KEY TAKEAWAYS

The Basic Attention Token rose in 2023 and 2024 but still underperformed the market.

BAT is one of the longer-serving crypto tokens, operating since 2017.

Our Basic Attention Token price predictions suggest BAT could reach $0.50 this year.

Interested in buying or selling BASIC ATTENTION TOKEN BAT coin? Read our review of the best exchanges to buy and sell BASIC ATTENTION TOKEN BAT.

Although the Basic Attention Token rose in both 2023 and 2024, it still underperformed against the crypto market as a whole. Investors hope that long-standing crypto will have a better year, although it has dropped since the start of January.

Meanwhile, the announcement of BAT’s latest roadmap could potentially spur interest in the token. On Feb. 20, 2025, the Basic Attention Token was worth about $0.1805.

Let’s now look at our price predictions for Basic Attention Token, made on Feb. 20, 2025. We will also examine the BAT price history and briefly discuss what BAT is and what it does.

Basic Attention Token Price Prediction

Here are CCN’s Basic Attention Token price predictions, made on Feb. 20 2025. It is important to remember that price forecasts, especially for something as potentially volatile as crypto, are often wrong.

Basic Attention Token Price Prediction 2025

BAT’s price action in 2025 largely depends on whether it successfully breaks out of its current corrective structure and re-establishes bullish momentum. If market conditions improve and buying interest returns, BAT could see a recovery toward $0.35 on average, with potential spikes up to $0.50 in a bullish scenario.

Basic Attention Token Price Prediction 2026

By 2026, BAT may experience a stronger upside if it follows a completed Elliott Wave cycle and enters a new impulsive phase driven by broader crypto adoption and renewed demand for utility tokens. If bullish sentiment prevails, the price could average around $0.55, with highs reaching $0.80, while downside risks may limit it to $0.30.

Basic Attention Token Price Prediction 2030

In the long term, BAT’s value will likely be shaped by technological advancements, increased utility in the Brave ecosystem, and macroeconomic trends in the crypto sector. A strong adoption curve and bullish market cycles could push the price above $2, while moderate growth would place it around $1.20, with a bearish floor near $0.60.

Basic Attention Token Price Analysis

BAT has been in a prolonged corrective phase (WXYXZ), which has been nearing completion since April 4, 2023. After hitting $0.372 on Dec. 7, it failed to break above horizontal resistance and declined toward the $0.134 to $0.162 support zone, where the final wave is forming.

This zone has historically acted as strong support, and the daily RSI is attempting to recover from oversold conditions, suggesting a potential bottom.

However, low buying volume raises concerns. A breakdown below $0.134 could trigger further decline, while a break above the descending trendline is needed to confirm a reversal.

Short-term Basic Attention Token Price Prediction

On the one-hour chart, BAT remains within a wedge, forming a potential (a-b-c-d-e) corrective pattern. A recent rejection at the upper trendline suggests a final drop toward the $0.134 to $0.162 zone before a reversal.

Elliott Wave analysis indicates that the final corrective leg may extend slightly lower before completion. If support holds, BAT could rebound toward $0.20, with further upside targets at $0.25 and $0.30, confirming the end of the correction.

A failure to hold $0.134 could lead to a deeper drop.

The Basic Attention Token price prediction for the next 24 hours depends on confirmation of a reversal, which would require a breakout above the wedge and sustained trading above $0.20.

