Ethereum price action looks quiet, but the entire formation is slowly turning bullish. Over the past 24 hours, ETH has traded almost flat, while the past seven days show a modest 2.6% gain. Price has remained above $3,100 for several sessions, suggesting strength rather than exhaustion.

This sideways move is not random. Ethereum is compressing near key levels, where breakouts often form. The next move depends on whether buyers, who are gradually returning, can turn this consolidation into a continuation.

Bull Flag Structure Holds as the Breakout Zone Appears

Ethereum appears to be breaking out after consolidating inside a bull flag. A bull flag forms when the price pauses after a strong upward move, then trades in a narrow range before the next leg higher. This pattern signals consolidation, not weakness.

The structure remains intact as long as ETH holds above $3,090. That means, unless there is a daily candle close below this level, the much-anticipated breakout might hold.

This level has acted as firm support, absorbing selling pressure during recent pullbacks. Price has repeatedly bounced from this zone, showing buyers are still defending it.

Breakout Setup Forms: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A clean daily close above $3,130 would be the first confirmation that the flag is resolving higher. That move would signal that consolidation is ending and buyers are regaining control. Without that close, Ethereum remains in compression, but the bullish structure stays valid.

Selling Pressure Eases as Key Ethereum Price Levels Emerge

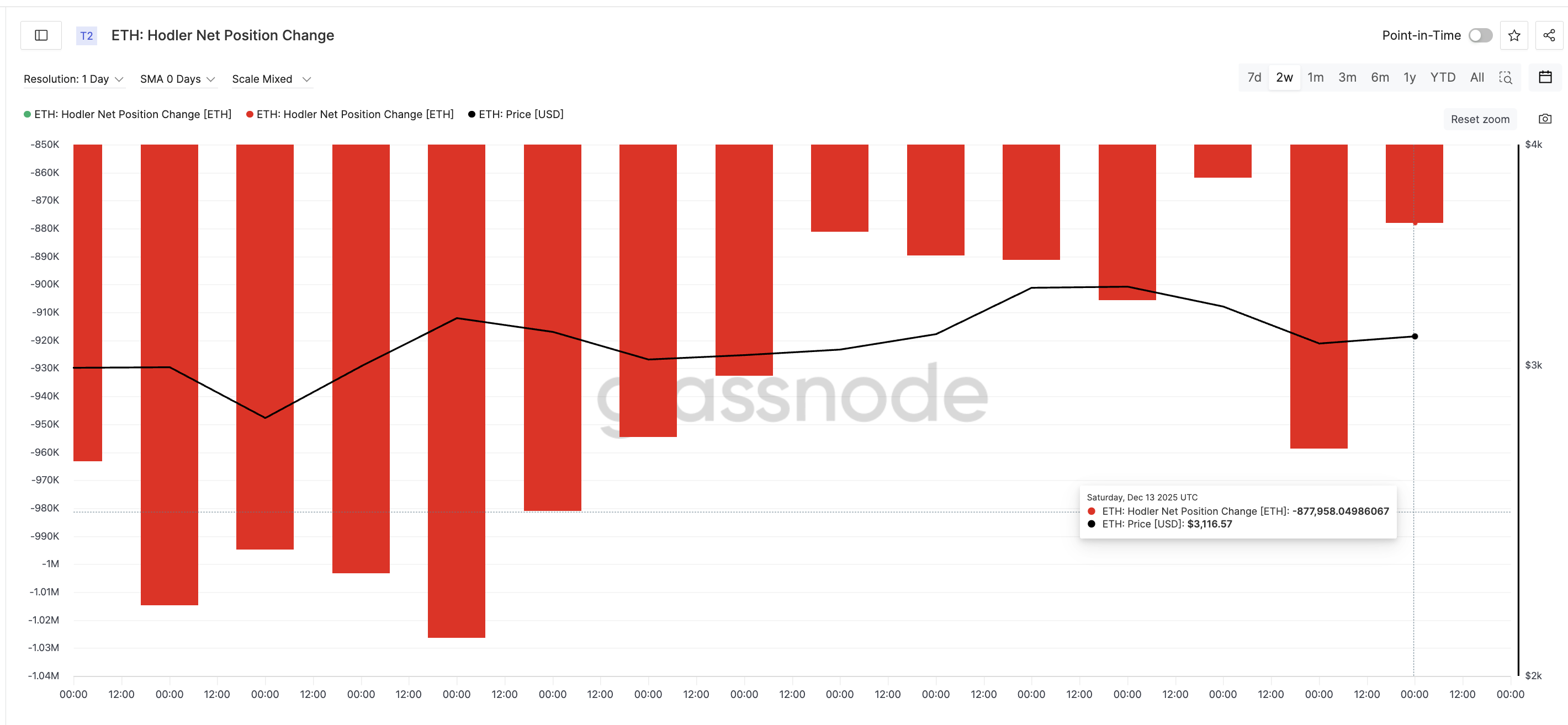

On-chain data support the price structure. Holder Net Position Change, which tracks whether long-term investors are adding or selling ETH, shows that selling pressure has eased compared to earlier sessions.

On December 12, Ethereum holders distributed roughly 958,771 ETH. By December 13, net selling dropped to around 877,958 ETH, marking a decline of roughly 8.4% in selling pressure within 24 hours.

Ethereum Holders Are Selling Fewer Coins: Glassnode

That shift matters. Ethereum is still seeing net distribution, but the pace of selling is slowing as the price compresses near resistance. This behavior typically appears during late-stage consolidation, not during breakdowns.

When selling pressure eases near a key level without price slipping lower, it increases the odds that buyers step in once a breakout confirms. Ethereum is not seeing panic exits. Instead, holders appear more willing to wait.

Ethereum Price Analysis: TradingView

If the Ethereum price secures a daily close above $3,130, the next resistance sits near $3,390. Clearing that zone would open the path toward the $4,000–$4,020 area, aligning with the measured move from the bull flag structure.

However, the bullish structure would weaken if the Ethereum price drops under $3,090 or even $2,910. Closing below the latter would break the pattern completely.