HIGHLIGHTS

Numerai now plans to expand its team following the strategic investment from JPMorgan.

JPMorgan is one of the largest investors in quantitative strategies globally.

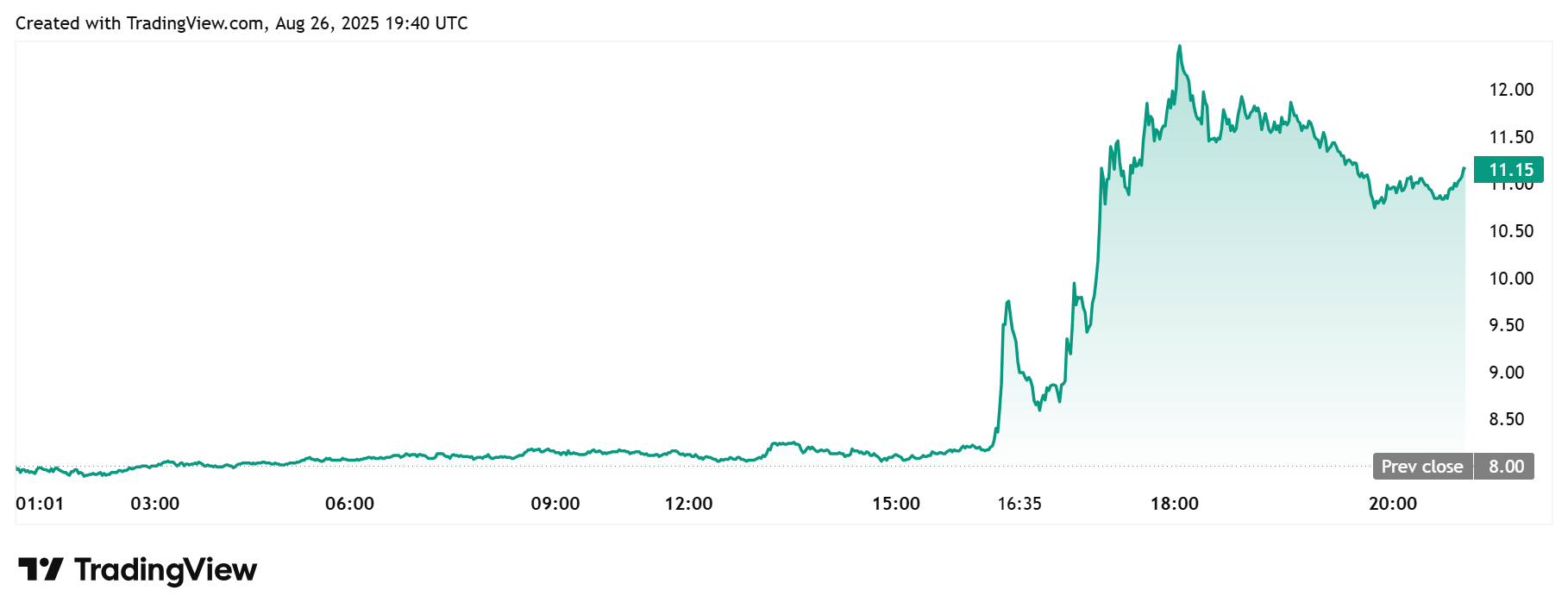

NMR price was one of the best-performing altcoins today amid a wider crypto correction.

JPMorgan Chase has invested $500 million in the AI hedge fund Numerai. The San Francisco-based hedge fund has now doubled its assets under management, after growing its AUM from $60 million to $450 million at the time of this writing.

Numerai Secures $500 Million Investment From JPMorgan

In a press release, the team behind the AI hedge fund announced that JPMorgan has invested in the fund, securing $500 million in capacity. The asset manager is now one of the largest allocators to the quantitative strategies worldwide, including in machine learning quantitative funds.

With the latest funding, Numerai is keen to expand its workforce. The company highlighted that it has recently hired an artificial intelligence (AI) researcher who formerly worked at Meta, as well as a trading engineer who formerly worked at Voleon.

According to Richard Crain, the founder of Numerai, in an interview with Bloomberg, investors waited until the firm proved it could sustain performance. Moreover, the company has existed in the industry since 2015.

“When you’re doing something unusual and different, they might wait even longer before they get excited,” Craib stated.

JPMorgan’s investment will play a crucial role in helping Numerai create a hedge fund for the AI era. Already, Numerai has attracted 517 data scientists to its leaderboard, who have staked 784,044 NMR tokens, along with approximately 4,238 signal models.

Last year, JPMorgan CEO Jamie Dimon announced that the bank is expanding its use of AI to transform banking processes. Moreover, the bank has worked with several AI projects, including OpenAI’s ChatGPT.

NMR Price Surges Over 33% Today

Following the announcement, NMR price surged more than 33 percent on Tuesday to trade at about $11.71. The small-cap altcoin, with a fully diluted valuation of about $125 million, has since surged to the highest level in three months, possibly ending its consolidation. Notably, this rally comes amid a market correction in the broader crypto market.

On July 17, 2025, Numerai announced a strategic NMR buyback from the open market. Notably, the company initiated a buyback of $1 million worth of NMR with the help of the Coinbase Global crypto exchange.

The NMR buyback followed a strategic halving of the token’s total supply, and is currently capped at 11 million tokens. According to Numerai, it currently holds about 3 million NMR tokens through its treasury.

Why The Investment Matters

The strategic investment of $500 million from JPMorgan to Numerai will help validate its radical AI-driven hedge fund model. Moreover, the company now has a whopping $1 billion in AUM, thus upsizing Numerai to a unicorn status.

In 2024, the Numerai global equity hedge fund achieved a 25.45 percent net return, accompanied by a 2.75 Sharpe ratio. Notably, Numerai has only had a single down month, outshining most traditional hedge funds globally.

The approval from JPMorgan will play a crucial role in NMR price action in the near future. Moreover, altcoins backed by traditional financial institutions have attracted more attention from speculative crypto traders.

Potential buybacks of NMR tokens are more likely to occur to strengthen its market structure further. Furthermore, Numerai announced that it had just kicked off strategic NMR buybacks from the open market.