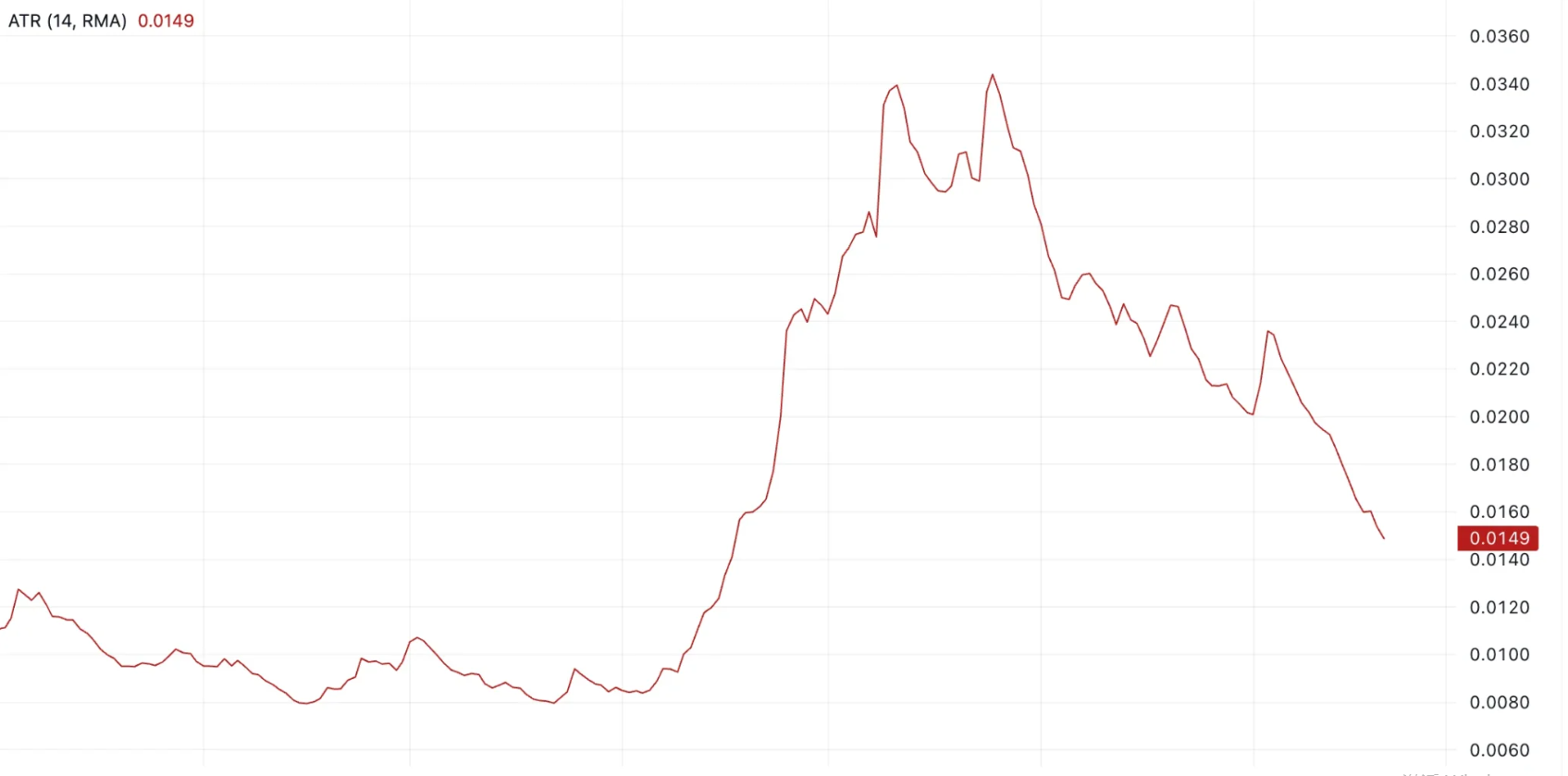

Basic Attention Token Average True Range (ATR): BAT Volatility

The Average True Range (ATR) measures market volatility by averaging the largest of three values: the current high minus the current low, the absolute value of the current high minus the previous close, and the absolute value of the current low minus the previous close over a period, typically 14 days.

Looking for a safe place to buy and sell BASIC ATTENTION TOKEN BAT? See the leading platforms for buying and selling BASIC ATTENTION TOKEN BAT.

A rising ATR indicates increasing volatility, while a falling ATR indicates decreasing volatility.

