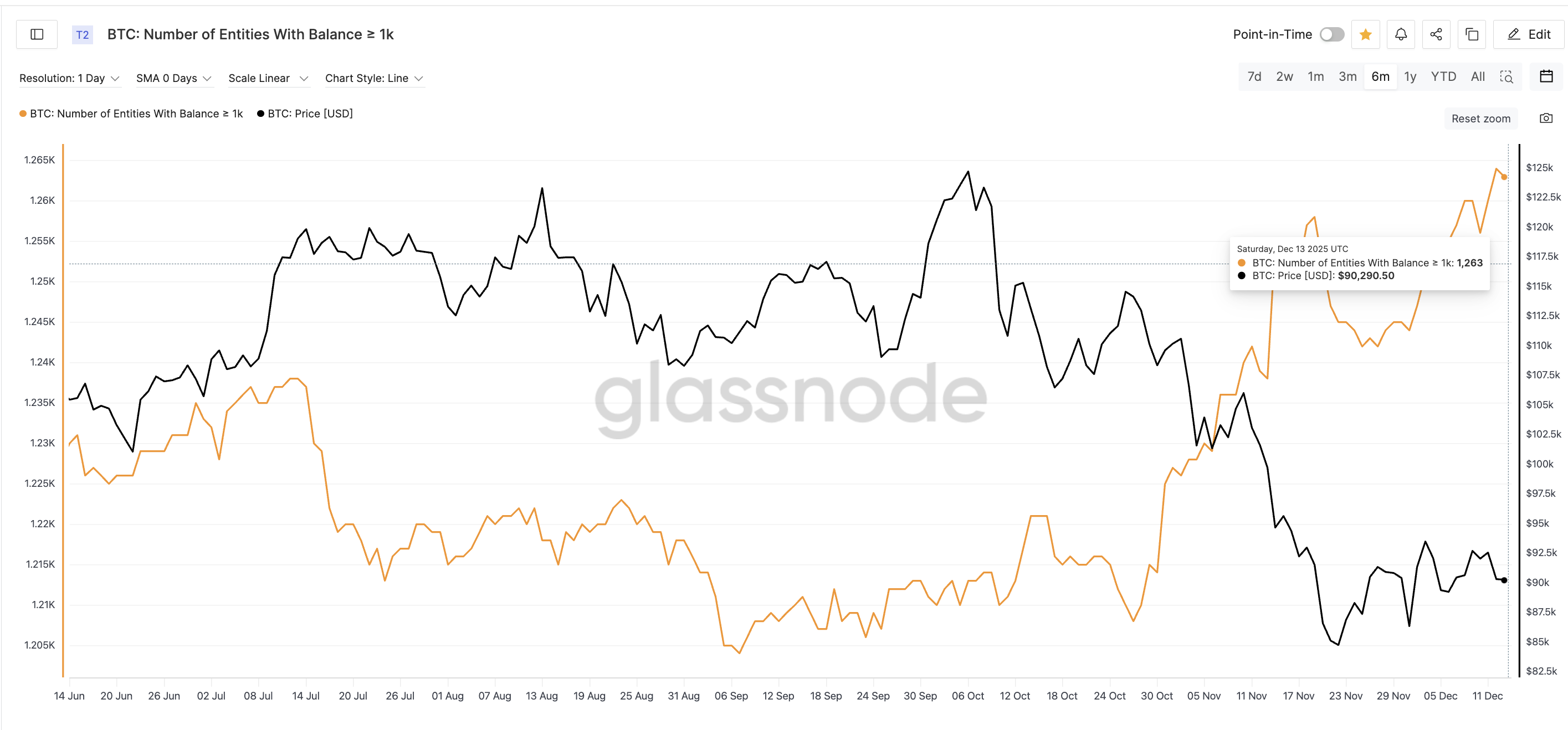

The strongest signal comes from whales. The number of entities holding at least 1,000 BTC remains near its six-month high. This metric often reflects large, long-term investors.

Since late October, the Bitcoin price has corrected and moved sideways. During the same period, whale entities continued to add. This creates a clear divergence. Price weakened, but large holders kept accumulating. And they usually do not add without any valid reason.

BTC Whales Keep Increasing: Glassnode

This behavior helps explain why bullish Bitcoin price predictions from analysts like Tom Lee remain in play.

These forecasts are not based on short-term candles. They rely on reduced selling, improving volume structure, and steady whale accumulation. Still, the Bitcoin price must confirm the thesis.

Bitcoin Price Levels That Decide Whether Bulls Take Control

For Bitcoin to turn these signals into action, price confirmation is required.

The most important level remains $94,600. A daily close above this zone would mark roughly a 5% move from current levels and break above the upper boundary of the current compression structure. That would signal that buyers have regained short-term control.

Bitcoin Price Analysis: TradingView

If $94,600 breaks, the next resistance sits near $99,800. A sustained move above that level could open the path toward $107,500, if broader market conditions allow. That could be the first real catalyst to Tom Lee’s aggressive $180,000 outlook, as stated earlier.

On the downside, if the Bitcoin price loses $90,000, support lies near $89,200. Below that, $87,500 becomes the next key level. A break under these zones would invalidate the bullish setup, at least in the short term.