Since ATR values can be higher for higher-priced assets, normalize ATR by dividing it by the asset price to compare volatility across different price levels. On Feb. 19, 2025, BAT’s ATR was 0.0149, a sign of relatively low volatility.

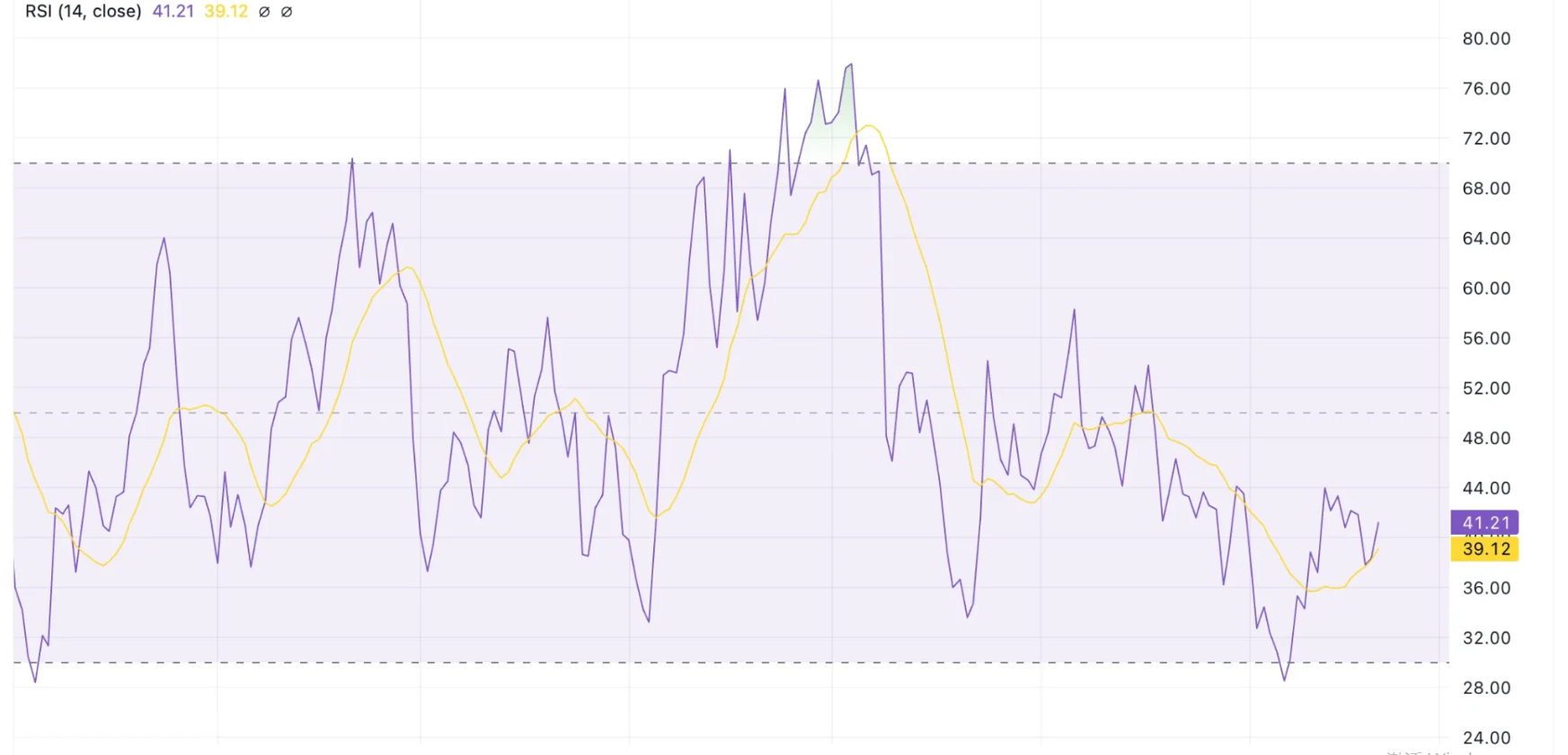

Basic Attention Token Relative Strength Index (RSI): Is BAT Overbought or Oversold?

The Relative Strength Index (RSI) is a momentum indicator traders use to determine whether an asset is overbought or oversold.

Movements above 70 and below 30 show over and undervaluation, respectively. Movements above and below the 50 line also indicate if the trend is bullish or bearish.

On Feb. 19, 2025, the BAT RSI was 41, a sign of a bearish trend.

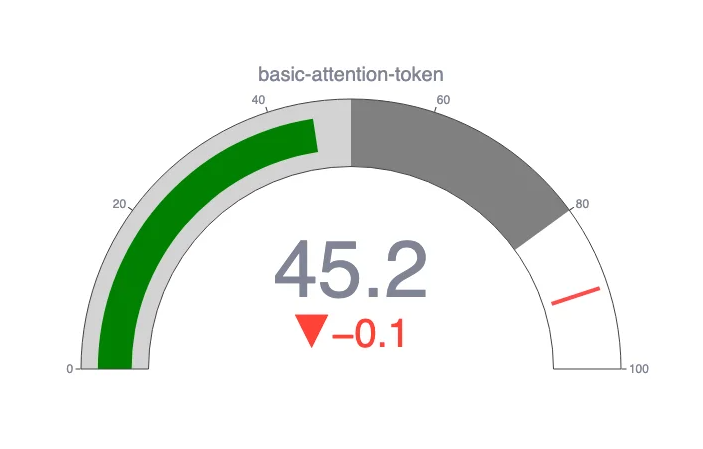

CCN Strength Index

The CCN Strength Index combines an array of advanced market signals to measure the strength of individual cryptocurrencies over the last 30 days.

Every day, it assigns a strength score, ranging from 0 to 100, to the top 500 assets by market capitalization on CoinMarketCap, focusing on both trend direction and the intensity of price movements.

0 to 24: Assets exhibit significant weakness, showing signs of sustained downtrend behavior.

25 to 35: The price tends to move within stable bounds with minimal volatility.

36 to 49: Assets begin a stable uptrend but without strong surges.

50 to 59: Consistent growth with moderate price advances, building momentum.

60+: Sharp price movements and high demand indicate stronger volatility and trend shifts.

The index dynamically adapts to rapid changes. For example, an asset experiencing a 100% increase within a short timeframe would see a sharp jump in its score to reflect the intensity of the rise.

However, should that asset stabilize at this new price level, the score will gradually taper down and align with the dampened momentum as the movement normalizes. The same principle applies to rapid declines: a sudden drop will spike the score downward, but the score will slowly adjust back up as volatility decreases.

On Feb 20, 2025, Basic Attention Token scored 45.2 on the CCN Index, suggesting moderate momentum.

Basic Attention Token Price Performance Comparisons

BAT is a decentralized finance token that deals with content creation, so let’s compare its performance with other similar projects.

Best Days and Months to Buy BAT

We looked at the BAT price history and found the times when the price was at its lowest across certain days, months, quarters, and even weeks in the year, indicating the best times to buy BAT.

| Times to Buy BAT | Days, Months, and Quarters |

|---|---|

| Best Day of the Week | Friday |

| Best Month | April |

| Best Week | 16 |

| Best Quarter | First |

BAT Price History

Let’s take a closer look at some of the key dates in the Basic Attention Token price history. While past performance isn’t necessarily indicative of future results, understanding what the crypto has done can give us some much-needed context when it comes to either making or interpreting a BAT price prediction.

| Period | BAT Price |

|---|---|

| Last week (Feb. 13, 2025) | $0.1928 |

| Last month (Jan. 20, 2025) | $0.2506 |

| Three months ago (Nov. 20, 2024) | $0.2175 |

| Last year (Feb. 20, 2024) | $0.2663 |

| Five years ago (Feb. 20, 2020) | $0.2614 |

| Launch price (June 2, 2017) | $0.1712 |

| All-Time High (Nov. 28, 2021) | $0.1712 |

| All-Time low (July 16, 2017) | $0.06621 |

BAT Market Cap

The market capitalization, or market cap, is the sum of the total number of BAT in circulation multiplied by its price.

On Feb. 20, 2025, BAT’s market cap was $269 million, making it the 174th-largest crypto by that metric.

Who Owns the Most Basic Attention Token?

As of Feb. 20, 2025, one wallet held nearly 15% of the BAT supply.

Richest BAT Wallet Addresses

On Feb. 2,0 2025, the five wallets with the most Basic Attention Token (BAT) were:

0xfd821d8cea64feacb6ec86d979e37bc64c64a00b: This wallet held 206,414,556 BAT, or 13.76% of the supply.

0x6c8c6b02e7b2be14d4fa6022dfd6d75921d90e4e. The wallet held 142,720,158 BAT, or 9.51% of the supply.

0xf977814e90da44bfa03b6295a0616a897441acec. This wallet, listed as Binance, held 98,400,597 BAT, or 6.56% of the supply.

0xeb4d561dc3f84f86198ecfbb96399c821811df1b. This wallet held 27,988,385 BAT, or 1.87% of the supply.

0xba35e6add28f269e1b4516ae1e79a551d825013b. This wallet also held 27,988,385 BAT, or 1.87% of the supply.

BAT Supply and Distribution

| Supply and Distribution | Figures |

|---|---|

| Maximum Supply | 1,500,000,000 |

| Circulating Supply (as of Feb. 20, 2025) | 1,495,668,356 (99.71% of maximum supply) |

| Holder Distribution | Top 10 holders owned 41.71% of the supply as of Feb. 20, 2025. |

From the Basic Attention Token Whitepaper

In its technical documentation or whitepaper, Basic Attention Token describes itself as ” a decentralized, transparent digital ad exchange based on Blockchain.”

Basic Attention Token (BAT) Explained

In 2016, Brendan Eich, the software developer who created JavaScript and founded the Mozilla project, launched the Brave browser. The Brave browser is designed to block ads and trackers by default. It is run on open source code and protects users’ privacy. The browser uses the Basic Attention Token (BAT) as a payment method.

BAT is based on the Ethereum (ETH) blockchain, so it is a token, not a coin. You might see references to such things as a BAT coin price prediction, but these are wrong.

How Basic Attention Token Works

Advertisers buy advertising space and user attention with BAT, while content creators and publishers pay for user contributions and advertising revenue with the token BAT. Meanwhile, Brave’s users get BAT for paying attention to adverts.

Basically, if someone chooses to watch an advert on Brave, they get paid BAT. A system called Brave Payments automatically calculates how much people get at the end of each month based on time spent viewing content. Users can also make specific contributions regardless of time spent viewing content, much like a site like Patreon does.

BAT can also be bought, sold, and traded on exchanges.

Because BAT is based on Ethereum, it is a token, not a coin. You might see references to such things as Basic Attention Token coin price predictions. Not only are these unwieldy, they are also wrong.

Is Basic Attention Token a Good Investment?

It is hard to say. The token has been around for a long time but has yet to make it into crypto’s highest echelons. It also underperformed over the last few years.

As ever with crypto, you will need to make sure you do your own research before deciding whether or not to invest in BAT.

Will Basic Attention Token go up or down?

No one can really tell right now. While the Basic Attention Token crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind that prices can and do go down and up.

Should I invest in Basic Attention Token?

Before deciding whether to invest in Basic Attention Token, you will have to do your own research, not only on BAT, but on other coins and tokens such as The Graph (GRT) and Uniswap (UNI). Either way, you must also ensure you never invest more money than you can afford to lose.